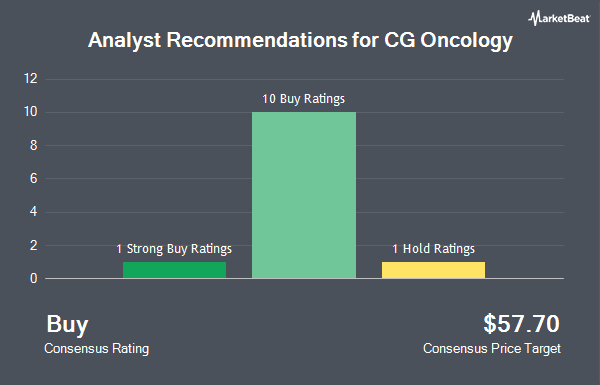

CG Oncology, Inc. (NASDAQ:CGON - Get Free Report) has been given a consensus recommendation of "Buy" by the nine analysts that are presently covering the company, MarketBeat.com reports. Eight investment analysts have rated the stock with a buy recommendation and one has given a strong buy recommendation to the company. The average twelve-month price target among brokers that have covered the stock in the last year is $63.88.

CGON has been the topic of several research reports. Roth Mkm initiated coverage on CG Oncology in a report on Tuesday, August 27th. They issued a "buy" rating and a $65.00 price target on the stock. Roth Capital raised CG Oncology to a "strong-buy" rating in a report on Tuesday, August 27th. Bank of America reaffirmed a "buy" rating and issued a $65.00 price target on shares of CG Oncology in a report on Tuesday, October 8th. HC Wainwright reissued a "buy" rating and set a $75.00 target price on shares of CG Oncology in a research note on Tuesday, November 12th. Finally, Royal Bank of Canada initiated coverage on shares of CG Oncology in a research note on Monday, September 23rd. They set an "outperform" rating and a $66.00 target price on the stock.

Check Out Our Latest Stock Analysis on CGON

CG Oncology Stock Down 6.5 %

CG Oncology stock traded down $2.35 during midday trading on Thursday, hitting $33.56. The stock had a trading volume of 1,903,636 shares, compared to its average volume of 645,963. CG Oncology has a 12 month low of $25.77 and a 12 month high of $50.23. The business has a fifty day moving average price of $35.84 and a 200 day moving average price of $34.84.

CG Oncology (NASDAQ:CGON - Get Free Report) last issued its earnings results on Tuesday, November 12th. The company reported ($0.30) EPS for the quarter, beating analysts' consensus estimates of ($0.36) by $0.06. The company had revenue of $0.04 million during the quarter, compared to the consensus estimate of $0.30 million. CG Oncology had a negative return on equity of 18.97% and a negative net margin of 10,642.98%. On average, sell-side analysts forecast that CG Oncology will post -1.31 earnings per share for the current fiscal year.

Hedge Funds Weigh In On CG Oncology

A number of hedge funds have recently modified their holdings of CGON. California State Teachers Retirement System acquired a new position in shares of CG Oncology in the first quarter worth $103,000. Bank of New York Mellon Corp increased its stake in shares of CG Oncology by 38.4% in the second quarter. Bank of New York Mellon Corp now owns 89,344 shares of the company's stock worth $2,821,000 after acquiring an additional 24,801 shares during the last quarter. Rhumbline Advisers increased its stake in shares of CG Oncology by 13.0% in the second quarter. Rhumbline Advisers now owns 34,229 shares of the company's stock worth $1,081,000 after acquiring an additional 3,940 shares during the last quarter. TD Asset Management Inc acquired a new position in shares of CG Oncology in the second quarter worth $2,939,000. Finally, Massachusetts Financial Services Co. MA boosted its holdings in CG Oncology by 2.7% in the second quarter. Massachusetts Financial Services Co. MA now owns 266,787 shares of the company's stock worth $8,422,000 after purchasing an additional 6,899 shares in the last quarter. 26.56% of the stock is owned by institutional investors and hedge funds.

CG Oncology Company Profile

(

Get Free ReportCG Oncology, Inc, an oncolytic immunotherapy company, focuses on developing and commercializing backbone bladder-sparing therapeutics for patients with bladder cancer. The company develops BOND-003 for the treatment of high-risk bacillus calmette guerin (BCG)-unresponsive non-muscle invasive bladder cancer (NMIBC) patients; CORE-001 to treat cretostimogene in combination with pembrolizumab in high-risk BCG-unresponsive NMIBC patients; and CORE-002 for the treatment of cretostimogene in combination with the checkpoint inhibitor nivolumab in muscle invasive bladder cancer patients.

See Also

Before you consider CG Oncology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CG Oncology wasn't on the list.

While CG Oncology currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.