Stifel Financial Corp increased its position in shares of CEVA, Inc. (NASDAQ:CEVA - Free Report) by 31.7% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 117,497 shares of the semiconductor company's stock after purchasing an additional 28,248 shares during the quarter. Stifel Financial Corp owned 0.50% of CEVA worth $2,838,000 as of its most recent filing with the SEC.

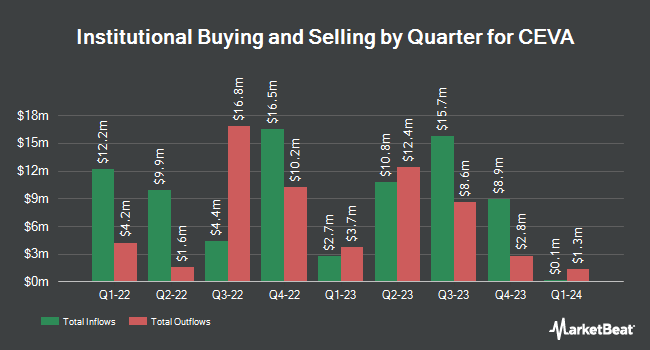

Other institutional investors also recently bought and sold shares of the company. Charles Schwab Investment Management Inc. raised its stake in shares of CEVA by 8.0% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 222,962 shares of the semiconductor company's stock worth $5,385,000 after buying an additional 16,463 shares during the last quarter. Connor Clark & Lunn Investment Management Ltd. raised its position in CEVA by 97.3% during the third quarter. Connor Clark & Lunn Investment Management Ltd. now owns 211,771 shares of the semiconductor company's stock worth $5,114,000 after acquiring an additional 104,453 shares during the last quarter. GSA Capital Partners LLP purchased a new stake in shares of CEVA in the third quarter valued at about $263,000. D.A. Davidson & CO. acquired a new stake in shares of CEVA in the third quarter valued at approximately $1,343,000. Finally, American Century Companies Inc. grew its position in shares of CEVA by 18.9% in the second quarter. American Century Companies Inc. now owns 32,168 shares of the semiconductor company's stock valued at $621,000 after purchasing an additional 5,119 shares during the last quarter. 85.37% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts recently issued reports on the company. StockNews.com lowered CEVA from a "buy" rating to a "hold" rating in a research note on Friday, November 15th. Rosenblatt Securities boosted their price target on CEVA from $28.00 to $35.00 and gave the stock a "buy" rating in a report on Friday, November 8th. Finally, Roth Mkm increased their price objective on CEVA from $25.00 to $40.00 and gave the company a "buy" rating in a research note on Friday, November 8th. One equities research analyst has rated the stock with a hold rating and four have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $34.00.

Get Our Latest Stock Report on CEVA

CEVA Price Performance

CEVA traded down $1.21 during trading on Wednesday, hitting $31.01. The company's stock had a trading volume of 213,048 shares, compared to its average volume of 159,786. CEVA, Inc. has a twelve month low of $16.02 and a twelve month high of $33.44. The stock has a market cap of $732.67 million, a PE ratio of -221.48 and a beta of 1.27. The firm's 50 day moving average price is $27.52 and its 200-day moving average price is $23.58.

CEVA Profile

(

Free Report)

CEVA, Inc provides silicon and software IP solutions to semiconductor and original equipment manufacturer (OEM) companies worldwide. Its 5G mobile and infrastructure products include Ceva-XC vector digital signal processors (DSPs) for 5G handsets, 5G RAN, and general-purpose baseband processing; PentaG-RAN, an open ran platform for base station and radio; and PentaG2 - 5G NR modem platform for UE, as well as for non-handset 5G vertical markets, such as fixed wireless access, industry 4.0, robotics, and AR/VR devices.

Recommended Stories

Before you consider CEVA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CEVA wasn't on the list.

While CEVA currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.