Centaurus Financial Inc. boosted its position in shares of MicroStrategy Incorporated (NASDAQ:MSTR - Free Report) by 1,565.6% during the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 2,032 shares of the software maker's stock after purchasing an additional 1,910 shares during the quarter. Centaurus Financial Inc.'s holdings in MicroStrategy were worth $343,000 at the end of the most recent reporting period.

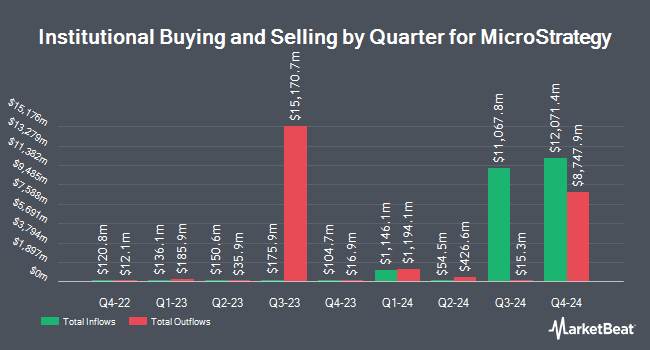

Other large investors also recently bought and sold shares of the company. Larson Financial Group LLC increased its stake in MicroStrategy by 2,051.9% in the 3rd quarter. Larson Financial Group LLC now owns 1,743 shares of the software maker's stock worth $294,000 after buying an additional 1,662 shares during the period. Penserra Capital Management LLC raised its position in MicroStrategy by 1,006.8% during the 3rd quarter. Penserra Capital Management LLC now owns 35,383 shares of the software maker's stock worth $5,964,000 after buying an additional 32,186 shares during the last quarter. Family Capital Management Inc. lifted its position in MicroStrategy by 898.7% during the third quarter. Family Capital Management Inc. now owns 6,661 shares of the software maker's stock valued at $1,123,000 after purchasing an additional 5,994 shares during the period. Kingsview Wealth Management LLC lifted its holdings in MicroStrategy by 852.5% in the third quarter. Kingsview Wealth Management LLC now owns 3,810 shares of the software maker's stock valued at $642,000 after acquiring an additional 3,410 shares during the period. Finally, Cerity Partners LLC acquired a new stake in MicroStrategy during the third quarter valued at $1,040,000. 72.03% of the stock is currently owned by institutional investors.

Insider Transactions at MicroStrategy

In other news, CAO Jeanine Montgomery sold 56,250 shares of the stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $257.41, for a total value of $14,479,312.50. Following the transaction, the chief accounting officer now directly owns 5,670 shares of the company's stock, valued at $1,459,514.70. This represents a 90.84 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Andrew Kang sold 5,700 shares of the business's stock in a transaction that occurred on Wednesday, November 6th. The shares were sold at an average price of $257.15, for a total value of $1,465,755.00. Following the completion of the sale, the chief financial officer now owns 12,080 shares of the company's stock, valued at approximately $3,106,372. This trade represents a 32.06 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 102,000 shares of company stock worth $32,259,177 in the last quarter. 13.18% of the stock is owned by company insiders.

MicroStrategy Stock Up 9.6 %

MSTR traded up $33.99 on Wednesday, reaching $387.68. 25,843,233 shares of the company traded hands, compared to its average volume of 18,410,406. The stock's 50 day moving average price is $243.51 and its 200-day moving average price is $180.24. MicroStrategy Incorporated has a 52-week low of $43.87 and a 52-week high of $543.00. The company has a market cap of $78.56 billion, a price-to-earnings ratio of -183.44 and a beta of 3.05. The company has a debt-to-equity ratio of 1.12, a current ratio of 0.65 and a quick ratio of 0.65.

MicroStrategy (NASDAQ:MSTR - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The software maker reported ($1.56) earnings per share (EPS) for the quarter, missing the consensus estimate of ($0.12) by ($1.44). The company had revenue of $116.07 million during the quarter, compared to analyst estimates of $121.45 million. MicroStrategy had a negative return on equity of 17.31% and a negative net margin of 87.05%. The company's revenue was down 10.3% on a year-over-year basis. During the same quarter in the previous year, the business posted ($8.98) EPS.

Analyst Ratings Changes

MSTR has been the topic of a number of recent research reports. Canaccord Genuity Group boosted their price target on shares of MicroStrategy from $300.00 to $510.00 and gave the stock a "buy" rating in a research report on Monday. Maxim Group boosted their target price on MicroStrategy from $193.00 to $270.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Barclays lifted their target price on MicroStrategy from $275.00 to $515.00 and gave the company an "overweight" rating in a research note on Monday. Benchmark lifted their price target on shares of MicroStrategy from $450.00 to $650.00 and gave the company a "buy" rating in a research report on Monday. Finally, BTIG Research upped their price objective on shares of MicroStrategy from $290.00 to $570.00 and gave the company a "buy" rating in a research note on Thursday, November 21st. One analyst has rated the stock with a sell rating and eight have given a buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus price target of $479.25.

Get Our Latest Report on MicroStrategy

MicroStrategy Profile

(

Free Report)

MicroStrategy Incorporated provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers MicroStrategy ONE, which provides non-technical users with the ability to directly access novel and actionable insights for decision-making; and MicroStrategy Cloud for Government service, which offers always-on threat monitoring that meets the rigorous technical and regulatory needs of governments and financial institutions.

Further Reading

Before you consider MicroStrategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MicroStrategy wasn't on the list.

While MicroStrategy currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.