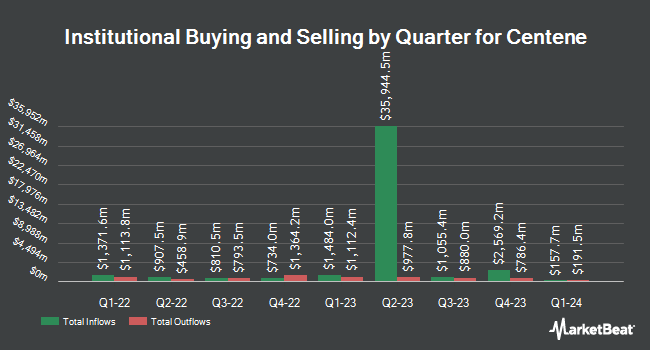

Cerity Partners LLC boosted its stake in Centene Co. (NYSE:CNC - Free Report) by 41.5% in the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 86,587 shares of the company's stock after buying an additional 25,412 shares during the quarter. Cerity Partners LLC's holdings in Centene were worth $6,518,000 as of its most recent SEC filing.

Several other large investors have also bought and sold shares of CNC. Boston Partners raised its holdings in shares of Centene by 0.4% in the first quarter. Boston Partners now owns 8,652,177 shares of the company's stock valued at $678,033,000 after purchasing an additional 32,427 shares during the last quarter. Bank of New York Mellon Corp lifted its position in shares of Centene by 0.5% during the 2nd quarter. Bank of New York Mellon Corp now owns 5,491,968 shares of the company's stock worth $364,117,000 after buying an additional 25,595 shares in the last quarter. Legal & General Group Plc boosted its stake in shares of Centene by 14.2% in the 2nd quarter. Legal & General Group Plc now owns 5,113,759 shares of the company's stock worth $339,042,000 after buying an additional 636,683 shares during the last quarter. Dimensional Fund Advisors LP grew its holdings in shares of Centene by 8.9% in the second quarter. Dimensional Fund Advisors LP now owns 4,707,648 shares of the company's stock valued at $312,150,000 after acquiring an additional 385,426 shares in the last quarter. Finally, AQR Capital Management LLC increased its position in shares of Centene by 22.9% during the second quarter. AQR Capital Management LLC now owns 4,461,517 shares of the company's stock valued at $295,799,000 after acquiring an additional 832,318 shares during the last quarter. 93.63% of the stock is currently owned by institutional investors.

Centene Stock Performance

Shares of NYSE CNC traded down $0.07 during mid-day trading on Thursday, hitting $59.93. The company had a trading volume of 3,468,386 shares, compared to its average volume of 4,051,659. The stock's 50-day moving average price is $65.43 and its 200-day moving average price is $70.04. The company has a market capitalization of $30.26 billion, a price-to-earnings ratio of 10.40, a P/E/G ratio of 0.84 and a beta of 0.49. The company has a current ratio of 1.10, a quick ratio of 1.10 and a debt-to-equity ratio of 0.64. Centene Co. has a 1 year low of $57.20 and a 1 year high of $81.42.

Analyst Ratings Changes

CNC has been the subject of a number of recent analyst reports. Barclays reduced their price objective on Centene from $97.00 to $91.00 and set an "overweight" rating for the company in a research note on Tuesday, October 29th. Stephens restated an "equal weight" rating and set a $78.00 price target on shares of Centene in a research report on Monday, August 5th. Wells Fargo & Company lowered their price objective on shares of Centene from $91.00 to $90.00 and set an "overweight" rating on the stock in a research report on Monday, November 4th. Robert W. Baird reduced their target price on shares of Centene from $83.00 to $66.00 and set a "neutral" rating for the company in a research report on Friday, October 25th. Finally, Cantor Fitzgerald reaffirmed an "overweight" rating and issued a $90.00 price target on shares of Centene in a report on Tuesday, October 1st. Seven equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $83.92.

Check Out Our Latest Stock Analysis on CNC

Insider Buying and Selling at Centene

In other news, CEO Sarah London purchased 4,117 shares of the business's stock in a transaction on Friday, November 8th. The stock was purchased at an average cost of $60.80 per share, with a total value of $250,313.60. Following the acquisition, the chief executive officer now directly owns 667,229 shares in the company, valued at approximately $40,567,523.20. This trade represents a 0.62 % increase in their ownership of the stock. The purchase was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, CFO Andrew Lynn Asher acquired 17,200 shares of the stock in a transaction that occurred on Wednesday, November 13th. The stock was acquired at an average price of $58.14 per share, for a total transaction of $1,000,008.00. Following the transaction, the chief financial officer now directly owns 486,847 shares of the company's stock, valued at $28,305,284.58. This represents a 3.66 % increase in their position. The disclosure for this purchase can be found here. Insiders own 0.29% of the company's stock.

About Centene

(

Free Report)

Centene Corporation operates as a healthcare enterprise that provides programs and services to under-insured and uninsured families, commercial organizations, and military families in the United States. The company operates through Medicaid, Medicare, Commercial, and Other segments. The Medicaid segment offers health plan coverage, including medicaid expansion, aged, blind, disabled, children's health insurance program, foster care, medicare-medicaid plans, long-term services and support.

Featured Articles

Before you consider Centene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Centene wasn't on the list.

While Centene currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.