StockNews.com cut shares of Cenovus Energy (NYSE:CVE - Free Report) TSE: CVE from a buy rating to a hold rating in a report released on Tuesday morning.

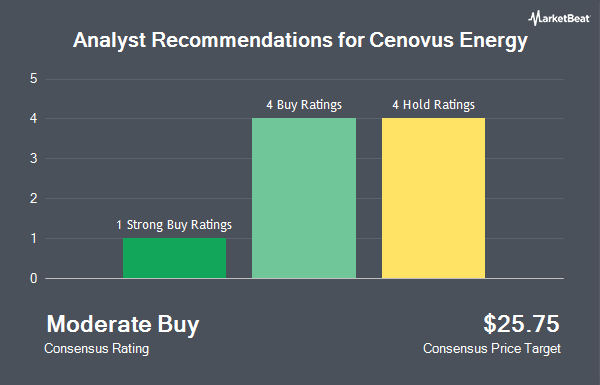

A number of other analysts have also recently issued reports on the stock. BMO Capital Markets cut their target price on shares of Cenovus Energy from $31.00 to $28.00 and set an "outperform" rating for the company in a research note on Friday, November 1st. TD Securities cut shares of Cenovus Energy from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, October 1st. Two analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, Cenovus Energy currently has an average rating of "Moderate Buy" and an average price target of $30.00.

Check Out Our Latest Stock Analysis on Cenovus Energy

Cenovus Energy Stock Performance

Shares of CVE traded down $0.35 during midday trading on Tuesday, reaching $15.49. The stock had a trading volume of 13,822,980 shares, compared to its average volume of 8,902,615. The firm has a 50 day simple moving average of $16.72 and a 200-day simple moving average of $18.30. Cenovus Energy has a one year low of $14.69 and a one year high of $21.90. The firm has a market cap of $28.29 billion, a PE ratio of 10.64 and a beta of 2.05. The company has a current ratio of 1.59, a quick ratio of 0.95 and a debt-to-equity ratio of 0.24.

Cenovus Energy (NYSE:CVE - Get Free Report) TSE: CVE last posted its earnings results on Thursday, October 31st. The oil and gas company reported $0.42 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.34 by $0.08. The company had revenue of $14.20 billion during the quarter, compared to analysts' expectations of $10.25 billion. Cenovus Energy had a net margin of 6.72% and a return on equity of 12.88%. Cenovus Energy's quarterly revenue was down 17.9% compared to the same quarter last year. During the same quarter last year, the company posted $0.72 EPS. As a group, sell-side analysts anticipate that Cenovus Energy will post 1.5 EPS for the current year.

Cenovus Energy Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 13th will be issued a $0.133 dividend. This is a positive change from Cenovus Energy's previous quarterly dividend of $0.13. This represents a $0.53 annualized dividend and a yield of 3.43%. The ex-dividend date is Friday, December 13th. Cenovus Energy's dividend payout ratio (DPR) is currently 36.55%.

Hedge Funds Weigh In On Cenovus Energy

Several hedge funds have recently bought and sold shares of CVE. Boston Partners grew its holdings in Cenovus Energy by 29.0% during the 1st quarter. Boston Partners now owns 37,540,511 shares of the oil and gas company's stock worth $750,435,000 after acquiring an additional 8,438,979 shares during the last quarter. Assenagon Asset Management S.A. grew its holdings in Cenovus Energy by 22,396.6% during the 2nd quarter. Assenagon Asset Management S.A. now owns 7,429,036 shares of the oil and gas company's stock worth $146,054,000 after acquiring an additional 7,396,013 shares during the last quarter. 1832 Asset Management L.P. grew its holdings in Cenovus Energy by 81.1% during the 2nd quarter. 1832 Asset Management L.P. now owns 12,538,499 shares of the oil and gas company's stock worth $246,507,000 after acquiring an additional 5,613,320 shares during the last quarter. Acadian Asset Management LLC grew its holdings in Cenovus Energy by 32,791.8% during the 2nd quarter. Acadian Asset Management LLC now owns 4,440,391 shares of the oil and gas company's stock worth $87,246,000 after acquiring an additional 4,426,891 shares during the last quarter. Finally, Canada Pension Plan Investment Board grew its holdings in Cenovus Energy by 2,236.1% during the 2nd quarter. Canada Pension Plan Investment Board now owns 4,610,779 shares of the oil and gas company's stock worth $90,608,000 after acquiring an additional 4,413,405 shares during the last quarter. 51.19% of the stock is owned by institutional investors.

Cenovus Energy Company Profile

(

Get Free Report)

Cenovus Energy Inc, together with its subsidiaries, develops, produces, refines, transports, and markets crude oil, natural gas, and refined petroleum products in Canada and internationally. The company operates through Oil Sands, Conventional, Offshore, Canadian Refining, and U.S. Refining segments.

Featured Articles

Before you consider Cenovus Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cenovus Energy wasn't on the list.

While Cenovus Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.