Cerity Partners LLC raised its position in shares of Patterson-UTI Energy, Inc. (NASDAQ:PTEN - Free Report) by 82.7% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,338,844 shares of the oil and gas company's stock after acquiring an additional 606,054 shares during the quarter. Cerity Partners LLC owned about 0.34% of Patterson-UTI Energy worth $10,242,000 as of its most recent SEC filing.

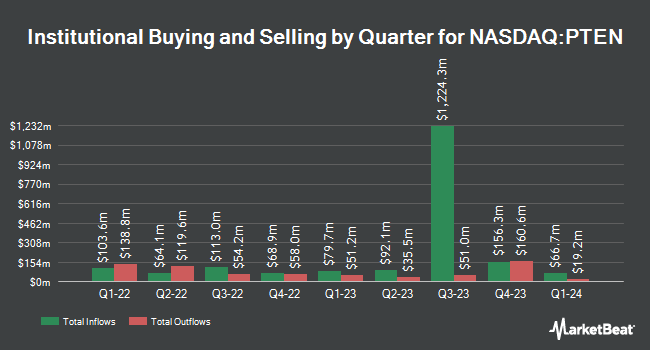

Several other hedge funds have also recently made changes to their positions in the business. Hexagon Capital Partners LLC raised its holdings in shares of Patterson-UTI Energy by 119.5% during the second quarter. Hexagon Capital Partners LLC now owns 2,401 shares of the oil and gas company's stock valued at $25,000 after purchasing an additional 1,307 shares during the period. Massmutual Trust Co. FSB ADV increased its holdings in shares of Patterson-UTI Energy by 250.4% during the third quarter. Massmutual Trust Co. FSB ADV now owns 4,320 shares of the oil and gas company's stock valued at $33,000 after acquiring an additional 3,087 shares in the last quarter. Covestor Ltd lifted its position in Patterson-UTI Energy by 92.4% in the 3rd quarter. Covestor Ltd now owns 6,885 shares of the oil and gas company's stock valued at $53,000 after acquiring an additional 3,307 shares in the last quarter. CWM LLC lifted its holdings in shares of Patterson-UTI Energy by 49.9% in the second quarter. CWM LLC now owns 6,043 shares of the oil and gas company's stock valued at $63,000 after purchasing an additional 2,012 shares in the last quarter. Finally, Blue Trust Inc. boosted its holdings in Patterson-UTI Energy by 25.0% during the 3rd quarter. Blue Trust Inc. now owns 9,498 shares of the oil and gas company's stock worth $73,000 after acquiring an additional 1,901 shares during the last quarter. 97.91% of the stock is owned by institutional investors.

Analyst Ratings Changes

A number of equities research analysts recently issued reports on the company. Royal Bank of Canada lowered their price objective on Patterson-UTI Energy from $12.00 to $11.00 and set an "outperform" rating on the stock in a research note on Friday, October 25th. Morgan Stanley decreased their price target on Patterson-UTI Energy from $12.00 to $10.00 and set an "equal weight" rating on the stock in a research report on Monday, September 16th. Susquehanna cut their price objective on shares of Patterson-UTI Energy from $13.00 to $10.00 and set a "positive" rating for the company in a research report on Friday, October 11th. Citigroup decreased their target price on Patterson-UTI Energy from $11.00 to $10.00 and set a "buy" rating on the stock in a research note on Thursday, October 31st. Finally, Stifel Nicolaus lowered their target price on shares of Patterson-UTI Energy from $15.00 to $14.00 and set a "buy" rating on the stock in a research note on Friday, October 11th. One equities research analyst has rated the stock with a sell rating, three have given a hold rating, nine have given a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of $11.88.

View Our Latest Analysis on PTEN

Patterson-UTI Energy Trading Up 1.4 %

Shares of PTEN stock traded up $0.12 during trading hours on Wednesday, reaching $8.46. The company's stock had a trading volume of 5,862,332 shares, compared to its average volume of 7,222,316. The company has a current ratio of 1.52, a quick ratio of 1.32 and a debt-to-equity ratio of 0.35. The stock has a market capitalization of $3.30 billion, a P/E ratio of -3.91 and a beta of 2.12. The firm's fifty day simple moving average is $8.11 and its 200 day simple moving average is $9.23. Patterson-UTI Energy, Inc. has a one year low of $7.38 and a one year high of $12.65.

Patterson-UTI Energy Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Monday, December 16th. Stockholders of record on Monday, December 2nd will be paid a $0.08 dividend. This represents a $0.32 dividend on an annualized basis and a dividend yield of 3.78%. The ex-dividend date of this dividend is Monday, December 2nd. Patterson-UTI Energy's payout ratio is presently -14.61%.

Patterson-UTI Energy Company Profile

(

Free Report)

Patterson-UTI Energy, Inc, through its subsidiaries, engages in the provision of contract drilling services to oil and natural gas operators in the United States and internationally. It operates through three segments: Drilling Services, Completion Services, and Drilling Products. The Contract Drilling Services segment provides contract and directional drilling services in onshore oil and natural gas basins, as well as engages in the service and re-certification of equipment for drilling contractors, and provision of electrical controls and automation to the energy, marine and mining industries.

Recommended Stories

Before you consider Patterson-UTI Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Patterson-UTI Energy wasn't on the list.

While Patterson-UTI Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.