Centiva Capital LP trimmed its holdings in shares of Onto Innovation Inc. (NYSE:ONTO - Free Report) by 77.8% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 1,348 shares of the semiconductor company's stock after selling 4,724 shares during the period. Centiva Capital LP's holdings in Onto Innovation were worth $280,000 at the end of the most recent quarter.

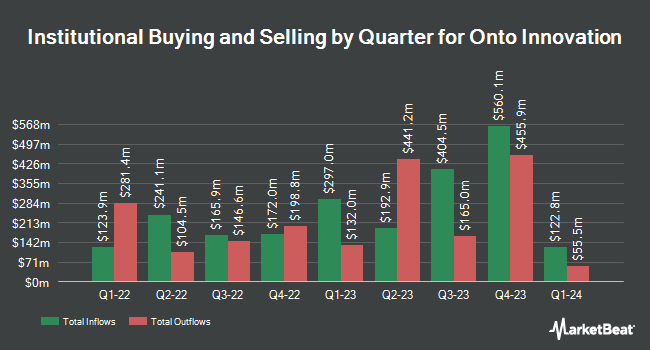

Other large investors have also made changes to their positions in the company. Point72 Hong Kong Ltd purchased a new stake in shares of Onto Innovation in the third quarter worth about $2,732,000. Encompass More Asset Management lifted its holdings in Onto Innovation by 38.5% in the third quarter. Encompass More Asset Management now owns 1,404 shares of the semiconductor company's stock valued at $291,000 after acquiring an additional 390 shares during the period. Circle Wealth Management LLC boosted its position in Onto Innovation by 104.8% in the 3rd quarter. Circle Wealth Management LLC now owns 4,732 shares of the semiconductor company's stock worth $982,000 after purchasing an additional 2,421 shares in the last quarter. PDT Partners LLC grew its stake in shares of Onto Innovation by 181.1% during the 3rd quarter. PDT Partners LLC now owns 5,502 shares of the semiconductor company's stock worth $1,142,000 after purchasing an additional 3,545 shares during the period. Finally, Fred Alger Management LLC grew its stake in shares of Onto Innovation by 171.8% during the 3rd quarter. Fred Alger Management LLC now owns 13,600 shares of the semiconductor company's stock worth $2,823,000 after purchasing an additional 8,597 shares during the period. 98.35% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several equities analysts recently issued reports on the stock. Jefferies Financial Group decreased their target price on shares of Onto Innovation from $265.00 to $245.00 and set a "buy" rating for the company in a research note on Friday, November 1st. Needham & Company LLC decreased their price objective on shares of Onto Innovation from $245.00 to $230.00 and set a "buy" rating for the company in a research report on Friday, November 1st. Oppenheimer raised their target price on Onto Innovation from $260.00 to $275.00 and gave the company an "outperform" rating in a research report on Friday, November 1st. Finally, Benchmark restated a "buy" rating and issued a $230.00 price target on shares of Onto Innovation in a research note on Friday, November 1st. One investment analyst has rated the stock with a hold rating and seven have given a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $254.29.

View Our Latest Report on Onto Innovation

Onto Innovation Trading Up 2.6 %

ONTO traded up $4.26 on Wednesday, hitting $167.60. 457,270 shares of the company's stock were exchanged, compared to its average volume of 597,209. The firm has a 50-day moving average price of $184.78 and a 200-day moving average price of $199.51. The stock has a market cap of $8.28 billion, a price-to-earnings ratio of 45.42, a P/E/G ratio of 1.08 and a beta of 1.30. Onto Innovation Inc. has a fifty-two week low of $134.11 and a fifty-two week high of $238.93.

Onto Innovation (NYSE:ONTO - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The semiconductor company reported $1.34 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.31 by $0.03. Onto Innovation had a net margin of 19.44% and a return on equity of 13.38%. The company had revenue of $252.20 million during the quarter, compared to analysts' expectations of $250.85 million. During the same quarter in the prior year, the company earned $0.96 EPS. Onto Innovation's revenue was up 21.7% compared to the same quarter last year. On average, equities analysts predict that Onto Innovation Inc. will post 5.22 EPS for the current year.

Onto Innovation Profile

(

Free Report)

Onto Innovation Inc engages in the design, development, manufacture, and support of process control tools that performs optical metrology. The company offers lithography systems and process control analytical software. It also offers process and yield management solutions, and device packaging and test facilities through standalone systems for optical metrology, macro-defect inspection, packaging lithography, and transparent and opaque thin film measurements.

Featured Articles

Before you consider Onto Innovation, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Onto Innovation wasn't on the list.

While Onto Innovation currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.