Cerity Partners LLC increased its stake in shares of Vodafone Group Public Limited (NASDAQ:VOD - Free Report) by 178.6% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 93,596 shares of the cell phone carrier's stock after buying an additional 59,998 shares during the quarter. Cerity Partners LLC's holdings in Vodafone Group Public were worth $938,000 at the end of the most recent quarter.

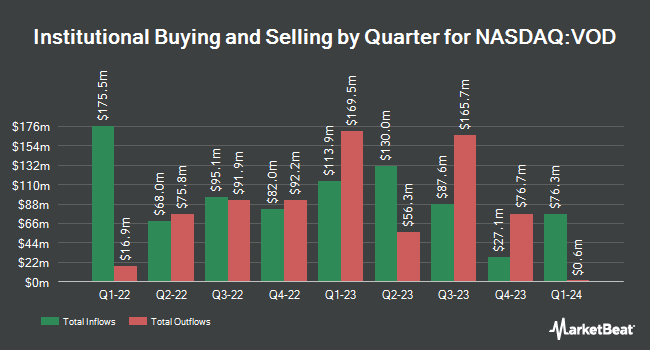

Several other large investors have also recently added to or reduced their stakes in VOD. Vicus Capital grew its holdings in Vodafone Group Public by 10.0% in the 2nd quarter. Vicus Capital now owns 12,629 shares of the cell phone carrier's stock worth $112,000 after buying an additional 1,144 shares in the last quarter. Cohen Investment Advisors LLC increased its holdings in shares of Vodafone Group Public by 4.4% during the second quarter. Cohen Investment Advisors LLC now owns 27,092 shares of the cell phone carrier's stock valued at $257,000 after purchasing an additional 1,148 shares during the period. Apollon Wealth Management LLC lifted its holdings in Vodafone Group Public by 7.6% in the third quarter. Apollon Wealth Management LLC now owns 17,072 shares of the cell phone carrier's stock worth $171,000 after purchasing an additional 1,204 shares during the period. Profund Advisors LLC grew its position in Vodafone Group Public by 3.0% in the 2nd quarter. Profund Advisors LLC now owns 46,497 shares of the cell phone carrier's stock valued at $412,000 after buying an additional 1,350 shares in the last quarter. Finally, Valeo Financial Advisors LLC raised its position in shares of Vodafone Group Public by 8.5% during the 2nd quarter. Valeo Financial Advisors LLC now owns 17,597 shares of the cell phone carrier's stock worth $156,000 after buying an additional 1,384 shares in the last quarter. 7.84% of the stock is owned by institutional investors and hedge funds.

Vodafone Group Public Price Performance

Shares of Vodafone Group Public stock traded up $0.30 during midday trading on Thursday, reaching $9.06. 8,557,524 shares of the company's stock traded hands, compared to its average volume of 6,170,156. Vodafone Group Public Limited has a 52 week low of $8.02 and a 52 week high of $10.39. The company's 50 day simple moving average is $9.32 and its 200 day simple moving average is $9.38. The company has a quick ratio of 1.34, a current ratio of 1.37 and a debt-to-equity ratio of 0.78.

Vodafone Group Public Cuts Dividend

The firm also recently disclosed a semi-annual dividend, which will be paid on Friday, February 7th. Investors of record on Friday, November 22nd will be given a dividend of $0.2423 per share. The ex-dividend date of this dividend is Friday, November 22nd. This represents a dividend yield of 8%.

Analyst Upgrades and Downgrades

Separately, StockNews.com upgraded shares of Vodafone Group Public from a "hold" rating to a "buy" rating in a research report on Friday, August 30th. One equities research analyst has rated the stock with a sell rating, one has given a hold rating, two have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy".

Get Our Latest Research Report on VOD

About Vodafone Group Public

(

Free Report)

Vodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services comprising end-to-end services for mobile voice and data, messaging, device management, BYOx, and telecoms management, as well as professional and consulting services; and fixed line connectivity, such as fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet, and satellite; and financial services, as well as business and merchant services.

Read More

Before you consider Vodafone Group Public, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vodafone Group Public wasn't on the list.

While Vodafone Group Public currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.