Cerity Partners LLC lifted its stake in shares of First Solar, Inc. (NASDAQ:FSLR - Free Report) by 60.0% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The firm owned 7,457 shares of the solar cell manufacturer's stock after acquiring an additional 2,796 shares during the period. Cerity Partners LLC's holdings in First Solar were worth $1,860,000 as of its most recent filing with the Securities & Exchange Commission.

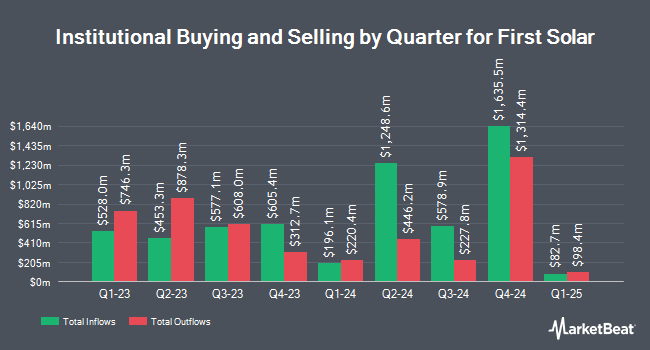

Several other institutional investors have also modified their holdings of FSLR. Western Financial Corp CA acquired a new stake in First Solar during the third quarter worth $1,209,000. Harbour Capital Advisors LLC increased its position in shares of First Solar by 224.0% during the 3rd quarter. Harbour Capital Advisors LLC now owns 5,217 shares of the solar cell manufacturer's stock worth $1,301,000 after purchasing an additional 3,607 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. raised its holdings in First Solar by 6.4% in the 3rd quarter. Sumitomo Mitsui Trust Group Inc. now owns 244,140 shares of the solar cell manufacturer's stock valued at $60,898,000 after buying an additional 14,597 shares during the period. Mivtachim The Workers Social Insurance Fund Ltd. Under Special Management acquired a new position in First Solar in the third quarter valued at about $17,635,000. Finally, Warther Private Wealth LLC purchased a new position in First Solar during the third quarter worth about $2,655,000. Hedge funds and other institutional investors own 92.08% of the company's stock.

Wall Street Analysts Forecast Growth

FSLR has been the topic of several recent analyst reports. Janney Montgomery Scott upgraded shares of First Solar from a "neutral" rating to a "buy" rating and set a $260.00 price objective on the stock in a report on Tuesday, October 29th. Morgan Stanley lowered their price target on First Solar from $329.00 to $297.00 and set an "overweight" rating for the company in a research report on Wednesday, October 30th. BMO Capital Markets reiterated an "outperform" rating and issued a $260.00 price objective (down previously from $286.00) on shares of First Solar in a report on Wednesday, October 30th. Guggenheim lowered their target price on First Solar from $368.00 to $335.00 and set a "buy" rating for the company in a report on Wednesday, October 30th. Finally, Mizuho cut their price target on shares of First Solar from $274.00 to $257.00 and set a "neutral" rating on the stock in a research note on Thursday, October 31st. Four investment analysts have rated the stock with a hold rating, twenty-three have assigned a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $280.71.

View Our Latest Report on First Solar

First Solar Stock Performance

NASDAQ FSLR traded down $0.41 on Tuesday, reaching $207.51. The stock had a trading volume of 1,915,403 shares, compared to its average volume of 2,526,287. The stock has a market cap of $22.22 billion, a P/E ratio of 17.87, a price-to-earnings-growth ratio of 0.36 and a beta of 1.46. First Solar, Inc. has a 12-month low of $135.88 and a 12-month high of $306.77. The business's 50-day moving average price is $207.29 and its 200 day moving average price is $226.01. The company has a debt-to-equity ratio of 0.05, a quick ratio of 1.44 and a current ratio of 2.14.

First Solar (NASDAQ:FSLR - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The solar cell manufacturer reported $2.91 EPS for the quarter, missing the consensus estimate of $3.10 by ($0.19). The business had revenue of $887.70 million during the quarter, compared to analysts' expectations of $1.07 billion. First Solar had a net margin of 32.41% and a return on equity of 17.56%. The firm's revenue for the quarter was up 10.7% compared to the same quarter last year. During the same quarter last year, the company earned $2.50 EPS. As a group, equities analysts expect that First Solar, Inc. will post 13.15 earnings per share for the current year.

First Solar Company Profile

(

Free Report)

First Solar, Inc, a solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, Japan, Chile, and internationally. The company manufactures and sells PV solar modules with a thin film semiconductor technology that provides a lower-carbon alternative to conventional crystalline silicon PV solar modules.

Read More

Before you consider First Solar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Solar wasn't on the list.

While First Solar currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.