Cerity Partners LLC boosted its stake in AppFolio, Inc. (NASDAQ:APPF - Free Report) by 1,120.7% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 14,648 shares of the software maker's stock after acquiring an additional 13,448 shares during the period. Cerity Partners LLC's holdings in AppFolio were worth $3,448,000 at the end of the most recent reporting period.

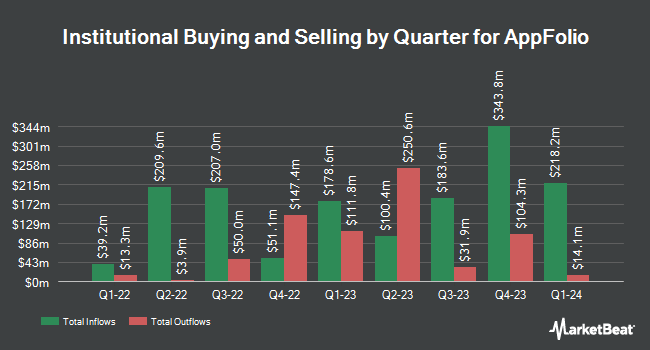

Several other institutional investors have also recently added to or reduced their stakes in the stock. Bank of New York Mellon Corp grew its position in shares of AppFolio by 13.5% in the 2nd quarter. Bank of New York Mellon Corp now owns 241,801 shares of the software maker's stock worth $59,137,000 after acquiring an additional 28,673 shares in the last quarter. Driehaus Capital Management LLC raised its position in shares of AppFolio by 16.7% during the 2nd quarter. Driehaus Capital Management LLC now owns 227,632 shares of the software maker's stock worth $55,672,000 after purchasing an additional 32,633 shares during the period. Squarepoint Ops LLC lifted its holdings in shares of AppFolio by 188.2% in the 2nd quarter. Squarepoint Ops LLC now owns 185,034 shares of the software maker's stock worth $45,254,000 after purchasing an additional 120,835 shares during the last quarter. Principal Financial Group Inc. boosted its position in AppFolio by 16.1% during the 3rd quarter. Principal Financial Group Inc. now owns 177,831 shares of the software maker's stock valued at $41,861,000 after purchasing an additional 24,697 shares during the period. Finally, Charles Schwab Investment Management Inc. grew its stake in AppFolio by 15.8% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 176,815 shares of the software maker's stock worth $41,622,000 after buying an additional 24,141 shares during the last quarter. 62.34% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on APPF shares. Piper Sandler reduced their price target on shares of AppFolio from $300.00 to $265.00 and set an "overweight" rating for the company in a report on Friday, October 25th. StockNews.com lowered shares of AppFolio from a "buy" rating to a "hold" rating in a research note on Thursday, August 22nd. Keefe, Bruyette & Woods lowered shares of AppFolio from a "market perform" rating to an "underperform" rating and dropped their price target for the company from $255.00 to $193.00 in a research note on Tuesday, October 15th. Finally, KeyCorp cut their price target on AppFolio from $300.00 to $252.00 and set an "overweight" rating on the stock in a report on Friday, October 25th. One research analyst has rated the stock with a sell rating, one has given a hold rating and seven have assigned a buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $261.75.

Read Our Latest Research Report on APPF

Insider Activity

In other news, CEO William Shane Trigg sold 3,500 shares of the stock in a transaction that occurred on Friday, November 15th. The shares were sold at an average price of $229.85, for a total value of $804,475.00. Following the completion of the sale, the chief executive officer now directly owns 74,327 shares of the company's stock, valued at $17,084,060.95. This represents a 4.50 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, major shareholder Maurice J. Duca sold 2,577 shares of the business's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $250.75, for a total transaction of $646,182.75. Following the transaction, the insider now directly owns 2,875 shares in the company, valued at $720,906.25. The trade was a 47.27 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 24,461 shares of company stock worth $5,766,272 over the last quarter. Corporate insiders own 5.24% of the company's stock.

AppFolio Trading Down 0.4 %

Shares of NASDAQ APPF traded down $1.07 during midday trading on Friday, reaching $253.75. The company's stock had a trading volume of 106,111 shares, compared to its average volume of 272,741. The company has a market cap of $9.22 billion, a price-to-earnings ratio of 70.68 and a beta of 0.83. AppFolio, Inc. has a one year low of $164.29 and a one year high of $274.56. The company has a 50 day moving average price of $225.24 and a 200 day moving average price of $231.28.

AppFolio (NASDAQ:APPF - Get Free Report) last posted its quarterly earnings results on Thursday, October 24th. The software maker reported $1.29 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.03 by $0.26. AppFolio had a return on equity of 30.64% and a net margin of 17.26%. The company had revenue of $206.00 million for the quarter, compared to analysts' expectations of $199.11 million. During the same quarter in the prior year, the company earned $0.26 earnings per share. The firm's revenue was up 24.5% on a year-over-year basis. Research analysts anticipate that AppFolio, Inc. will post 3.23 earnings per share for the current fiscal year.

AppFolio Company Profile

(

Free Report)

AppFolio, Inc, together with its subsidiaries, provides cloud business management solutions for the real estate industry in the United States. The company provides a cloud-based platform that enables users to automate and optimize common workflows; tools that assist with leasing, maintenance, and accounting; and other technology and services offered by third parties.

Featured Articles

Before you consider AppFolio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AppFolio wasn't on the list.

While AppFolio currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.