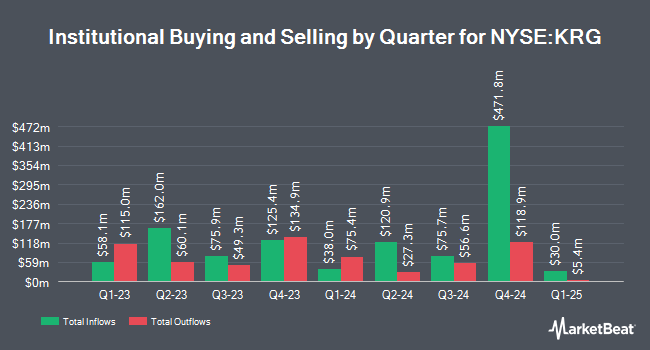

Centiva Capital LP boosted its position in shares of Kite Realty Group Trust (NYSE:KRG - Free Report) by 100.0% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 67,717 shares of the real estate investment trust's stock after purchasing an additional 33,866 shares during the period. Centiva Capital LP's holdings in Kite Realty Group Trust were worth $1,799,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently made changes to their positions in the stock. Point72 Hong Kong Ltd lifted its position in shares of Kite Realty Group Trust by 334.2% in the third quarter. Point72 Hong Kong Ltd now owns 24,161 shares of the real estate investment trust's stock worth $642,000 after buying an additional 18,596 shares during the last quarter. Edgestream Partners L.P. bought a new position in Kite Realty Group Trust during the third quarter valued at about $969,000. Captrust Financial Advisors grew its stake in shares of Kite Realty Group Trust by 6.8% in the 3rd quarter. Captrust Financial Advisors now owns 17,601 shares of the real estate investment trust's stock valued at $467,000 after purchasing an additional 1,114 shares during the period. Martingale Asset Management L P grew its stake in shares of Kite Realty Group Trust by 44.6% in the 3rd quarter. Martingale Asset Management L P now owns 19,440 shares of the real estate investment trust's stock valued at $516,000 after purchasing an additional 6,000 shares during the period. Finally, UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in Kite Realty Group Trust by 432.7% during the 3rd quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 1,361,062 shares of the real estate investment trust's stock worth $36,150,000 after acquiring an additional 1,105,539 shares during the last quarter. Institutional investors and hedge funds own 90.81% of the company's stock.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on KRG shares. Wells Fargo & Company upgraded Kite Realty Group Trust from an "underweight" rating to an "equal weight" rating and increased their price target for the stock from $23.00 to $26.00 in a research report on Wednesday, August 28th. Robert W. Baird upped their price objective on Kite Realty Group Trust from $26.00 to $29.00 and gave the stock a "neutral" rating in a report on Friday, November 15th. KeyCorp upped their price objective on Kite Realty Group Trust from $28.00 to $31.00 and gave the stock an "overweight" rating in a report on Tuesday, November 12th. Piper Sandler upped their price objective on Kite Realty Group Trust from $30.00 to $33.00 and gave the stock an "overweight" rating in a report on Tuesday, September 3rd. Finally, Raymond James raised Kite Realty Group Trust from a "market perform" rating to a "strong-buy" rating and set a $28.00 price objective on the stock in a report on Friday, August 16th. Three equities research analysts have rated the stock with a hold rating, four have issued a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, Kite Realty Group Trust has an average rating of "Moderate Buy" and a consensus price target of $28.86.

View Our Latest Stock Analysis on Kite Realty Group Trust

Kite Realty Group Trust Stock Performance

NYSE:KRG traded up $0.05 during mid-day trading on Wednesday, hitting $26.95. The stock had a trading volume of 1,490,234 shares, compared to its average volume of 1,586,734. Kite Realty Group Trust has a twelve month low of $19.64 and a twelve month high of $28.24. The stock has a market cap of $5.92 billion, a price-to-earnings ratio of -673.63, a PEG ratio of 3.76 and a beta of 1.28. The company's 50 day simple moving average is $26.53 and its 200 day simple moving average is $24.73. The company has a debt-to-equity ratio of 0.97, a quick ratio of 3.08 and a current ratio of 3.08.

Kite Realty Group Trust Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, January 16th. Investors of record on Thursday, January 9th will be paid a $0.27 dividend. This represents a $1.08 dividend on an annualized basis and a yield of 4.01%. This is a boost from Kite Realty Group Trust's previous quarterly dividend of $0.26. The ex-dividend date of this dividend is Thursday, January 9th. Kite Realty Group Trust's dividend payout ratio (DPR) is -2,600.00%.

Insiders Place Their Bets

In other news, Director Steven P. Grimes sold 37,295 shares of Kite Realty Group Trust stock in a transaction on Monday, September 16th. The shares were sold at an average price of $26.80, for a total transaction of $999,506.00. Following the transaction, the director now owns 732,252 shares in the company, valued at approximately $19,624,353.60. The trade was a 4.85 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 2.00% of the company's stock.

About Kite Realty Group Trust

(

Free Report)

Kite Realty Group Trust NYSE: KRG is a real estate investment trust (REIT) headquartered in Indianapolis, IN that is one of the largest publicly traded owners and operators of open-air shopping centers and mixed-use assets. The Company's primarily grocery-anchored portfolio is located in high-growth Sun Belt and select strategic gateway markets.

Read More

Before you consider Kite Realty Group Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kite Realty Group Trust wasn't on the list.

While Kite Realty Group Trust currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.