Cerity Partners LLC raised its position in shares of Nordson Co. (NASDAQ:NDSN - Free Report) by 16.0% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 14,499 shares of the industrial products company's stock after buying an additional 1,998 shares during the quarter. Cerity Partners LLC's holdings in Nordson were worth $3,808,000 at the end of the most recent reporting period.

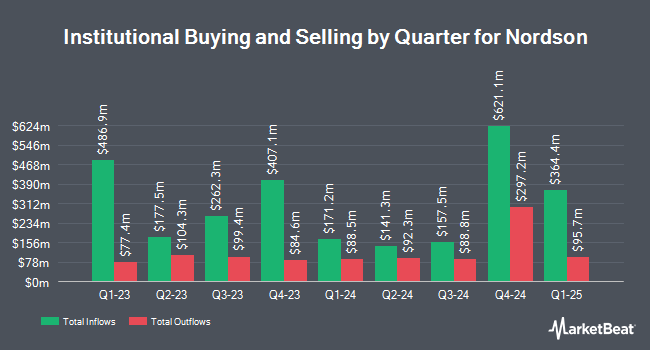

A number of other institutional investors have also modified their holdings of NDSN. Ashton Thomas Private Wealth LLC acquired a new stake in Nordson in the second quarter valued at approximately $27,000. Tortoise Investment Management LLC lifted its holdings in shares of Nordson by 70.7% during the 2nd quarter. Tortoise Investment Management LLC now owns 140 shares of the industrial products company's stock valued at $32,000 after purchasing an additional 58 shares during the last quarter. Blue Trust Inc. boosted its position in shares of Nordson by 130.0% in the 3rd quarter. Blue Trust Inc. now owns 161 shares of the industrial products company's stock worth $42,000 after purchasing an additional 91 shares in the last quarter. Whittier Trust Co. of Nevada Inc. purchased a new position in Nordson during the 2nd quarter worth $46,000. Finally, UMB Bank n.a. increased its position in Nordson by 2,387.5% during the 2nd quarter. UMB Bank n.a. now owns 199 shares of the industrial products company's stock valued at $46,000 after buying an additional 191 shares in the last quarter. 72.11% of the stock is currently owned by institutional investors.

Insider Activity

In other news, EVP Jennifer L. Mcdonough sold 225 shares of the stock in a transaction on Monday, November 11th. The shares were sold at an average price of $262.27, for a total value of $59,010.75. Following the sale, the executive vice president now owns 3,287 shares in the company, valued at $862,081.49. This represents a 6.41 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Joseph P. Kelley sold 3,000 shares of the firm's stock in a transaction on Wednesday, October 9th. The stock was sold at an average price of $249.98, for a total transaction of $749,940.00. Following the transaction, the executive vice president now directly owns 8,659 shares of the company's stock, valued at approximately $2,164,576.82. This trade represents a 25.73 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 3,312 shares of company stock valued at $831,742. Company insiders own 0.86% of the company's stock.

Nordson Stock Performance

Shares of NDSN traded up $1.63 during trading hours on Friday, reaching $260.99. 122,000 shares of the company traded hands, compared to its average volume of 233,152. The company has a quick ratio of 1.52, a current ratio of 2.36 and a debt-to-equity ratio of 0.49. The business has a fifty day moving average price of $255.72 and a 200-day moving average price of $246.16. Nordson Co. has a 12-month low of $222.18 and a 12-month high of $279.38. The stock has a market capitalization of $14.92 billion, a P/E ratio of 31.79, a P/E/G ratio of 1.93 and a beta of 0.90.

Analyst Upgrades and Downgrades

Separately, Robert W. Baird raised their price target on Nordson from $272.00 to $287.00 and gave the stock an "outperform" rating in a report on Friday, August 23rd. Two analysts have rated the stock with a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $299.00.

View Our Latest Analysis on NDSN

About Nordson

(

Free Report)

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids worldwide. It operates through three segments: Industrial Precision Solutions; Medical and Fluid Solutions; and Advanced Technology Solutions.

Further Reading

Before you consider Nordson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nordson wasn't on the list.

While Nordson currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.