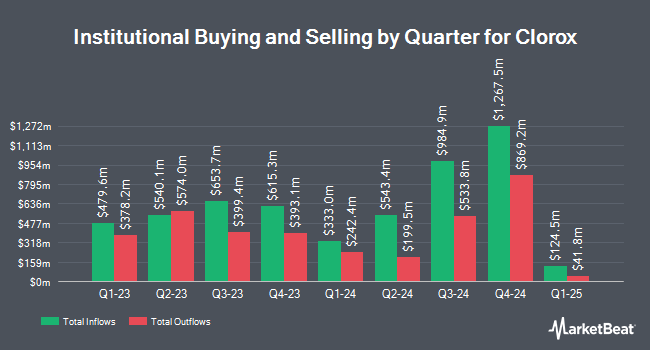

Centiva Capital LP acquired a new stake in shares of The Clorox Company (NYSE:CLX - Free Report) in the third quarter, according to its most recent disclosure with the SEC. The firm acquired 4,982 shares of the company's stock, valued at approximately $812,000.

A number of other institutional investors have also added to or reduced their stakes in the stock. Mizuho Securities USA LLC increased its holdings in shares of Clorox by 46,877.8% in the third quarter. Mizuho Securities USA LLC now owns 4,500,000 shares of the company's stock worth $733,095,000 after purchasing an additional 4,490,421 shares during the last quarter. Nuance Investments LLC increased its stake in Clorox by 150.6% in the 2nd quarter. Nuance Investments LLC now owns 1,597,674 shares of the company's stock worth $218,035,000 after acquiring an additional 960,094 shares during the last quarter. Van ECK Associates Corp raised its holdings in shares of Clorox by 2.2% during the 3rd quarter. Van ECK Associates Corp now owns 1,492,717 shares of the company's stock worth $237,372,000 after acquiring an additional 31,510 shares in the last quarter. Bank of New York Mellon Corp boosted its position in shares of Clorox by 14.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 961,387 shares of the company's stock valued at $131,200,000 after acquiring an additional 120,716 shares during the last quarter. Finally, Dimensional Fund Advisors LP boosted its position in shares of Clorox by 11.9% during the 2nd quarter. Dimensional Fund Advisors LP now owns 802,237 shares of the company's stock valued at $109,483,000 after acquiring an additional 85,529 shares during the last quarter. 78.53% of the stock is owned by hedge funds and other institutional investors.

Clorox Trading Down 1.6 %

NYSE:CLX traded down $2.77 during midday trading on Friday, hitting $166.97. The stock had a trading volume of 1,217,064 shares, compared to its average volume of 1,054,507. The company has a quick ratio of 0.62, a current ratio of 1.00 and a debt-to-equity ratio of 11.08. The stock has a 50-day moving average of $163.50 and a 200 day moving average of $150.49. The company has a market capitalization of $20.67 billion, a price-to-earnings ratio of 58.18, a PEG ratio of 3.10 and a beta of 0.42. The Clorox Company has a one year low of $127.60 and a one year high of $171.37.

Clorox (NYSE:CLX - Get Free Report) last announced its quarterly earnings results on Wednesday, October 30th. The company reported $1.86 EPS for the quarter, beating the consensus estimate of $1.36 by $0.50. Clorox had a return on equity of 316.08% and a net margin of 4.78%. The firm had revenue of $1.76 billion for the quarter, compared to analyst estimates of $1.64 billion. During the same quarter last year, the firm posted $0.49 earnings per share. The business's revenue for the quarter was up 27.0% on a year-over-year basis. As a group, sell-side analysts forecast that The Clorox Company will post 6.85 EPS for the current year.

Clorox Dividend Announcement

The business also recently declared a quarterly dividend, which will be paid on Friday, February 14th. Stockholders of record on Wednesday, January 29th will be given a $1.22 dividend. This represents a $4.88 annualized dividend and a dividend yield of 2.92%. The ex-dividend date of this dividend is Wednesday, January 29th. Clorox's payout ratio is 170.04%.

Wall Street Analysts Forecast Growth

CLX has been the topic of a number of recent research reports. JPMorgan Chase & Co. upped their price target on shares of Clorox from $148.00 to $174.00 and gave the company a "neutral" rating in a research note on Friday, October 11th. Barclays upped their target price on shares of Clorox from $137.00 to $139.00 and gave the company an "underweight" rating in a research report on Friday, November 1st. Jefferies Financial Group raised shares of Clorox from a "hold" rating to a "buy" rating and increased their price target for the company from $174.00 to $187.00 in a report on Tuesday, October 1st. Citigroup boosted their price objective on Clorox from $165.00 to $170.00 and gave the stock a "neutral" rating in a research note on Friday, September 6th. Finally, DA Davidson raised their price objective on Clorox from $153.00 to $171.00 and gave the company a "neutral" rating in a research note on Monday, November 4th. Five investment analysts have rated the stock with a sell rating, ten have issued a hold rating and one has given a buy rating to the stock. According to MarketBeat.com, Clorox has a consensus rating of "Hold" and an average price target of $155.00.

Get Our Latest Research Report on Clorox

Clorox Profile

(

Free Report)

The Clorox Company manufactures and markets consumer and professional products worldwide. It operates through four segments: Health and Wellness, Household, Lifestyle, and International. The Health and Wellness segment offers cleaning products, such as laundry additives and home care products primarily under the Clorox, Clorox2, Scentiva, Pine-Sol, Liquid-Plumr, Tilex, and Formula 409 brands; professional cleaning and disinfecting products under the CloroxPro and Clorox Healthcare brands; professional food service products under the Hidden Valley brand; and vitamins, minerals and supplement products under the RenewLife, Natural Vitality, NeoCell, and Rainbow Light brands in the United States.

Read More

Before you consider Clorox, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Clorox wasn't on the list.

While Clorox currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.