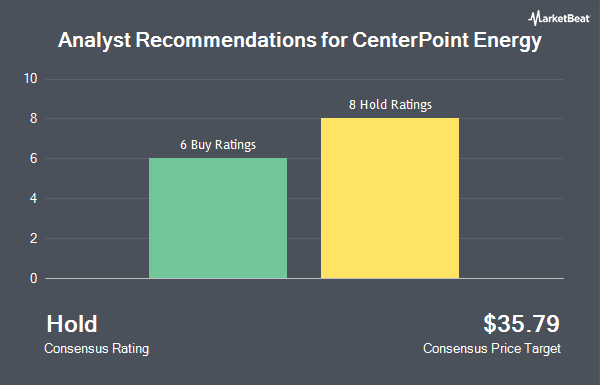

CenterPoint Energy, Inc. (NYSE:CNP - Get Free Report) has been assigned an average recommendation of "Hold" from the thirteen research firms that are presently covering the company, Marketbeat.com reports. One research analyst has rated the stock with a sell recommendation, eight have assigned a hold recommendation and four have issued a buy recommendation on the company. The average 1 year price target among brokerages that have updated their coverage on the stock in the last year is $31.27.

Several analysts have weighed in on CNP shares. Scotiabank upgraded CenterPoint Energy from a "sector perform" rating to a "sector outperform" rating and boosted their price objective for the company from $30.00 to $35.00 in a research report on Thursday, December 12th. StockNews.com cut shares of CenterPoint Energy from a "hold" rating to a "sell" rating in a research report on Thursday, October 17th. Bank of America started coverage on shares of CenterPoint Energy in a research report on Thursday, September 12th. They issued a "neutral" rating and a $29.00 price objective on the stock. Morgan Stanley dropped their target price on shares of CenterPoint Energy from $32.00 to $31.00 and set an "equal weight" rating for the company in a report on Friday, November 22nd. Finally, LADENBURG THALM/SH SH assumed coverage on CenterPoint Energy in a report on Thursday, December 12th. They set a "buy" rating and a $34.50 price target on the stock.

View Our Latest Stock Analysis on CNP

Institutional Investors Weigh In On CenterPoint Energy

Several hedge funds have recently bought and sold shares of the business. Wilmington Savings Fund Society FSB bought a new stake in shares of CenterPoint Energy in the 3rd quarter worth approximately $26,000. Rothschild Investment LLC purchased a new stake in shares of CenterPoint Energy in the second quarter worth $33,000. First Horizon Advisors Inc. increased its holdings in shares of CenterPoint Energy by 51.3% during the third quarter. First Horizon Advisors Inc. now owns 1,106 shares of the utilities provider's stock valued at $33,000 after acquiring an additional 375 shares in the last quarter. Strategic Investment Solutions Inc. IL purchased a new stake in CenterPoint Energy during the 2nd quarter valued at about $36,000. Finally, Kimelman & Baird LLC bought a new stake in CenterPoint Energy during the 2nd quarter valued at about $43,000. Institutional investors own 91.77% of the company's stock.

CenterPoint Energy Trading Down 0.8 %

Shares of CenterPoint Energy stock traded down $0.24 during trading on Thursday, reaching $31.49. The company's stock had a trading volume of 3,257,391 shares, compared to its average volume of 3,856,281. The company has a quick ratio of 0.92, a current ratio of 1.11 and a debt-to-equity ratio of 1.87. CenterPoint Energy has a 52-week low of $25.41 and a 52-week high of $33.00. The firm's 50-day moving average is $31.23 and its two-hundred day moving average is $29.56. The company has a market cap of $20.52 billion, a price-to-earnings ratio of 20.85, a PEG ratio of 2.77 and a beta of 0.96.

CenterPoint Energy (NYSE:CNP - Get Free Report) last posted its quarterly earnings results on Monday, October 28th. The utilities provider reported $0.31 earnings per share (EPS) for the quarter, meeting the consensus estimate of $0.31. The business had revenue of $1.86 billion during the quarter, compared to analyst estimates of $1.88 billion. CenterPoint Energy had a net margin of 11.25% and a return on equity of 9.73%. During the same period in the prior year, the business posted $0.40 earnings per share. On average, sell-side analysts anticipate that CenterPoint Energy will post 1.62 earnings per share for the current year.

CenterPoint Energy Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, March 13th. Shareholders of record on Thursday, February 20th will be issued a $0.22 dividend. This is an increase from CenterPoint Energy's previous quarterly dividend of $0.21. The ex-dividend date of this dividend is Thursday, February 20th. This represents a $0.88 dividend on an annualized basis and a yield of 2.79%. CenterPoint Energy's dividend payout ratio is 58.28%.

CenterPoint Energy Company Profile

(

Get Free ReportCenterPoint Energy, Inc operates as a public utility holding company in the United States. The company operates through two segments, Electric and Natural Gas. The Electric segment includes electric transmission and distribution services to electric customers and electric generation assets, as well as optimizes assets in the wholesale power market.

Further Reading

Before you consider CenterPoint Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CenterPoint Energy wasn't on the list.

While CenterPoint Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.