C.H. Robinson Worldwide (NASDAQ:CHRW - Free Report) had its price target raised by TD Cowen from $113.00 to $119.00 in a research note released on Friday, Marketbeat.com reports. They currently have a hold rating on the transportation company's stock.

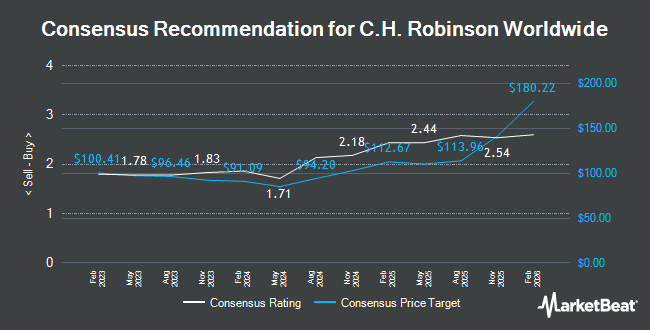

A number of other brokerages have also recently commented on CHRW. Robert W. Baird upped their price target on C.H. Robinson Worldwide from $115.00 to $124.00 and gave the company a "neutral" rating in a research report on Friday. Wells Fargo & Company raised shares of C.H. Robinson Worldwide from an "equal weight" rating to an "overweight" rating and upped their price objective for the company from $118.00 to $130.00 in a report on Monday. Evercore ISI lifted their target price on shares of C.H. Robinson Worldwide from $112.00 to $122.00 and gave the stock an "outperform" rating in a research note on Thursday, October 3rd. The Goldman Sachs Group boosted their price target on shares of C.H. Robinson Worldwide from $97.00 to $107.00 and gave the company a "neutral" rating in a research report on Friday, November 1st. Finally, BMO Capital Markets raised their price objective on shares of C.H. Robinson Worldwide from $115.00 to $118.00 and gave the stock a "market perform" rating in a report on Friday. One research analyst has rated the stock with a sell rating, twelve have issued a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and an average price target of $111.19.

Check Out Our Latest Research Report on C.H. Robinson Worldwide

C.H. Robinson Worldwide Stock Performance

NASDAQ CHRW traded down $2.68 during trading hours on Friday, reaching $111.38. 1,631,909 shares of the company were exchanged, compared to its average volume of 1,505,991. The company has a quick ratio of 1.49, a current ratio of 1.49 and a debt-to-equity ratio of 0.86. The stock has a market capitalization of $13.17 billion, a P/E ratio of 39.47, a P/E/G ratio of 1.25 and a beta of 0.83. C.H. Robinson Worldwide has a 1 year low of $65.00 and a 1 year high of $114.82. The business's 50 day simple moving average is $108.00 and its 200-day simple moving average is $99.24.

C.H. Robinson Worldwide (NASDAQ:CHRW - Get Free Report) last posted its quarterly earnings results on Wednesday, October 30th. The transportation company reported $1.28 EPS for the quarter, topping analysts' consensus estimates of $1.12 by $0.16. C.H. Robinson Worldwide had a net margin of 1.96% and a return on equity of 30.38%. The company had revenue of $4.64 billion for the quarter, compared to analysts' expectations of $4.53 billion. During the same quarter in the previous year, the firm posted $0.84 EPS. C.H. Robinson Worldwide's revenue was up 7.0% on a year-over-year basis. On average, equities research analysts expect that C.H. Robinson Worldwide will post 4.38 earnings per share for the current year.

C.H. Robinson Worldwide Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 6th will be issued a $0.62 dividend. The ex-dividend date is Friday, December 6th. This represents a $2.48 annualized dividend and a dividend yield of 2.23%. C.H. Robinson Worldwide's payout ratio is currently 85.81%.

Insider Activity

In related news, insider Michael John Short sold 10,408 shares of the firm's stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $109.87, for a total value of $1,143,526.96. Following the sale, the insider now directly owns 70,943 shares of the company's stock, valued at $7,794,507.41. This trade represents a 12.79 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Corporate insiders own 1.47% of the company's stock.

Hedge Funds Weigh In On C.H. Robinson Worldwide

A number of institutional investors have recently made changes to their positions in the stock. FMR LLC grew its position in C.H. Robinson Worldwide by 2,259.1% in the third quarter. FMR LLC now owns 2,557,791 shares of the transportation company's stock worth $282,303,000 after acquiring an additional 2,449,367 shares in the last quarter. Interval Partners LP purchased a new stake in C.H. Robinson Worldwide during the second quarter valued at about $82,581,000. Point72 Asset Management L.P. bought a new stake in C.H. Robinson Worldwide during the second quarter worth about $69,378,000. ProShare Advisors LLC increased its position in shares of C.H. Robinson Worldwide by 26.3% during the 2nd quarter. ProShare Advisors LLC now owns 2,528,787 shares of the transportation company's stock valued at $222,837,000 after purchasing an additional 526,872 shares during the last quarter. Finally, Citigroup Inc. raised its holdings in shares of C.H. Robinson Worldwide by 137.8% during the 3rd quarter. Citigroup Inc. now owns 431,033 shares of the transportation company's stock valued at $47,573,000 after buying an additional 249,774 shares in the last quarter. Institutional investors own 93.15% of the company's stock.

C.H. Robinson Worldwide Company Profile

(

Get Free Report)

C.H. Robinson Worldwide, Inc, together with its subsidiaries, provides freight transportation services, and related logistics and supply chain services in the United States and internationally. It operates through two segments: North American Surface Transportation and Global Forwarding. The company offers transportation and logistics services, such as truckload, less than truckload transportation brokerage services, which include the shipment of single or multiple pallets of freight; intermodal transportation that comprises the shipment service of freight in containers or trailers by a combination of truck and rail; and non-vessel operating common carrier and freight forwarding services, as well as organizes air shipments and provides door-to-door services.

Featured Articles

Before you consider C.H. Robinson Worldwide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and C.H. Robinson Worldwide wasn't on the list.

While C.H. Robinson Worldwide currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.