Principal Financial Group Inc. decreased its position in Celsius Holdings, Inc. (NASDAQ:CELH - Free Report) by 21.6% during the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 400,808 shares of the company's stock after selling 110,446 shares during the quarter. Principal Financial Group Inc. owned 0.17% of Celsius worth $12,569,000 at the end of the most recent quarter.

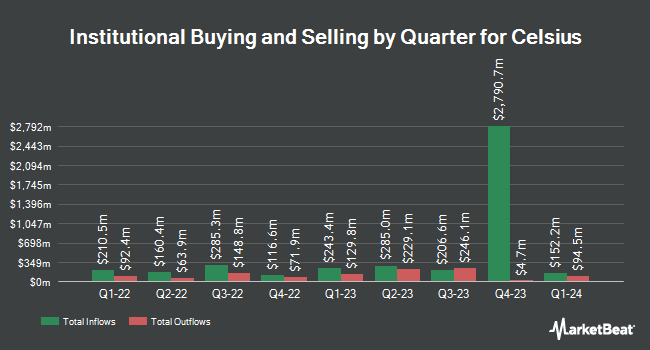

Other hedge funds and other institutional investors have also made changes to their positions in the company. EverSource Wealth Advisors LLC increased its position in shares of Celsius by 3,116.7% in the first quarter. EverSource Wealth Advisors LLC now owns 386 shares of the company's stock valued at $32,000 after buying an additional 374 shares in the last quarter. Beacon Capital Management LLC acquired a new position in Celsius during the first quarter worth approximately $40,000. S.A. Mason LLC acquired a new position in Celsius in the second quarter valued at $30,000. Benjamin F. Edwards & Company Inc. lifted its stake in shares of Celsius by 353.1% in the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 648 shares of the company's stock valued at $37,000 after purchasing an additional 505 shares in the last quarter. Finally, Newbridge Financial Services Group Inc. grew its stake in Celsius by 3,150.0% during the second quarter. Newbridge Financial Services Group Inc. now owns 650 shares of the company's stock worth $37,000 after buying an additional 630 shares during the period. Institutional investors and hedge funds own 60.95% of the company's stock.

Insider Activity at Celsius

In other Celsius news, CEO John Fieldly sold 74,847 shares of the business's stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $32.80, for a total value of $2,454,981.60. Following the completion of the transaction, the chief executive officer now directly owns 1,812,490 shares of the company's stock, valued at approximately $59,449,672. The trade was a 3.97 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. 2.20% of the stock is owned by company insiders.

Celsius Stock Down 4.7 %

Shares of CELH traded down $1.27 during trading on Friday, reaching $25.66. The company's stock had a trading volume of 10,025,815 shares, compared to its average volume of 8,374,845. The company has a market cap of $6.03 billion, a price-to-earnings ratio of 35.64, a P/E/G ratio of 2.95 and a beta of 1.86. The company has a fifty day moving average of $31.41 and a two-hundred day moving average of $49.47. Celsius Holdings, Inc. has a twelve month low of $25.50 and a twelve month high of $99.62.

Analyst Ratings Changes

A number of research firms recently weighed in on CELH. Piper Sandler lowered their price target on shares of Celsius from $50.00 to $47.00 and set an "overweight" rating for the company in a report on Tuesday, September 24th. Roth Mkm dropped their price objective on shares of Celsius from $43.00 to $40.00 and set a "buy" rating on the stock in a research note on Thursday, November 7th. TD Cowen dropped their price objective on shares of Celsius from $68.00 to $50.00 and set a "buy" rating on the stock in a report on Wednesday, August 7th. Jefferies Financial Group dropped their target price on Celsius from $53.00 to $48.00 and set a "buy" rating on the stock in a report on Thursday, October 10th. Finally, Truist Financial upped their target price on Celsius from $30.00 to $35.00 and gave the company a "hold" rating in a report on Wednesday, October 16th. One research analyst has rated the stock with a sell rating, three have issued a hold rating and eleven have issued a buy rating to the company's stock. Based on data from MarketBeat.com, Celsius has a consensus rating of "Moderate Buy" and an average target price of $54.40.

Check Out Our Latest Stock Report on CELH

Celsius Company Profile

(

Free Report)

Celsius Holdings, Inc develops, processes, markets, distributes, and sells functional energy drinks and liquid supplements in the United States, Australia, New Zealand, Canadian, European, Middle Eastern, Asia-Pacific, and internationally. The company offers CELSIUS, a fitness drink or supplement designed to accelerate metabolism and burn body fat; various flavors and carbonated and non-carbonated functional energy drinks under the CELSIUS Originals and Vibe name, as well as functional energy drink under the CELSIUS Essentials and CELSIUS On-the-Go Powder names; and CELSIUS ready-to drink products.

Featured Stories

Before you consider Celsius, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celsius wasn't on the list.

While Celsius currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.