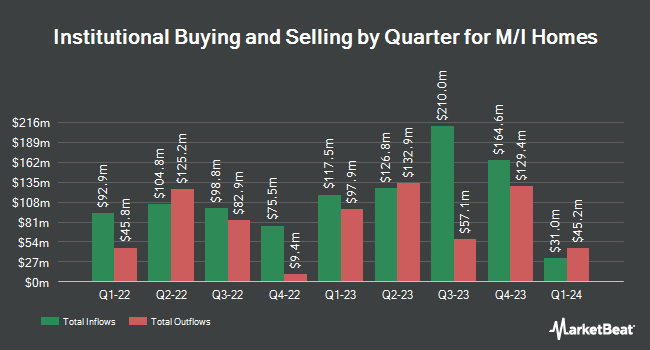

Cerity Partners LLC grew its stake in shares of M/I Homes, Inc. (NYSE:MHO - Free Report) by 507.3% during the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 15,833 shares of the construction company's stock after purchasing an additional 13,226 shares during the quarter. Cerity Partners LLC owned approximately 0.06% of M/I Homes worth $2,713,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the stock. V Square Quantitative Management LLC acquired a new stake in M/I Homes during the 3rd quarter worth $27,000. Signaturefd LLC increased its position in shares of M/I Homes by 42.8% during the second quarter. Signaturefd LLC now owns 237 shares of the construction company's stock worth $29,000 after purchasing an additional 71 shares in the last quarter. CWM LLC lifted its holdings in shares of M/I Homes by 184.8% in the 2nd quarter. CWM LLC now owns 507 shares of the construction company's stock valued at $62,000 after purchasing an additional 329 shares during the last quarter. Quarry LP boosted its position in shares of M/I Homes by 148.0% in the 2nd quarter. Quarry LP now owns 558 shares of the construction company's stock valued at $68,000 after purchasing an additional 333 shares during the period. Finally, GAMMA Investing LLC grew its stake in M/I Homes by 90.6% during the 3rd quarter. GAMMA Investing LLC now owns 606 shares of the construction company's stock worth $104,000 after buying an additional 288 shares during the last quarter. Institutional investors and hedge funds own 95.14% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have weighed in on MHO. StockNews.com cut M/I Homes from a "strong-buy" rating to a "buy" rating in a research note on Thursday, October 31st. Wedbush upgraded shares of M/I Homes from a "neutral" rating to an "outperform" rating and upped their price target for the company from $155.00 to $185.00 in a research report on Monday, November 4th.

View Our Latest Analysis on MHO

M/I Homes Stock Performance

Shares of M/I Homes stock traded up $0.49 during trading hours on Friday, hitting $165.03. 102,147 shares of the company were exchanged, compared to its average volume of 249,253. The business has a 50-day moving average of $162.43 and a 200-day moving average of $148.23. M/I Homes, Inc. has a 1 year low of $103.63 and a 1 year high of $176.18. The company has a current ratio of 6.81, a quick ratio of 1.60 and a debt-to-equity ratio of 0.33. The stock has a market capitalization of $4.58 billion, a price-to-earnings ratio of 8.84 and a beta of 2.24.

Insider Activity

In other M/I Homes news, CFO Phillip G. Creek sold 20,000 shares of the company's stock in a transaction dated Wednesday, November 6th. The shares were sold at an average price of $160.00, for a total transaction of $3,200,000.00. Following the transaction, the chief financial officer now directly owns 18,545 shares in the company, valued at approximately $2,967,200. This represents a 51.89 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Insiders own 3.70% of the company's stock.

About M/I Homes

(

Free Report)

M/I Homes, Inc, together with its subsidiaries, engages in the construction and sale of single-family residential homes in Ohio, Indiana, Illinois, Minnesota, Michigan, Florida, Texas, North Carolina, and Tennessee. The company operates through Northern Homebuilding, Southern Homebuilding, and Financial Services segments.

See Also

Before you consider M/I Homes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and M/I Homes wasn't on the list.

While M/I Homes currently has a "Strong Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.