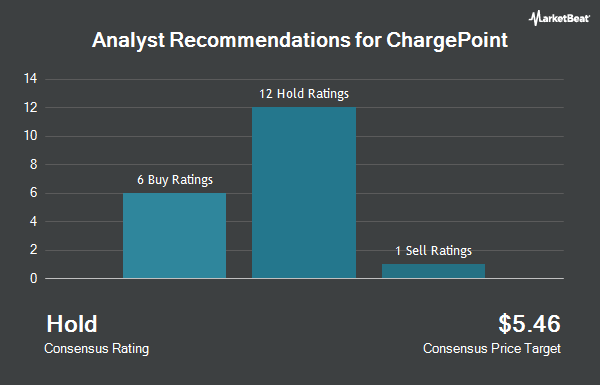

ChargePoint Holdings, Inc. (NYSE:CHPT - Get Free Report) has been given an average rating of "Hold" by the seventeen ratings firms that are currently covering the company, Marketbeat reports. Two analysts have rated the stock with a sell recommendation, eleven have assigned a hold recommendation, three have assigned a buy recommendation and one has assigned a strong buy recommendation to the company. The average twelve-month target price among brokers that have issued ratings on the stock in the last year is $2.47.

A number of research analysts have commented on CHPT shares. JPMorgan Chase & Co. cut shares of ChargePoint from an "overweight" rating to an "underweight" rating in a research note on Thursday, October 3rd. Benchmark reaffirmed a "buy" rating and issued a $3.00 price objective on shares of ChargePoint in a research report on Wednesday. Evercore ISI decreased their price target on shares of ChargePoint from $6.00 to $4.00 and set an "outperform" rating for the company in a research note on Thursday, September 5th. Stifel Nicolaus cut their price objective on ChargePoint from $3.00 to $2.00 and set a "hold" rating for the company in a report on Wednesday, October 30th. Finally, Wolfe Research assumed coverage on ChargePoint in a research note on Thursday, September 5th. They issued a "peer perform" rating on the stock.

Check Out Our Latest Stock Report on CHPT

Insider Buying and Selling

In other ChargePoint news, CAO Henrik Gerdes sold 26,288 shares of the stock in a transaction on Friday, October 11th. The shares were sold at an average price of $1.32, for a total transaction of $34,700.16. Following the completion of the sale, the chief accounting officer now owns 390,596 shares of the company's stock, valued at $515,586.72. This represents a 6.31 % decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CFO Mansi Khetani sold 23,409 shares of the company's stock in a transaction on Monday, September 23rd. The stock was sold at an average price of $1.35, for a total transaction of $31,602.15. Following the completion of the transaction, the chief financial officer now owns 849,084 shares of the company's stock, valued at $1,146,263.40. This trade represents a 2.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 100,803 shares of company stock worth $135,295 in the last quarter. 3.50% of the stock is owned by insiders.

Institutional Investors Weigh In On ChargePoint

A number of hedge funds and other institutional investors have recently bought and sold shares of CHPT. CIBC Asset Management Inc lifted its position in ChargePoint by 50.7% during the second quarter. CIBC Asset Management Inc now owns 17,145 shares of the company's stock valued at $26,000 after purchasing an additional 5,770 shares in the last quarter. Financial Advocates Investment Management bought a new stake in ChargePoint during the 3rd quarter valued at about $29,000. CreativeOne Wealth LLC bought a new position in shares of ChargePoint during the 1st quarter worth $30,000. Delap Wealth Advisory LLC purchased a new position in ChargePoint during the second quarter valued at approximately $31,000. Finally, Perennial Investment Advisors LLC raised its holdings in ChargePoint by 74.4% in the second quarter. Perennial Investment Advisors LLC now owns 24,380 shares of the company's stock worth $37,000 after purchasing an additional 10,400 shares in the last quarter. Hedge funds and other institutional investors own 37.77% of the company's stock.

ChargePoint Stock Performance

CHPT stock traded up $0.02 during midday trading on Friday, hitting $1.15. 12,127,806 shares of the company traded hands, compared to its average volume of 13,238,082. The business has a 50 day simple moving average of $1.29 and a 200-day simple moving average of $1.59. The company has a quick ratio of 1.32, a current ratio of 2.03 and a debt-to-equity ratio of 1.24. ChargePoint has a twelve month low of $1.05 and a twelve month high of $3.13. The stock has a market capitalization of $496.32 million, a price-to-earnings ratio of -1.16 and a beta of 1.70.

ChargePoint (NYSE:CHPT - Get Free Report) last announced its earnings results on Wednesday, September 4th. The company reported ($0.15) earnings per share for the quarter, meeting the consensus estimate of ($0.15). The firm had revenue of $108.54 million during the quarter, compared to the consensus estimate of $114.15 million. ChargePoint had a negative return on equity of 112.67% and a negative net margin of 89.12%. As a group, equities research analysts predict that ChargePoint will post -0.56 earnings per share for the current year.

ChargePoint Company Profile

(

Get Free ReportChargePoint Holdings, Inc, together with its subsidiaries, provides electric vehicle (EV) charging networks and charging solutions in the North America and Europe. The company serves commercial, such as retail, workplace, hospitality, parking, recreation, municipal, education, and highway fast charge; fleet, which include delivery, take home, logistics, motor pool, transit, and shared mobility; and residential including single family homes and multi-family apartments and condominiums customers.

Read More

Before you consider ChargePoint, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ChargePoint wasn't on the list.

While ChargePoint currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.