Cerity Partners LLC lowered its stake in shares of Cintas Co. (NASDAQ:CTAS - Free Report) by 21.1% in the fourth quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 184,109 shares of the business services provider's stock after selling 49,363 shares during the quarter. Cerity Partners LLC's holdings in Cintas were worth $35,402,000 at the end of the most recent quarter.

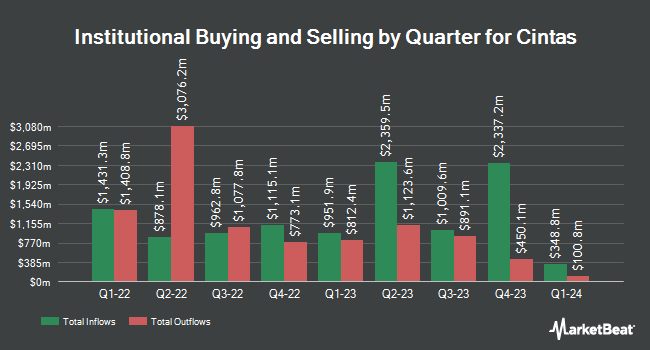

Several other large investors have also modified their holdings of CTAS. Geode Capital Management LLC grew its position in Cintas by 2.7% during the fourth quarter. Geode Capital Management LLC now owns 8,468,080 shares of the business services provider's stock valued at $1,544,822,000 after acquiring an additional 219,809 shares during the period. Norges Bank purchased a new stake in shares of Cintas during the 4th quarter worth about $877,216,000. Franklin Resources Inc. increased its position in Cintas by 264.7% during the 3rd quarter. Franklin Resources Inc. now owns 3,279,029 shares of the business services provider's stock worth $693,503,000 after purchasing an additional 2,379,932 shares in the last quarter. JPMorgan Chase & Co. increased its position in Cintas by 137.5% during the 3rd quarter. JPMorgan Chase & Co. now owns 2,222,527 shares of the business services provider's stock worth $457,574,000 after purchasing an additional 1,286,668 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its holdings in Cintas by 2.5% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,942,751 shares of the business services provider's stock valued at $354,941,000 after buying an additional 47,829 shares during the period. 63.46% of the stock is currently owned by hedge funds and other institutional investors.

Cintas Stock Up 1.6 %

NASDAQ:CTAS traded up $3.31 during mid-day trading on Friday, reaching $206.04. The stock had a trading volume of 2,116,050 shares, compared to its average volume of 1,693,472. The company has a debt-to-equity ratio of 0.47, a current ratio of 1.58 and a quick ratio of 1.38. The company has a market capitalization of $83.20 billion, a price-to-earnings ratio of 49.68, a price-to-earnings-growth ratio of 3.98 and a beta of 1.20. Cintas Co. has a 1-year low of $162.16 and a 1-year high of $228.12. The stock's 50 day simple moving average is $201.09 and its two-hundred day simple moving average is $204.23.

Cintas (NASDAQ:CTAS - Get Free Report) last issued its earnings results on Wednesday, March 26th. The business services provider reported $1.13 EPS for the quarter, topping the consensus estimate of $1.05 by $0.08. The company had revenue of $2.61 billion during the quarter, compared to analyst estimates of $2.60 billion. Cintas had a return on equity of 40.62% and a net margin of 17.23%. The business's revenue was up 8.4% on a year-over-year basis. During the same quarter last year, the firm earned $3.84 EPS. Equities analysts anticipate that Cintas Co. will post 4.31 EPS for the current year.

Cintas Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Friday, June 13th. Stockholders of record on Thursday, May 15th will be issued a $0.39 dividend. This represents a $1.56 annualized dividend and a dividend yield of 0.76%. The ex-dividend date is Thursday, May 15th. Cintas's dividend payout ratio (DPR) is presently 36.11%.

Analysts Set New Price Targets

CTAS has been the subject of several recent research reports. Robert W. Baird increased their price objective on shares of Cintas from $200.00 to $227.00 and gave the stock a "neutral" rating in a research report on Thursday, March 27th. Morgan Stanley increased their price target on Cintas from $195.00 to $213.00 and gave the company an "equal weight" rating in a report on Thursday, March 27th. Citigroup initiated coverage on Cintas in a research note on Monday, February 24th. They issued a "sell" rating and a $161.00 target price for the company. Truist Financial upped their price target on Cintas from $215.00 to $230.00 and gave the stock a "buy" rating in a report on Thursday, March 27th. Finally, UBS Group boosted their target price on shares of Cintas from $218.00 to $240.00 and gave the stock a "buy" rating in a research report on Thursday, March 27th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating and six have issued a buy rating to the stock. According to MarketBeat, Cintas presently has a consensus rating of "Hold" and an average price target of $213.62.

Check Out Our Latest Stock Analysis on Cintas

Insider Activity at Cintas

In other news, COO Jim Rozakis sold 2,000 shares of the business's stock in a transaction on Monday, April 7th. The shares were sold at an average price of $190.37, for a total transaction of $380,740.00. Following the completion of the transaction, the chief operating officer now owns 256,528 shares of the company's stock, valued at approximately $48,835,235.36. The trade was a 0.77 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Insiders own 15.00% of the company's stock.

About Cintas

(

Free Report)

Cintas Corporation engages in the provision of corporate identity uniforms and related business services primarily in the United States, Canada, and Latin America. It operates through Uniform Rental and Facility Services, First Aid and Safety Services, and All Other segments. The company rents and services uniforms and other garments, including flame resistant clothing, mats, mops and shop towels, and other ancillary items; and provides restroom cleaning services and supplies, as well as sells uniforms.

Further Reading

Before you consider Cintas, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cintas wasn't on the list.

While Cintas currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.