Centerra Gold (TSE:CG - Get Free Report) had its price target lowered by TD Securities from C$13.00 to C$12.00 in a report issued on Friday,BayStreet.CA reports. The firm presently has a "buy" rating on the stock. TD Securities' target price points to a potential upside of 44.75% from the company's previous close.

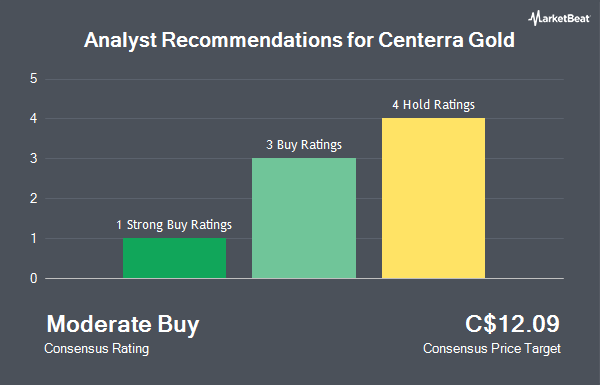

Several other equities analysts also recently commented on the company. CIBC lowered their price target on Centerra Gold from C$12.50 to C$9.80 in a report on Monday, December 2nd. Cormark cut Centerra Gold from a "moderate buy" rating to a "hold" rating in a research report on Wednesday, February 26th. Desjardins cut Centerra Gold from a "buy" rating to a "hold" rating and reduced their price objective for the company from C$12.75 to C$11.00 in a research report on Thursday, February 13th. Finally, Royal Bank of Canada reduced their price objective on Centerra Gold from C$12.00 to C$11.00 in a research report on Tuesday, January 7th. Four investment analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of C$11.47.

Get Our Latest Research Report on Centerra Gold

Centerra Gold Stock Down 1.9 %

TSE:CG traded down C$0.16 during mid-day trading on Friday, reaching C$8.29. The stock had a trading volume of 775,104 shares, compared to its average volume of 722,314. The business's 50 day moving average is C$8.75 and its 200 day moving average is C$9.01. Centerra Gold has a fifty-two week low of C$7.42 and a fifty-two week high of C$10.59. The stock has a market cap of C$1.25 billion, a P/E ratio of 12.01, a PEG ratio of 1.26 and a beta of 1.23. The company has a debt-to-equity ratio of 1.26, a current ratio of 3.60 and a quick ratio of 3.24.

Insider Buying and Selling

In other Centerra Gold news, Director Paul Botond Stilicho Tomory sold 8,563 shares of Centerra Gold stock in a transaction on Friday, March 7th. The stock was sold at an average price of C$8.28, for a total transaction of C$70,901.64. Also, Director Paul Nicholas Wright acquired 35,000 shares of the business's stock in a transaction on Friday, February 28th. The shares were bought at an average cost of C$8.11 per share, with a total value of C$283,752.00. 0.21% of the stock is owned by company insiders.

Centerra Gold Company Profile

(

Get Free Report)

Centerra Gold Inc, a gold mining company, engages in the acquisition, exploration, development, and operation of gold and copper properties in North America, Turkey, and internationally. The company explores for gold, copper, and molybdenum deposits. Its flagship projects are the 100% owned Mount Milligan gold-copper mine located in British Columbia, Canada; and the Öksüt gold mine located in Turkey.

Recommended Stories

Before you consider Centerra Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centerra Gold wasn't on the list.

While Centerra Gold currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.