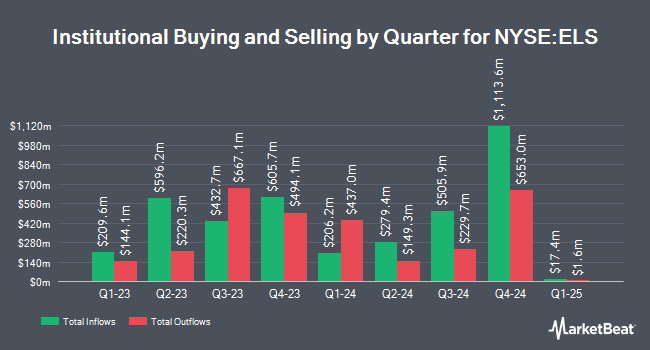

Cbre Investment Management Listed Real Assets LLC acquired a new position in shares of Equity LifeStyle Properties, Inc. (NYSE:ELS - Free Report) in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor acquired 621,489 shares of the real estate investment trust's stock, valued at approximately $41,391,000. Cbre Investment Management Listed Real Assets LLC owned 0.33% of Equity LifeStyle Properties as of its most recent SEC filing.

Several other institutional investors and hedge funds have also bought and sold shares of the company. Creative Planning lifted its holdings in shares of Equity LifeStyle Properties by 37.3% in the third quarter. Creative Planning now owns 6,715 shares of the real estate investment trust's stock worth $479,000 after acquiring an additional 1,824 shares during the last quarter. US Bancorp DE lifted its holdings in shares of Equity LifeStyle Properties by 4.0% in the third quarter. US Bancorp DE now owns 13,430 shares of the real estate investment trust's stock worth $958,000 after acquiring an additional 513 shares during the last quarter. Harbor Capital Advisors Inc. bought a new position in shares of Equity LifeStyle Properties in the third quarter worth about $75,000. Van ECK Associates Corp lifted its holdings in shares of Equity LifeStyle Properties by 12.2% in the third quarter. Van ECK Associates Corp now owns 81,480 shares of the real estate investment trust's stock worth $5,752,000 after acquiring an additional 8,849 shares during the last quarter. Finally, QRG Capital Management Inc. lifted its holdings in shares of Equity LifeStyle Properties by 23.0% in the third quarter. QRG Capital Management Inc. now owns 11,461 shares of the real estate investment trust's stock worth $818,000 after acquiring an additional 2,145 shares during the last quarter. Institutional investors own 97.21% of the company's stock.

Analyst Ratings Changes

A number of research analysts have recently commented on the stock. Robert W. Baird increased their target price on shares of Equity LifeStyle Properties from $72.00 to $73.00 and gave the stock an "outperform" rating in a report on Tuesday, January 28th. Jefferies Financial Group raised shares of Equity LifeStyle Properties from a "hold" rating to a "buy" rating and increased their target price for the stock from $72.00 to $80.00 in a report on Thursday, January 2nd. Evercore ISI lowered their price objective on Equity LifeStyle Properties from $74.00 to $73.00 and set an "in-line" rating for the company in a research note on Tuesday, January 28th. Deutsche Bank Aktiengesellschaft raised Equity LifeStyle Properties from a "hold" rating to a "buy" rating and upped their price objective for the company from $66.00 to $73.00 in a research note on Tuesday, January 21st. Finally, Truist Financial raised Equity LifeStyle Properties from a "hold" rating to a "buy" rating in a research note on Friday, January 17th. Three investment analysts have rated the stock with a hold rating, six have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $73.78.

Read Our Latest Report on Equity LifeStyle Properties

Equity LifeStyle Properties Trading Up 1.2 %

NYSE:ELS traded up $0.80 on Friday, reaching $68.56. 1,189,914 shares of the stock traded hands, compared to its average volume of 1,482,091. The firm has a market capitalization of $13.10 billion, a price-to-earnings ratio of 35.16, a price-to-earnings-growth ratio of 3.02 and a beta of 0.79. The company's 50 day moving average is $66.48 and its 200-day moving average is $69.07. The company has a current ratio of 0.02, a quick ratio of 0.03 and a debt-to-equity ratio of 0.15. Equity LifeStyle Properties, Inc. has a 1-year low of $59.82 and a 1-year high of $76.60.

Equity LifeStyle Properties (NYSE:ELS - Get Free Report) last released its earnings results on Monday, January 27th. The real estate investment trust reported $0.76 earnings per share for the quarter, meeting analysts' consensus estimates of $0.76. Equity LifeStyle Properties had a net margin of 24.05% and a return on equity of 23.12%. Equities research analysts anticipate that Equity LifeStyle Properties, Inc. will post 3.07 EPS for the current fiscal year.

Equity LifeStyle Properties Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, April 11th. Shareholders of record on Friday, March 28th will be given a dividend of $0.515 per share. This represents a $2.06 dividend on an annualized basis and a yield of 3.00%. The ex-dividend date is Friday, March 28th. This is an increase from Equity LifeStyle Properties's previous quarterly dividend of $0.48. Equity LifeStyle Properties's dividend payout ratio is currently 105.64%.

About Equity LifeStyle Properties

(

Free Report)

Equity LifeStyle Properties, Inc is a real estate investment trust, which engages in the ownership and operation of lifestyle-oriented properties consisting primarily of manufactured home, and recreational vehicle communities. It operates through the following segments: Property Operations and Home Sales and Rentals Operations.

Featured Articles

Before you consider Equity LifeStyle Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity LifeStyle Properties wasn't on the list.

While Equity LifeStyle Properties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.