iA Global Asset Management Inc. raised its stake in Cencora, Inc. (NYSE:COR - Free Report) by 400.5% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 7,087 shares of the company's stock after buying an additional 5,671 shares during the quarter. iA Global Asset Management Inc.'s holdings in Cencora were worth $1,595,000 as of its most recent filing with the Securities and Exchange Commission.

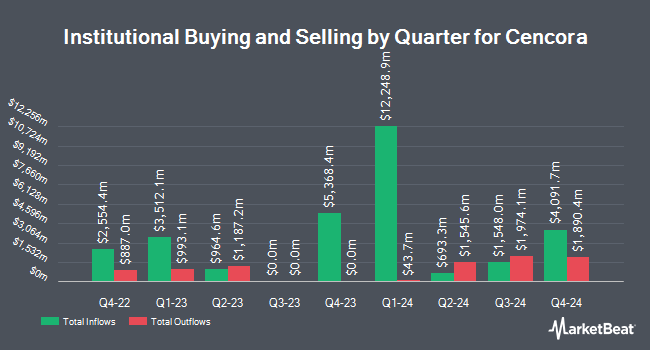

Several other hedge funds have also recently added to or reduced their stakes in COR. Czech National Bank lifted its stake in Cencora by 8.3% in the second quarter. Czech National Bank now owns 31,546 shares of the company's stock valued at $7,107,000 after buying an additional 2,414 shares during the period. Dynamic Advisor Solutions LLC increased its holdings in shares of Cencora by 9.4% in the second quarter. Dynamic Advisor Solutions LLC now owns 1,012 shares of the company's stock worth $228,000 after acquiring an additional 87 shares in the last quarter. Sequoia Financial Advisors LLC increased its holdings in shares of Cencora by 4.8% in the second quarter. Sequoia Financial Advisors LLC now owns 5,385 shares of the company's stock worth $1,213,000 after acquiring an additional 245 shares in the last quarter. Cooper Financial Group increased its holdings in shares of Cencora by 3.2% in the second quarter. Cooper Financial Group now owns 2,920 shares of the company's stock worth $658,000 after acquiring an additional 91 shares in the last quarter. Finally, Wedmont Private Capital increased its holdings in shares of Cencora by 12.0% in the second quarter. Wedmont Private Capital now owns 1,863 shares of the company's stock worth $415,000 after acquiring an additional 200 shares in the last quarter. Institutional investors and hedge funds own 97.52% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on COR. Barclays increased their price target on Cencora from $263.00 to $290.00 and gave the stock an "overweight" rating in a report on Thursday, November 7th. StockNews.com downgraded Cencora from a "strong-buy" rating to a "buy" rating in a report on Friday, September 20th. JPMorgan Chase & Co. increased their price objective on Cencora from $280.00 to $287.00 and gave the stock an "overweight" rating in a report on Wednesday, August 21st. Mizuho initiated coverage on Cencora in a report on Wednesday, December 4th. They set an "outperform" rating and a $280.00 price objective for the company. Finally, UBS Group increased their price objective on Cencora from $275.00 to $285.00 and gave the stock a "buy" rating in a report on Thursday, November 7th. Two investment analysts have rated the stock with a hold rating and ten have issued a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $276.80.

Read Our Latest Stock Analysis on COR

Insider Buying and Selling

In other Cencora news, Chairman Steven H. Collis sold 21,509 shares of Cencora stock in a transaction dated Tuesday, November 19th. The stock was sold at an average price of $242.16, for a total transaction of $5,208,619.44. Following the transaction, the chairman now directly owns 306,752 shares of the company's stock, valued at approximately $74,283,064.32. The trade was a 6.55 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. In the last ninety days, insiders sold 93,018 shares of company stock valued at $22,478,942. Insiders own 15.80% of the company's stock.

Cencora Stock Performance

Shares of COR traded down $2.90 during mid-day trading on Monday, reaching $240.51. The company's stock had a trading volume of 1,203,097 shares, compared to its average volume of 1,389,163. Cencora, Inc. has a 1-year low of $195.83 and a 1-year high of $253.27. The stock has a market cap of $46.49 billion, a P/E ratio of 32.03, a PEG ratio of 1.62 and a beta of 0.45. The business has a 50-day simple moving average of $237.43 and a two-hundred day simple moving average of $233.72. The company has a current ratio of 0.88, a quick ratio of 0.53 and a debt-to-equity ratio of 4.84.

Cencora Increases Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, November 29th. Investors of record on Friday, November 15th were issued a dividend of $0.55 per share. This is a boost from Cencora's previous quarterly dividend of $0.51. This represents a $2.20 annualized dividend and a yield of 0.91%. The ex-dividend date of this dividend was Friday, November 15th. Cencora's dividend payout ratio (DPR) is presently 29.29%.

Cencora Company Profile

(

Free Report)

Cencora, Inc sources and distributes pharmaceutical products. The company's U.S. Healthcare Solutions segment distributes pharmaceuticals, over-the-counter healthcare products, home healthcare supplies and equipment, and related services to acute care hospitals and health systems, independent and chain retail pharmacies, mail order pharmacies, medical clinics, long-term care and alternate site pharmacies, and other customers; provides pharmacy management, staffing, and other consulting services; supply management software to retail and institutional healthcare providers; packaging solutions to various institutional and retail healthcare providers; clinical trial support, product post-approval, and commercialization support services; data analytics, outcomes research, and additional services for biotechnology and pharmaceutical manufacturers; pharmaceuticals, vaccines, parasiticides, diagnostics, micro feed ingredients, and other products to the companion animal and production animal markets; and sales force services to manufacturers.

Read More

Before you consider Cencora, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cencora wasn't on the list.

While Cencora currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for January 2025. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.