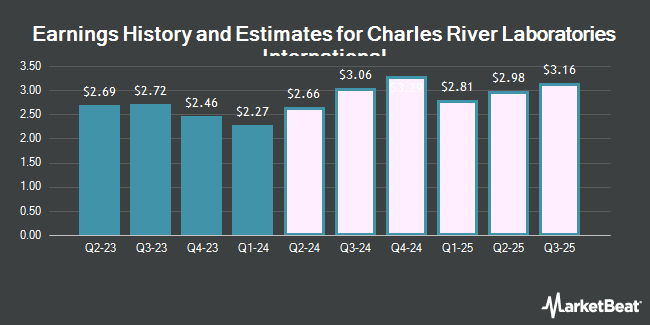

Charles River Laboratories International (NYSE:CRL - Get Free Report) updated its FY 2024 earnings guidance on Wednesday. The company provided earnings per share guidance of 10.100-10.300 for the period, compared to the consensus earnings per share estimate of 10.000. The company issued revenue guidance of $4.0 billion-$4.0 billion, compared to the consensus revenue estimate of $4.0 billion.

Charles River Laboratories International Stock Up 13.7 %

NYSE CRL traded up $25.87 on Wednesday, hitting $214.55. 1,534,381 shares of the stock traded hands, compared to its average volume of 611,354. The company has a market capitalization of $11.08 billion, a P/E ratio of 25.59, a price-to-earnings-growth ratio of 6.20 and a beta of 1.38. The stock has a 50-day moving average of $192.99 and a 200 day moving average of $208.56. The company has a current ratio of 1.58, a quick ratio of 1.21 and a debt-to-equity ratio of 0.65. Charles River Laboratories International has a twelve month low of $166.87 and a twelve month high of $275.00.

Charles River Laboratories International (NYSE:CRL - Get Free Report) last announced its quarterly earnings results on Wednesday, August 7th. The medical research company reported $2.80 EPS for the quarter, beating the consensus estimate of $2.39 by $0.41. The company had revenue of $1.03 billion for the quarter, compared to analyst estimates of $1.03 billion. Charles River Laboratories International had a net margin of 10.83% and a return on equity of 14.96%. As a group, analysts expect that Charles River Laboratories International will post 10.01 earnings per share for the current fiscal year.

Charles River Laboratories International declared that its Board of Directors has initiated a share buyback program on Wednesday, August 7th that allows the company to buyback $1.00 billion in shares. This buyback authorization allows the medical research company to buy up to 9.6% of its stock through open market purchases. Stock buyback programs are often a sign that the company's board believes its stock is undervalued.

Analysts Set New Price Targets

CRL has been the topic of several recent analyst reports. UBS Group dropped their target price on Charles River Laboratories International from $290.00 to $240.00 and set a "buy" rating on the stock in a report on Thursday, August 8th. Redburn Atlantic started coverage on Charles River Laboratories International in a report on Monday, October 14th. They issued a "sell" rating and a $151.00 price objective for the company. Robert W. Baird dropped their price target on shares of Charles River Laboratories International from $191.00 to $190.00 and set a "neutral" rating on the stock in a research report on Friday, September 20th. Barclays reduced their price objective on shares of Charles River Laboratories International from $230.00 to $210.00 and set an "equal weight" rating for the company in a research report on Thursday, August 8th. Finally, The Goldman Sachs Group cut their target price on shares of Charles River Laboratories International from $290.00 to $250.00 and set a "buy" rating for the company in a research note on Thursday, August 8th. Three equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Hold" and a consensus target price of $209.00.

View Our Latest Stock Report on Charles River Laboratories International

About Charles River Laboratories International

(

Get Free Report)

Charles River Laboratories International, Inc provides drug discovery, non-clinical development, and safety testing services in the United States, Europe, Canada, the Asia Pacific, and internationally. It operates through three segments: Research Models and Services (RMS), Discovery and Safety Assessment (DSA), and Manufacturing Solutions (Manufacturing).

Further Reading

Before you consider Charles River Laboratories International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles River Laboratories International wasn't on the list.

While Charles River Laboratories International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.