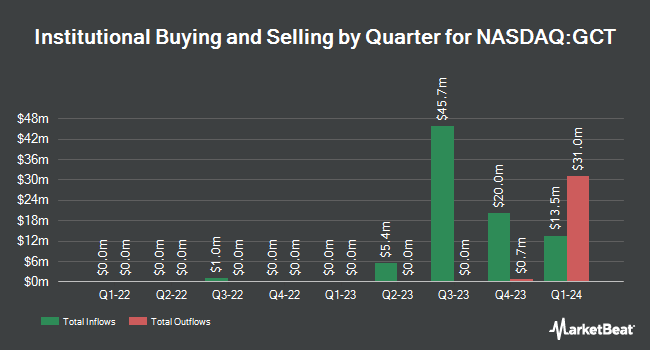

Centiva Capital LP purchased a new stake in shares of GigaCloud Technology Inc. (NASDAQ:GCT - Free Report) during the third quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 56,796 shares of the company's stock, valued at approximately $1,305,000. Centiva Capital LP owned approximately 0.14% of GigaCloud Technology as of its most recent SEC filing.

A number of other institutional investors and hedge funds have also made changes to their positions in the business. Amalgamated Bank bought a new position in shares of GigaCloud Technology in the 2nd quarter valued at about $25,000. MFA Wealth Advisors LLC purchased a new position in shares of GigaCloud Technology in the 3rd quarter worth approximately $26,000. New York State Teachers Retirement System bought a new position in shares of GigaCloud Technology during the 3rd quarter valued at approximately $49,000. Benjamin F. Edwards & Company Inc. bought a new stake in GigaCloud Technology in the second quarter worth $66,000. Finally, Zurcher Kantonalbank Zurich Cantonalbank purchased a new position in GigaCloud Technology during the third quarter worth $51,000. 34.94% of the stock is owned by hedge funds and other institutional investors.

GigaCloud Technology Trading Down 4.2 %

Shares of GCT stock traded down $1.06 on Thursday, reaching $24.26. 806,791 shares of the company's stock were exchanged, compared to its average volume of 2,173,272. The company's fifty day simple moving average is $24.37 and its 200 day simple moving average is $25.64. GigaCloud Technology Inc. has a 52 week low of $12.66 and a 52 week high of $45.18. The stock has a market capitalization of $993.93 million, a PE ratio of 8.01 and a beta of 1.74.

Wall Street Analyst Weigh In

Separately, Aegis raised shares of GigaCloud Technology to a "strong-buy" rating in a research note on Wednesday, August 14th.

View Our Latest Report on GCT

GigaCloud Technology Company Profile

(

Free Report)

GigaCloud Technology Inc provides end-to-end B2B ecommerce solutions for large parcel merchandise in the United States and internationally. The company offers GigaCloud Marketplace integrates product discovery to payments to logistics tools into one easy-to-use platform. Its marketplace connects manufacturers primarily in Asia with resellers in the United States, Asia, and Europe to execute cross-border transactions across furniture, home appliance, fitness equipment, and other large parcel categories.

Further Reading

Before you consider GigaCloud Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GigaCloud Technology wasn't on the list.

While GigaCloud Technology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.