CenterBook Partners LP bought a new position in shares of Barnes & Noble Education, Inc. (NYSE:BNED - Free Report) during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor bought 142,354 shares of the specialty retailer's stock, valued at approximately $1,429,000. CenterBook Partners LP owned approximately 0.47% of Barnes & Noble Education as of its most recent filing with the Securities & Exchange Commission.

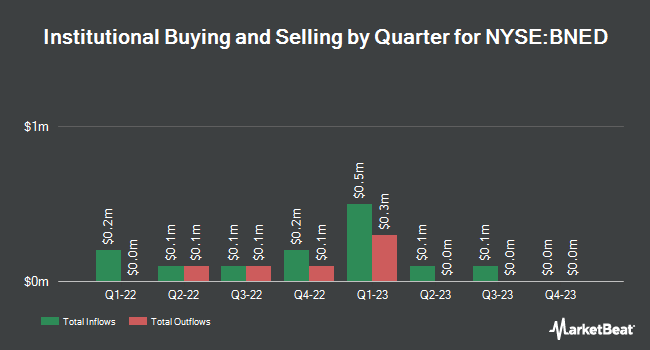

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in BNED. Centiva Capital LP acquired a new stake in Barnes & Noble Education during the third quarter worth approximately $169,000. State Street Corp boosted its position in Barnes & Noble Education by 40.9% during the 3rd quarter. State Street Corp now owns 35,463 shares of the specialty retailer's stock worth $328,000 after buying an additional 10,300 shares during the period. Geode Capital Management LLC grew its stake in shares of Barnes & Noble Education by 104.0% in the third quarter. Geode Capital Management LLC now owns 152,839 shares of the specialty retailer's stock worth $1,416,000 after purchasing an additional 77,932 shares during the last quarter. FNY Investment Advisers LLC acquired a new stake in shares of Barnes & Noble Education in the fourth quarter valued at about $49,000. Finally, Kanen Wealth Management LLC increased its position in Barnes & Noble Education by 49.6% during the 4th quarter. Kanen Wealth Management LLC now owns 2,365,360 shares of the specialty retailer's stock valued at $23,748,000 after purchasing an additional 784,576 shares during the period. 38.51% of the stock is owned by institutional investors.

Barnes & Noble Education Stock Performance

Barnes & Noble Education stock traded up $0.23 during mid-day trading on Tuesday, reaching $9.37. 264,812 shares of the company's stock were exchanged, compared to its average volume of 399,929. The firm has a market capitalization of $319.09 million, a PE ratio of -0.28 and a beta of 1.83. Barnes & Noble Education, Inc. has a one year low of $6.05 and a one year high of $135.00. The company has a quick ratio of 0.71, a current ratio of 1.31 and a debt-to-equity ratio of 0.87. The business's fifty day simple moving average is $9.81 and its 200 day simple moving average is $10.19.

Analyst Upgrades and Downgrades

Separately, StockNews.com upgraded Barnes & Noble Education from a "sell" rating to a "hold" rating in a report on Monday, April 7th.

Read Our Latest Stock Analysis on Barnes & Noble Education

Barnes & Noble Education Company Profile

(

Free Report)

Barnes and Noble Education, Inc engages in the management and operation of bookstore chains in universities. It operates through the Retail and Wholesale segments. The Retail segment operates college, university, and K-12 school bookstores, physical bookstores, and virtual bookstores. The Wholesale segment sells and distributes new and used textbooks to physical bookstores.

Featured Stories

Before you consider Barnes & Noble Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Barnes & Noble Education wasn't on the list.

While Barnes & Noble Education currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.