Cerity Partners LLC boosted its position in ProShares UltraPro QQQ (NASDAQ:TQQQ - Free Report) by 30.5% during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 29,339 shares of the exchange traded fund's stock after acquiring an additional 6,857 shares during the period. Cerity Partners LLC's holdings in ProShares UltraPro QQQ were worth $2,127,000 at the end of the most recent reporting period.

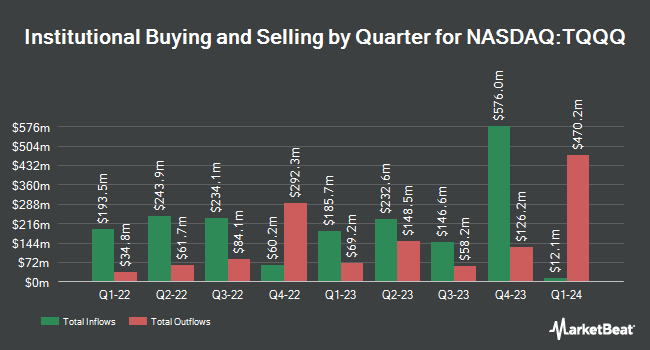

A number of other hedge funds have also recently modified their holdings of TQQQ. Cetera Investment Advisers purchased a new position in shares of ProShares UltraPro QQQ during the first quarter valued at approximately $2,152,000. U.S. Capital Wealth Advisors LLC purchased a new position in ProShares UltraPro QQQ during the 2nd quarter valued at $295,000. EWG Elevate Inc. purchased a new position in ProShares UltraPro QQQ during the 2nd quarter valued at $224,000. Steele Capital Management Inc. raised its holdings in ProShares UltraPro QQQ by 28.9% in the 2nd quarter. Steele Capital Management Inc. now owns 4,455 shares of the exchange traded fund's stock worth $330,000 after purchasing an additional 1,000 shares in the last quarter. Finally, Redhawk Wealth Advisors Inc. purchased a new stake in shares of ProShares UltraPro QQQ in the 2nd quarter worth about $226,000.

ProShares UltraPro QQQ Price Performance

Shares of NASDAQ TQQQ traded up $2.59 during midday trading on Monday, hitting $82.48. 35,699,224 shares of the company traded hands, compared to its average volume of 59,221,844. ProShares UltraPro QQQ has a 12-month low of $41.73 and a 12-month high of $85.20. The stock has a 50-day moving average price of $75.08 and a 200 day moving average price of $70.88.

ProShares UltraPro QQQ Increases Dividend

The company also recently disclosed a dividend, which was paid on Wednesday, October 2nd. Shareholders of record on Wednesday, September 25th were given a dividend of $0.2302 per share. This is a boost from ProShares UltraPro QQQ's previous dividend of $0.22. The ex-dividend date was Wednesday, September 25th.

ProShares UltraPro QQQ Company Profile

(

Free Report)

Proshares UltraPro QQQ ETF (the Fund) seeks daily investment results, before fees and expenses that correspond to triple (300%) the daily performance of the NASDAQ-100 Index (the Index). The Fund invests in equity securities, derivatives, such as futures contracts, swap agreements, and money market instruments.

Read More

Before you consider ProShares UltraPro QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ProShares UltraPro QQQ wasn't on the list.

While ProShares UltraPro QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.