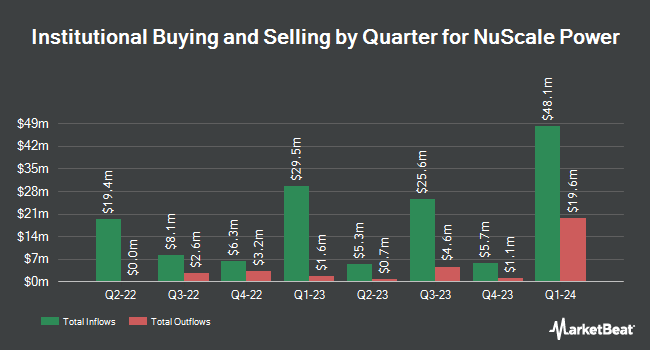

Centiva Capital LP acquired a new position in shares of NuScale Power Co. (NYSE:SMR - Free Report) in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 27,000 shares of the company's stock, valued at approximately $313,000.

Several other institutional investors and hedge funds also recently made changes to their positions in the business. Zurcher Kantonalbank Zurich Cantonalbank bought a new stake in shares of NuScale Power during the third quarter worth $44,000. US Bancorp DE acquired a new position in shares of NuScale Power during the third quarter worth about $54,000. CWM LLC boosted its position in shares of NuScale Power by 4,593.8% during the third quarter. CWM LLC now owns 5,304 shares of the company's stock worth $61,000 after buying an additional 5,191 shares during the period. International Assets Investment Management LLC acquired a new stake in NuScale Power in the 2nd quarter valued at approximately $64,000. Finally, TFC Financial Management Inc. acquired a new stake in NuScale Power in the 2nd quarter valued at approximately $75,000. Institutional investors own 15.28% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have weighed in on SMR. Craig Hallum raised their price target on NuScale Power from $16.00 to $21.00 and gave the company a "buy" rating in a research note on Thursday, October 17th. CLSA started coverage on shares of NuScale Power in a research note on Friday, September 13th. They issued an "outperform" rating and a $11.00 target price for the company. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $10.39.

Get Our Latest Stock Analysis on SMR

NuScale Power Stock Performance

Shares of SMR traded up $0.25 during mid-day trading on Wednesday, hitting $22.39. 10,010,638 shares of the company's stock were exchanged, compared to its average volume of 6,485,041. The company has a quick ratio of 2.24, a current ratio of 2.24 and a debt-to-equity ratio of 0.26. NuScale Power Co. has a 52 week low of $1.88 and a 52 week high of $32.30. The stock's 50-day simple moving average is $21.24 and its 200-day simple moving average is $13.89. The firm has a market cap of $5.72 billion, a price-to-earnings ratio of -23.57 and a beta of 1.33.

Insider Buying and Selling at NuScale Power

In other NuScale Power news, insider Robert K. Temple sold 144,627 shares of the company's stock in a transaction on Friday, September 20th. The stock was sold at an average price of $10.90, for a total transaction of $1,576,434.30. Following the completion of the sale, the insider now directly owns 14,054 shares in the company, valued at $153,188.60. This represents a 91.14 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, VP Jacqueline F. Engel sold 18,186 shares of NuScale Power stock in a transaction on Friday, November 29th. The shares were sold at an average price of $29.00, for a total value of $527,394.00. Following the completion of the transaction, the vice president now owns 3,801 shares in the company, valued at approximately $110,229. The trade was a 82.71 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 427,237 shares of company stock valued at $6,053,065 in the last three months. Corporate insiders own 1.96% of the company's stock.

NuScale Power Company Profile

(

Free Report)

NuScale Power Corporation engages in the development and sale of modular light water reactor nuclear power plants to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications. It offers NuScale Power Module (NPM), a water reactor that can generate 77 megawatts of electricity (MWe); and VOYGR power plant designs for three facility sizes that are capable of housing from one to four and six or twelve NPMs.

Featured Articles

Before you consider NuScale Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NuScale Power wasn't on the list.

While NuScale Power currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.