CenterBook Partners LP acquired a new position in shares of Varonis Systems, Inc. (NASDAQ:VRNS - Free Report) in the 4th quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm acquired 27,149 shares of the technology company's stock, valued at approximately $1,206,000.

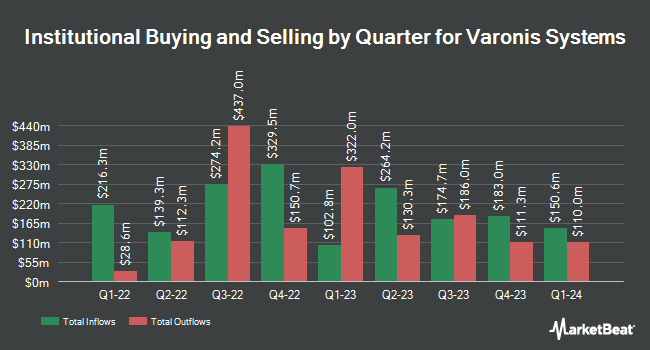

Several other institutional investors have also recently made changes to their positions in VRNS. Bailard Inc. increased its position in shares of Varonis Systems by 0.4% during the fourth quarter. Bailard Inc. now owns 93,627 shares of the technology company's stock valued at $4,160,000 after acquiring an additional 417 shares during the last quarter. Franklin Resources Inc. lifted its holdings in Varonis Systems by 1.1% during the 4th quarter. Franklin Resources Inc. now owns 40,209 shares of the technology company's stock worth $1,786,000 after buying an additional 424 shares during the last quarter. Arizona State Retirement System raised its position in shares of Varonis Systems by 1.3% during the 4th quarter. Arizona State Retirement System now owns 32,531 shares of the technology company's stock worth $1,445,000 after acquiring an additional 425 shares in the last quarter. Hillsdale Investment Management Inc. lifted its position in shares of Varonis Systems by 0.8% during the 4th quarter. Hillsdale Investment Management Inc. now owns 75,440 shares of the technology company's stock worth $3,352,000 after buying an additional 600 shares during the last quarter. Finally, Pacer Advisors Inc. grew its holdings in shares of Varonis Systems by 29.5% during the fourth quarter. Pacer Advisors Inc. now owns 2,645 shares of the technology company's stock worth $118,000 after purchasing an additional 603 shares during the last quarter. Hedge funds and other institutional investors own 95.65% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have commented on VRNS shares. Morgan Stanley assumed coverage on Varonis Systems in a research note on Tuesday, March 18th. They set an "overweight" rating for the company. Wolfe Research upgraded shares of Varonis Systems from a "peer perform" rating to an "outperform" rating and set a $50.00 target price on the stock in a research report on Friday, March 28th. Wells Fargo & Company cut their price target on Varonis Systems from $48.00 to $46.00 and set an "equal weight" rating for the company in a research note on Wednesday, February 5th. Needham & Company LLC reaffirmed a "buy" rating and issued a $67.00 target price on shares of Varonis Systems in a research note on Wednesday, February 5th. Finally, Cantor Fitzgerald started coverage on shares of Varonis Systems in a research note on Thursday, January 9th. They set an "overweight" rating and a $60.00 price target on the stock. One equities research analyst has rated the stock with a sell rating, five have assigned a hold rating, thirteen have issued a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus price target of $57.76.

View Our Latest Report on Varonis Systems

Varonis Systems Stock Performance

VRNS traded down $0.55 on Wednesday, hitting $41.13. 256,668 shares of the company's stock were exchanged, compared to its average volume of 1,505,954. The firm has a market cap of $4.63 billion, a PE ratio of -47.83 and a beta of 0.76. The stock has a fifty day moving average of $41.51 and a two-hundred day moving average of $46.95. Varonis Systems, Inc. has a twelve month low of $36.53 and a twelve month high of $60.58. The company has a current ratio of 1.24, a quick ratio of 1.24 and a debt-to-equity ratio of 0.99.

Varonis Systems (NASDAQ:VRNS - Get Free Report) last released its quarterly earnings results on Tuesday, February 4th. The technology company reported ($0.10) earnings per share for the quarter, missing analysts' consensus estimates of $0.14 by ($0.24). Varonis Systems had a negative net margin of 17.38% and a negative return on equity of 20.35%. On average, research analysts anticipate that Varonis Systems, Inc. will post -0.83 earnings per share for the current fiscal year.

Varonis Systems declared that its board has authorized a stock repurchase plan on Monday, February 10th that allows the company to buyback $100.00 million in outstanding shares. This buyback authorization allows the technology company to purchase up to 2.1% of its shares through open market purchases. Shares buyback plans are typically a sign that the company's management believes its shares are undervalued.

Varonis Systems Company Profile

(

Free Report)

Varonis Systems, Inc provides software products and services that allow enterprises to manage, analyze, alert, and secure enterprise data in North America, Europe, the Middle East, Africa, and internationally. Its software enables enterprises to protect data stored on premises and in the cloud, including sensitive files and emails; confidential personal data belonging to customers, and patients and employees' data; financial records; source code, strategic and product plans; and other intellectual property.

Featured Articles

Before you consider Varonis Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Varonis Systems wasn't on the list.

While Varonis Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.