Natixis Advisors LLC increased its position in shares of CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS - Free Report) by 22.5% in the third quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 305,321 shares of the company's stock after buying an additional 56,147 shares during the quarter. Natixis Advisors LLC's holdings in CCC Intelligent Solutions were worth $3,374,000 as of its most recent SEC filing.

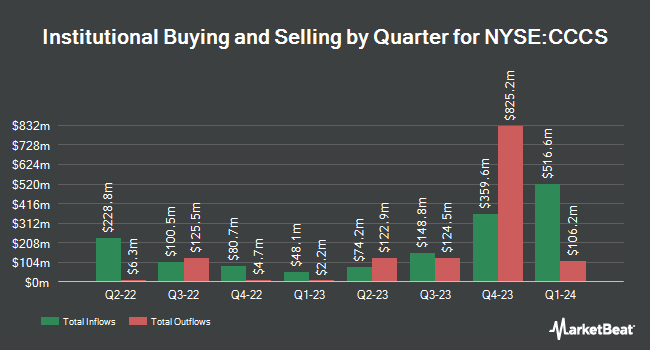

Several other institutional investors have also recently bought and sold shares of CCCS. Dragoneer Investment Group LLC grew its position in shares of CCC Intelligent Solutions by 31.5% in the 2nd quarter. Dragoneer Investment Group LLC now owns 15,904,993 shares of the company's stock valued at $176,704,000 after acquiring an additional 3,809,200 shares during the period. Comerica Bank grew its holdings in CCC Intelligent Solutions by 103.1% in the 1st quarter. Comerica Bank now owns 774,261 shares of the company's stock valued at $9,260,000 after buying an additional 392,966 shares in the last quarter. Harbor Capital Advisors Inc. increased its position in CCC Intelligent Solutions by 200.1% during the 2nd quarter. Harbor Capital Advisors Inc. now owns 203,543 shares of the company's stock worth $2,261,000 after buying an additional 135,710 shares during the period. Element Capital Management LLC acquired a new stake in shares of CCC Intelligent Solutions during the second quarter worth $7,941,000. Finally, Vanguard Group Inc. boosted its position in shares of CCC Intelligent Solutions by 17.7% in the first quarter. Vanguard Group Inc. now owns 28,034,997 shares of the company's stock valued at $335,299,000 after acquiring an additional 4,225,920 shares during the period. Institutional investors own 95.79% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts have issued reports on CCCS shares. Bank of America began coverage on shares of CCC Intelligent Solutions in a report on Tuesday, August 20th. They issued a "buy" rating and a $15.00 price objective for the company. Barrington Research restated an "outperform" rating and set a $14.00 price objective on shares of CCC Intelligent Solutions in a research note on Tuesday, October 29th. JPMorgan Chase & Co. cut their target price on CCC Intelligent Solutions from $14.00 to $13.00 and set an "overweight" rating for the company in a research report on Tuesday, October 29th. Morgan Stanley raised CCC Intelligent Solutions from an "equal weight" rating to an "overweight" rating and boosted their price target for the company from $14.00 to $15.00 in a research note on Wednesday, November 13th. Finally, Jefferies Financial Group reduced their price objective on shares of CCC Intelligent Solutions from $14.00 to $13.00 and set a "buy" rating on the stock in a research note on Wednesday, July 31st. Two investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $13.78.

Get Our Latest Report on CCCS

CCC Intelligent Solutions Price Performance

Shares of CCCS stock traded up $0.13 on Friday, reaching $12.47. The company had a trading volume of 3,156,728 shares, compared to its average volume of 3,267,361. The stock has a market capitalization of $7.80 billion, a PE ratio of 623.50, a price-to-earnings-growth ratio of 7.08 and a beta of 0.63. The company has a quick ratio of 3.19, a current ratio of 3.19 and a debt-to-equity ratio of 0.39. The business's 50-day moving average is $11.10 and its 200 day moving average is $11.04. CCC Intelligent Solutions Holdings Inc. has a one year low of $9.79 and a one year high of $12.68.

CCC Intelligent Solutions (NYSE:CCCS - Get Free Report) last released its quarterly earnings results on Monday, October 28th. The company reported $0.10 earnings per share for the quarter, topping the consensus estimate of $0.09 by $0.01. The company had revenue of $238.48 million for the quarter, compared to analysts' expectations of $237.41 million. CCC Intelligent Solutions had a return on equity of 5.35% and a net margin of 5.02%. The business's quarterly revenue was up 7.8% compared to the same quarter last year. During the same period in the previous year, the business posted $0.03 earnings per share. Equities research analysts forecast that CCC Intelligent Solutions Holdings Inc. will post 0.16 EPS for the current fiscal year.

Insider Buying and Selling

In related news, CAO Rodney Christo sold 75,000 shares of the business's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $12.01, for a total transaction of $900,750.00. The transaction was disclosed in a filing with the SEC, which is available at this hyperlink. Also, insider Githesh Ramamurthy sold 9,348 shares of the firm's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $11.50, for a total transaction of $107,502.00. Following the completion of the sale, the insider now owns 4,798,040 shares of the company's stock, valued at $55,177,460. The trade was a 0.19 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 268,153 shares of company stock valued at $3,195,485 over the last ninety days. 6.67% of the stock is owned by company insiders.

CCC Intelligent Solutions Company Profile

(

Free Report)

CCC Intelligent Solutions Holdings Inc, operates as a software as a service company for the property and casualty insurance economy in the United States and China. The company's cloud-based software as a service platform connects trading partners, facilitates commerce, and supports mission-critical, artificial intelligence enabled digital workflow across the insurance economy, including insurers, repairers, automakers, parts suppliers, lenders and more.

See Also

Before you consider CCC Intelligent Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CCC Intelligent Solutions wasn't on the list.

While CCC Intelligent Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.