Two Sigma Advisers LP increased its position in Cencora, Inc. (NYSE:COR - Free Report) by 21.7% in the 3rd quarter, according to its most recent filing with the SEC. The fund owned 1,638,400 shares of the company's stock after purchasing an additional 292,600 shares during the period. Cencora accounts for about 0.9% of Two Sigma Advisers LP's holdings, making the stock its 24th biggest holding. Two Sigma Advisers LP owned 0.83% of Cencora worth $368,771,000 at the end of the most recent reporting period.

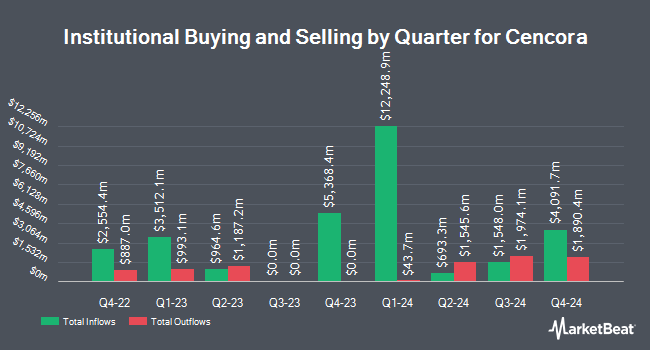

Several other institutional investors and hedge funds have also made changes to their positions in COR. Pacer Advisors Inc. raised its stake in Cencora by 6,855.3% during the 3rd quarter. Pacer Advisors Inc. now owns 2,065,374 shares of the company's stock valued at $464,874,000 after acquiring an additional 2,035,679 shares during the last quarter. Bank of Montreal Can raised its stake in Cencora by 136.8% during the 2nd quarter. Bank of Montreal Can now owns 641,887 shares of the company's stock valued at $153,623,000 after acquiring an additional 370,841 shares during the last quarter. American Century Companies Inc. raised its stake in Cencora by 155.0% during the 2nd quarter. American Century Companies Inc. now owns 598,438 shares of the company's stock valued at $134,828,000 after acquiring an additional 363,796 shares during the last quarter. State Street Corp increased its position in Cencora by 3.8% during the 3rd quarter. State Street Corp now owns 8,045,896 shares of the company's stock worth $1,810,970,000 after purchasing an additional 291,867 shares during the period. Finally, Eagle Asset Management Inc. increased its position in Cencora by 32.9% during the 3rd quarter. Eagle Asset Management Inc. now owns 1,009,454 shares of the company's stock worth $250,758,000 after purchasing an additional 249,739 shares during the period. 97.52% of the stock is owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of equities research analysts recently weighed in on COR shares. Bank of America restated a "neutral" rating and issued a $245.00 price target (down previously from $275.00) on shares of Cencora in a report on Wednesday, September 18th. Evercore ISI upped their price target on Cencora from $250.00 to $285.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. JPMorgan Chase & Co. upped their price target on Cencora from $280.00 to $287.00 and gave the stock an "overweight" rating in a report on Wednesday, August 21st. Barclays upped their price target on Cencora from $263.00 to $290.00 and gave the stock an "overweight" rating in a report on Thursday, November 7th. Finally, Leerink Partners reduced their target price on Cencora from $277.00 to $275.00 and set an "outperform" rating on the stock in a research note on Monday, October 7th. Two research analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $276.80.

Read Our Latest Analysis on Cencora

Insider Activity

In related news, Chairman Steven H. Collis sold 21,509 shares of Cencora stock in a transaction dated Tuesday, October 22nd. The stock was sold at an average price of $235.80, for a total value of $5,071,822.20. Following the completion of the transaction, the chairman now directly owns 285,088 shares in the company, valued at approximately $67,223,750.40. This trade represents a 7.02 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Insiders sold 93,018 shares of company stock worth $22,478,942 over the last ninety days. Corporate insiders own 15.80% of the company's stock.

Cencora Stock Down 0.2 %

NYSE COR traded down $0.53 during trading hours on Friday, hitting $243.78. The company had a trading volume of 527,934 shares, compared to its average volume of 1,386,945. Cencora, Inc. has a fifty-two week low of $195.83 and a fifty-two week high of $253.27. The company has a market capitalization of $47.12 billion, a price-to-earnings ratio of 32.53, a P/E/G ratio of 1.66 and a beta of 0.45. The company has a debt-to-equity ratio of 4.84, a current ratio of 0.88 and a quick ratio of 0.53. The firm's 50 day moving average is $236.75 and its 200 day moving average is $233.19.

Cencora Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, November 29th. Stockholders of record on Friday, November 15th were paid a dividend of $0.55 per share. The ex-dividend date of this dividend was Friday, November 15th. This is an increase from Cencora's previous quarterly dividend of $0.51. This represents a $2.20 annualized dividend and a dividend yield of 0.90%. Cencora's dividend payout ratio (DPR) is currently 29.29%.

About Cencora

(

Free Report)

Cencora, Inc sources and distributes pharmaceutical products. The company's U.S. Healthcare Solutions segment distributes pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to acute care hospitals and health systems, independent and chain retail pharmacies, mail order pharmacies, medical clinics, long-term care and alternate site pharmacies, and other customers; provides pharmacy management, staffing, and other consulting services; supply management software to retail and institutional healthcare providers; packaging solutions to various institutional and retail healthcare providers; clinical trial support, product post-approval, and commercialization support services; data analytics, outcomes research, and additional services for biotechnology and pharmaceutical manufacturers; pharmaceuticals, vaccines, parasiticides, diagnostics, micro feed ingredients, and other products to the companion animal and production animal markets; and sales force services to manufacturers.

Recommended Stories

Before you consider Cencora, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cencora wasn't on the list.

While Cencora currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.