American Century Companies Inc. lessened its holdings in shares of C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW - Free Report) by 27.7% during the 4th quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 28,910 shares of the transportation company's stock after selling 11,093 shares during the period. American Century Companies Inc.'s holdings in C.H. Robinson Worldwide were worth $2,987,000 at the end of the most recent reporting period.

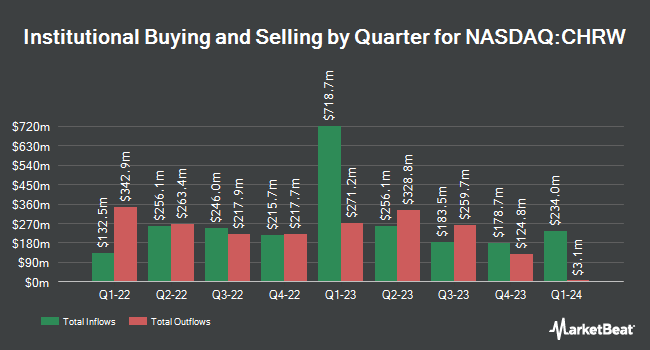

Several other institutional investors have also recently added to or reduced their stakes in the business. Quantbot Technologies LP purchased a new stake in shares of C.H. Robinson Worldwide during the 4th quarter worth approximately $4,747,000. Blueshift Asset Management LLC purchased a new position in shares of C.H. Robinson Worldwide during the fourth quarter worth about $280,000. iA Global Asset Management Inc. increased its position in shares of C.H. Robinson Worldwide by 4.9% during the fourth quarter. iA Global Asset Management Inc. now owns 8,088 shares of the transportation company's stock worth $836,000 after purchasing an additional 378 shares in the last quarter. Teacher Retirement System of Texas purchased a new stake in shares of C.H. Robinson Worldwide in the 4th quarter valued at about $1,075,000. Finally, Royal London Asset Management Ltd. grew its stake in C.H. Robinson Worldwide by 11.0% during the 4th quarter. Royal London Asset Management Ltd. now owns 56,661 shares of the transportation company's stock worth $5,854,000 after buying an additional 5,638 shares during the last quarter. Hedge funds and other institutional investors own 93.15% of the company's stock.

C.H. Robinson Worldwide Price Performance

CHRW traded up $0.99 on Friday, hitting $91.26. 1,141,961 shares of the company were exchanged, compared to its average volume of 1,416,731. C.H. Robinson Worldwide, Inc. has a fifty-two week low of $65.00 and a fifty-two week high of $114.82. The company has a debt-to-equity ratio of 0.54, a quick ratio of 1.49 and a current ratio of 1.28. The firm has a market capitalization of $10.79 billion, a P/E ratio of 23.70, a price-to-earnings-growth ratio of 1.16 and a beta of 0.86. The business's fifty day moving average is $97.96 and its 200 day moving average is $103.59.

C.H. Robinson Worldwide (NASDAQ:CHRW - Get Free Report) last released its quarterly earnings results on Wednesday, January 29th. The transportation company reported $1.21 earnings per share for the quarter, topping analysts' consensus estimates of $1.10 by $0.11. C.H. Robinson Worldwide had a return on equity of 34.53% and a net margin of 2.63%. As a group, sell-side analysts anticipate that C.H. Robinson Worldwide, Inc. will post 4.83 EPS for the current year.

C.H. Robinson Worldwide Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Tuesday, April 1st. Stockholders of record on Friday, March 7th were given a $0.62 dividend. This represents a $2.48 dividend on an annualized basis and a dividend yield of 2.72%. The ex-dividend date was Friday, March 7th. C.H. Robinson Worldwide's dividend payout ratio is currently 64.42%.

Wall Street Analysts Forecast Growth

Several equities research analysts have recently weighed in on the company. Wells Fargo & Company decreased their price objective on C.H. Robinson Worldwide from $130.00 to $125.00 and set an "overweight" rating for the company in a report on Thursday, March 27th. Truist Financial started coverage on shares of C.H. Robinson Worldwide in a research report on Thursday, March 13th. They set a "buy" rating and a $115.00 price objective on the stock. Stephens restated an "equal weight" rating and issued a $111.00 price objective on shares of C.H. Robinson Worldwide in a research note on Thursday, January 30th. Raymond James decreased their target price on shares of C.H. Robinson Worldwide from $118.00 to $111.00 and set an "outperform" rating for the company in a research note on Friday. Finally, Bank of America dropped their price target on C.H. Robinson Worldwide from $122.00 to $119.00 and set a "buy" rating on the stock in a research report on Friday, March 28th. One equities research analyst has rated the stock with a sell rating, eight have issued a hold rating and thirteen have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $117.20.

Get Our Latest Report on C.H. Robinson Worldwide

Insider Transactions at C.H. Robinson Worldwide

In related news, insider Angela K. Freeman sold 8,000 shares of the company's stock in a transaction that occurred on Thursday, February 27th. The stock was sold at an average price of $100.39, for a total value of $803,120.00. Following the sale, the insider now owns 77,027 shares of the company's stock, valued at approximately $7,732,740.53. This represents a 9.41 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, insider Michael D. Castagnetto sold 5,016 shares of the firm's stock in a transaction on Tuesday, February 18th. The stock was sold at an average price of $99.60, for a total value of $499,593.60. Following the transaction, the insider now directly owns 34,586 shares of the company's stock, valued at $3,444,765.60. The trade was a 12.67 % decrease in their position. The disclosure for this sale can be found here. Corporate insiders own 0.91% of the company's stock.

C.H. Robinson Worldwide Profile

(

Free Report)

C.H. Robinson Worldwide, Inc, together with its subsidiaries, provides freight transportation services, and related logistics and supply chain services in the United States and internationally. It operates through two segments: North American Surface Transportation and Global Forwarding. The company offers transportation and logistics services, such as truckload, less than truckload transportation brokerage services, which include the shipment of single or multiple pallets of freight; intermodal transportation that comprises the shipment service of freight in containers or trailers by a combination of truck and rail; and non-vessel operating common carrier and freight forwarding services, as well as organizes air shipments and provides door-to-door services.

See Also

Before you consider C.H. Robinson Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C.H. Robinson Worldwide wasn't on the list.

While C.H. Robinson Worldwide currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.