Centrais Elétricas Brasileiras S.A. - Eletrobrás (NYSE:EBR - Get Free Report) will likely be issuing its quarterly earnings data before the market opens on Thursday, March 27th. Analysts expect the company to announce earnings of $0.11 per share and revenue of $10.17 billion for the quarter. Parties that wish to register for the company's conference call can do so using this link.

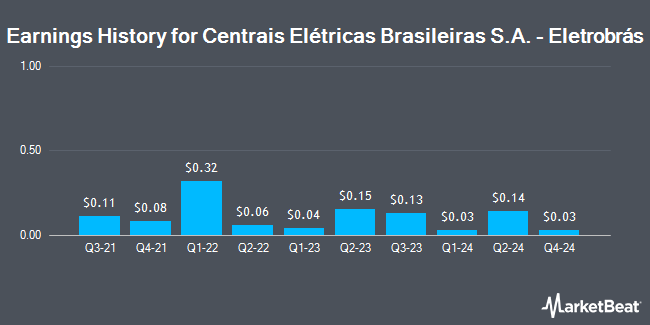

Centrais Elétricas Brasileiras S.A. - Eletrobrás (NYSE:EBR - Get Free Report) last issued its quarterly earnings results on Friday, March 14th. The utilities provider reported $0.03 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.11 by ($0.08). Centrais Elétricas Brasileiras S.A. - Eletrobrás had a return on equity of 9.00% and a net margin of 26.50%. The business had revenue of $1.67 billion during the quarter, compared to the consensus estimate of $10.17 billion. On average, analysts expect Centrais Elétricas Brasileiras S.A. - Eletrobrás to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Centrais Elétricas Brasileiras S.A. - Eletrobrás Stock Down 1.3 %

NYSE:EBR traded down $0.10 during mid-day trading on Friday, hitting $7.32. 989,912 shares of the company's stock were exchanged, compared to its average volume of 1,151,493. The company has a market cap of $16.43 billion, a PE ratio of 8.92, a P/E/G ratio of 4.35 and a beta of 1.00. The company has a debt-to-equity ratio of 0.47, a current ratio of 2.06 and a quick ratio of 2.04. Centrais Elétricas Brasileiras S.A. - Eletrobrás has a one year low of $5.45 and a one year high of $8.57. The business has a fifty day moving average price of $6.41 and a 200 day moving average price of $6.45.

Centrais Elétricas Brasileiras S.A. - Eletrobrás Cuts Dividend

The business also recently disclosed a -- dividend, which was paid on Tuesday, January 21st. Shareholders of record on Monday, December 30th were paid a dividend of $0.1414 per share. This represents a yield of 1%. The ex-dividend date was Monday, December 30th. Centrais Elétricas Brasileiras S.A. - Eletrobrás's payout ratio is 23.17%.

About Centrais Elétricas Brasileiras S.A. - Eletrobrás

(

Get Free Report)

Centrais Elétricas Brasileiras SA - Eletrobrás, through its subsidiaries, engages in the generation, transmission, and commercialization of electricity in Brazil. The company generates electricity through hydroelectric, thermoelectric, nuclear, wind, and solar plants. As of December 31, 2023, it owned and operated 44 hydroelectric plants with a total capacity of 42,293.5 megawatt (MW); 5 thermal plants, including coal and gas power generation units with a total installed capacity of 1,632 MW; and two nuclear power plants comprising Angra 1 with an installed capacity of 657 MW and Angra 2 with an installed capacity of 1350 MW.

Featured Articles

Before you consider Centrais Elétricas Brasileiras S.A. - Eletrobrás, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centrais Elétricas Brasileiras S.A. - Eletrobrás wasn't on the list.

While Centrais Elétricas Brasileiras S.A. - Eletrobrás currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.