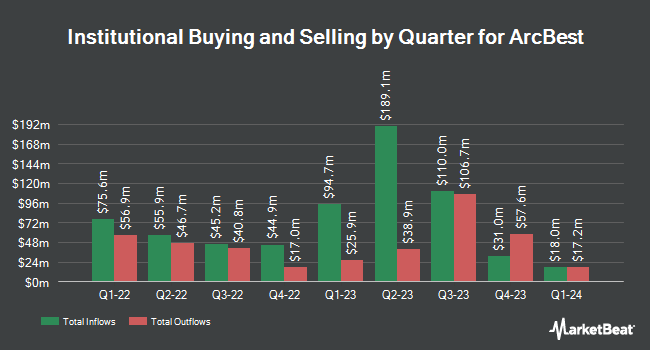

Centiva Capital LP bought a new position in shares of ArcBest Co. (NASDAQ:ARCB - Free Report) during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The fund bought 5,087 shares of the transportation company's stock, valued at approximately $552,000.

Several other institutional investors and hedge funds also recently bought and sold shares of ARCB. Quarry LP raised its holdings in ArcBest by 120.7% in the 2nd quarter. Quarry LP now owns 245 shares of the transportation company's stock valued at $26,000 after buying an additional 134 shares during the period. Innealta Capital LLC acquired a new position in shares of ArcBest in the 2nd quarter worth approximately $33,000. Quest Partners LLC acquired a new stake in ArcBest in the 2nd quarter valued at approximately $36,000. Cultivar Capital Inc. purchased a new stake in ArcBest in the second quarter valued at approximately $43,000. Finally, Mather Group LLC. acquired a new position in ArcBest during the second quarter worth $46,000. 99.27% of the stock is currently owned by institutional investors and hedge funds.

ArcBest Stock Down 0.0 %

NASDAQ:ARCB traded down $0.05 during trading hours on Friday, hitting $107.26. The company's stock had a trading volume of 208,230 shares, compared to its average volume of 230,834. The stock has a market capitalization of $2.51 billion, a P/E ratio of 13.24, a price-to-earnings-growth ratio of 2.44 and a beta of 1.49. The company has a current ratio of 1.04, a quick ratio of 1.04 and a debt-to-equity ratio of 0.09. The stock has a fifty day moving average of $107.29 and a 200-day moving average of $108.15. ArcBest Co. has a 52-week low of $94.76 and a 52-week high of $153.60.

ArcBest (NASDAQ:ARCB - Get Free Report) last issued its earnings results on Friday, November 1st. The transportation company reported $1.64 earnings per share for the quarter, missing the consensus estimate of $1.84 by ($0.20). The business had revenue of $1.06 billion for the quarter, compared to analyst estimates of $1.07 billion. ArcBest had a return on equity of 14.27% and a net margin of 4.54%. ArcBest's revenue was down 5.8% on a year-over-year basis. During the same period last year, the business posted $2.31 EPS. On average, equities analysts forecast that ArcBest Co. will post 6.07 earnings per share for the current year.

ArcBest Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Wednesday, November 27th. Stockholders of record on Wednesday, November 13th were issued a $0.12 dividend. This represents a $0.48 annualized dividend and a dividend yield of 0.45%. The ex-dividend date was Wednesday, November 13th. ArcBest's payout ratio is 5.93%.

Insider Activity at ArcBest

In other ArcBest news, Director Craig E. Philip sold 3,900 shares of ArcBest stock in a transaction that occurred on Friday, November 22nd. The stock was sold at an average price of $109.91, for a total value of $428,649.00. Following the transaction, the director now directly owns 23,250 shares in the company, valued at approximately $2,555,407.50. This trade represents a 14.36 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, SVP Michael E. Newcity sold 10,443 shares of the business's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $120.60, for a total transaction of $1,259,425.80. Following the completion of the transaction, the senior vice president now directly owns 5,051 shares in the company, valued at $609,150.60. This represents a 67.40 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 1.65% of the company's stock.

Analyst Upgrades and Downgrades

A number of equities research analysts have recently weighed in on ARCB shares. TD Cowen cut ArcBest from a "buy" rating to a "hold" rating and dropped their price objective for the company from $131.00 to $114.00 in a research note on Monday, October 14th. Bank of America cut their price target on shares of ArcBest from $102.00 to $99.00 and set an "underperform" rating on the stock in a research note on Wednesday, September 4th. Morgan Stanley reduced their price target on shares of ArcBest from $175.00 to $170.00 and set an "overweight" rating on the stock in a research report on Monday, November 4th. Jefferies Financial Group dropped their price objective on shares of ArcBest from $140.00 to $130.00 and set a "buy" rating for the company in a report on Thursday, October 10th. Finally, The Goldman Sachs Group reduced their target price on shares of ArcBest from $133.00 to $125.00 and set a "neutral" rating on the stock in a report on Wednesday, October 9th. One investment analyst has rated the stock with a sell rating, seven have issued a hold rating and six have assigned a buy rating to the stock. Based on data from MarketBeat, the company currently has an average rating of "Hold" and an average target price of $124.50.

Check Out Our Latest Analysis on ArcBest

ArcBest Profile

(

Free Report)

ArcBest Corporation, an integrated logistics company, engages in the provision of ground, air, and ocean transportation solutions. It operates through two segments: Asset-Based and Asset-Light. The Asset-Based segment provides less-than-truckload (LTL) services, that transports general commodities, such as food, textiles, apparel, furniture, appliances, chemicals, non-bulk petroleum products, rubber, plastics, metal and metal products, wood, glass, automotive parts, machinery, and miscellaneous manufactured products.

Further Reading

Before you consider ArcBest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcBest wasn't on the list.

While ArcBest currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.