Centiva Capital LP purchased a new position in Trupanion, Inc. (NASDAQ:TRUP - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 14,165 shares of the financial services provider's stock, valued at approximately $595,000.

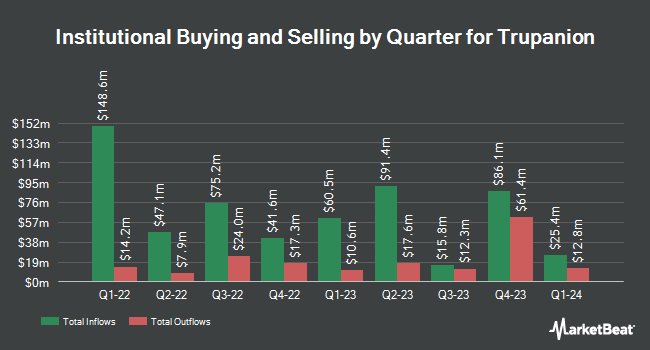

Several other hedge funds have also recently made changes to their positions in the stock. Zurcher Kantonalbank Zurich Cantonalbank boosted its holdings in Trupanion by 7.3% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 9,861 shares of the financial services provider's stock worth $414,000 after purchasing an additional 671 shares during the last quarter. FORA Capital LLC bought a new position in shares of Trupanion during the 3rd quarter valued at $540,000. Blueshift Asset Management LLC boosted its stake in shares of Trupanion by 215.8% in the 3rd quarter. Blueshift Asset Management LLC now owns 37,230 shares of the financial services provider's stock worth $1,563,000 after buying an additional 25,440 shares during the last quarter. BNP Paribas Financial Markets grew its holdings in shares of Trupanion by 7.6% in the third quarter. BNP Paribas Financial Markets now owns 124,548 shares of the financial services provider's stock worth $5,229,000 after acquiring an additional 8,781 shares during the period. Finally, FMR LLC increased its position in Trupanion by 55,963.7% during the third quarter. FMR LLC now owns 1,172,293 shares of the financial services provider's stock valued at $49,213,000 after acquiring an additional 1,170,202 shares during the last quarter.

Insider Buying and Selling at Trupanion

In other news, SVP Emily Dreyer sold 3,100 shares of the business's stock in a transaction on Friday, November 22nd. The shares were sold at an average price of $54.85, for a total value of $170,035.00. Following the transaction, the senior vice president now owns 24,708 shares of the company's stock, valued at approximately $1,355,233.80. The trade was a 11.15 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Steve Weinrauch sold 11,916 shares of the firm's stock in a transaction on Thursday, November 21st. The shares were sold at an average price of $53.00, for a total transaction of $631,548.00. Following the transaction, the executive vice president now directly owns 48,978 shares of the company's stock, valued at $2,595,834. The trade was a 19.57 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 28,405 shares of company stock valued at $1,512,482 over the last ninety days. 5.50% of the stock is currently owned by company insiders.

Analyst Upgrades and Downgrades

Several brokerages have issued reports on TRUP. Bank of America raised their target price on Trupanion from $47.00 to $56.00 and gave the stock a "buy" rating in a research report on Friday, September 20th. Stifel Nicolaus raised their price objective on shares of Trupanion from $30.00 to $40.00 and gave the stock a "hold" rating in a report on Monday, September 23rd. Piper Sandler upped their target price on shares of Trupanion from $45.00 to $57.00 and gave the company a "neutral" rating in a report on Thursday, October 31st. Finally, Northland Securities lifted their price target on shares of Trupanion from $45.00 to $50.00 and gave the stock a "market perform" rating in a research note on Thursday, October 31st. Three investment analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $44.67.

View Our Latest Research Report on Trupanion

Trupanion Stock Performance

Trupanion stock traded up $1.87 during midday trading on Friday, hitting $53.46. The stock had a trading volume of 459,460 shares, compared to its average volume of 556,974. Trupanion, Inc. has a 52-week low of $19.69 and a 52-week high of $57.90. The company has a market capitalization of $2.26 billion, a PE ratio of -167.06 and a beta of 1.60. The firm's fifty day moving average is $51.08 and its two-hundred day moving average is $41.19. The company has a current ratio of 1.66, a quick ratio of 1.66 and a debt-to-equity ratio of 0.40.

Trupanion (NASDAQ:TRUP - Get Free Report) last announced its quarterly earnings data on Wednesday, October 30th. The financial services provider reported $0.03 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.06) by $0.09. Trupanion had a negative net margin of 1.08% and a negative return on equity of 4.36%. The firm had revenue of $327.50 million during the quarter, compared to analysts' expectations of $321.79 million. During the same period in the prior year, the company posted ($0.10) earnings per share. The company's revenue for the quarter was up 14.6% compared to the same quarter last year. On average, research analysts forecast that Trupanion, Inc. will post -0.23 EPS for the current year.

Trupanion Profile

(

Free Report)

Trupanion, Inc, together with its subsidiaries, provides medical insurance for cats and dogs on a monthly subscription basis in the United States, Canada, Continental Europe, and Australia. The company operates in two segments, Subscription Business and Other Business. It serves pet owners and veterinarians.

See Also

Before you consider Trupanion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trupanion wasn't on the list.

While Trupanion currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.