Cerity Partners LLC grew its stake in shares of Gates Industrial Corp PLC (NYSE:GTES - Free Report) by 15.1% in the third quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 176,382 shares of the company's stock after purchasing an additional 23,175 shares during the quarter. Cerity Partners LLC owned approximately 0.07% of Gates Industrial worth $3,096,000 at the end of the most recent quarter.

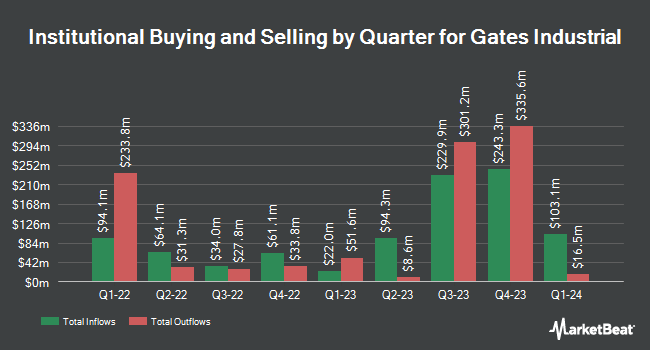

Several other institutional investors and hedge funds have also recently made changes to their positions in GTES. Park Avenue Securities LLC lifted its holdings in Gates Industrial by 172.6% in the 2nd quarter. Park Avenue Securities LLC now owns 65,962 shares of the company's stock worth $1,043,000 after buying an additional 41,762 shares during the period. First Hawaiian Bank purchased a new stake in Gates Industrial in the second quarter worth $520,000. GAMMA Investing LLC boosted its holdings in Gates Industrial by 333.9% in the third quarter. GAMMA Investing LLC now owns 3,896 shares of the company's stock valued at $68,000 after acquiring an additional 2,998 shares in the last quarter. Mutual of America Capital Management LLC purchased a new position in Gates Industrial during the 3rd quarter valued at $597,000. Finally, Foundry Partners LLC purchased a new stake in shares of Gates Industrial in the 3rd quarter worth about $4,247,000. Institutional investors own 98.50% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently issued reports on GTES shares. KeyCorp boosted their price target on shares of Gates Industrial from $22.00 to $23.00 and gave the company an "overweight" rating in a research report on Thursday, November 21st. Barclays upped their price target on Gates Industrial from $16.00 to $21.00 and gave the stock an "equal weight" rating in a research note on Tuesday, November 5th. Morgan Stanley initiated coverage on Gates Industrial in a research report on Friday, September 6th. They set an "equal weight" rating and a $19.00 price objective for the company. Royal Bank of Canada raised shares of Gates Industrial from a "sector perform" rating to an "outperform" rating and upped their target price for the stock from $20.00 to $22.00 in a research report on Monday, August 19th. Finally, Evercore ISI lifted their price target on shares of Gates Industrial from $15.00 to $16.00 and gave the company an "in-line" rating in a research report on Monday, August 19th. Four analysts have rated the stock with a hold rating and six have given a buy rating to the stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $20.40.

View Our Latest Stock Report on GTES

Gates Industrial Stock Performance

Shares of Gates Industrial stock traded up $0.04 during trading on Friday, hitting $22.16. 775,395 shares of the company's stock traded hands, compared to its average volume of 3,211,928. The business has a 50-day simple moving average of $19.33 and a 200-day simple moving average of $17.74. The company has a debt-to-equity ratio of 0.70, a current ratio of 3.02 and a quick ratio of 2.11. The stock has a market capitalization of $5.64 billion, a P/E ratio of 26.70 and a beta of 1.38. Gates Industrial Corp PLC has a 1 year low of $11.22 and a 1 year high of $22.43.

Gates Industrial Company Profile

(

Free Report)

Gates Industrial Corporation PLC designs and manufactures power transmission equipment. Its products serves harsh and hazardous industries such as agriculture, construction, manufacturing and energy, to everyday consumer applications such as printers, power washers, automatic doors and vacuum cleaners and virtually every form of transportation.

Featured Stories

Before you consider Gates Industrial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Gates Industrial wasn't on the list.

While Gates Industrial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.