Charles River Laboratories International (NYSE:CRL - Free Report) had its price objective increased by TD Cowen from $203.00 to $227.00 in a research note published on Monday,Benzinga reports. TD Cowen currently has a hold rating on the medical research company's stock.

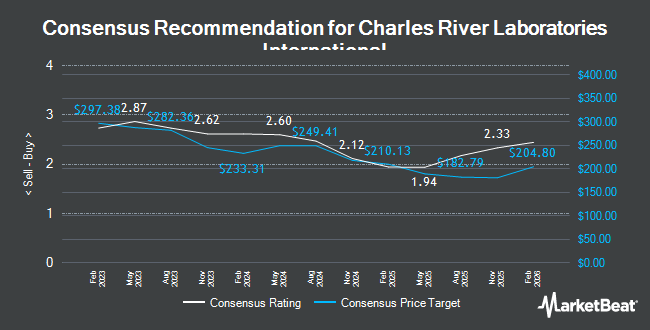

A number of other equities analysts have also commented on CRL. The Goldman Sachs Group cut their price objective on shares of Charles River Laboratories International from $290.00 to $250.00 and set a "buy" rating for the company in a research report on Thursday, August 8th. UBS Group raised their price objective on Charles River Laboratories International from $240.00 to $250.00 and gave the company a "buy" rating in a research report on Thursday. Bank of America cut shares of Charles River Laboratories International from a "buy" rating to a "neutral" rating and decreased their price objective for the company from $250.00 to $215.00 in a report on Wednesday, October 2nd. Barclays reduced their target price on shares of Charles River Laboratories International from $230.00 to $210.00 and set an "equal weight" rating for the company in a report on Thursday, August 8th. Finally, Baird R W downgraded Charles River Laboratories International from a "strong-buy" rating to a "hold" rating in a research report on Thursday, August 8th. Two investment analysts have rated the stock with a sell rating, twelve have assigned a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and an average target price of $217.54.

Read Our Latest Analysis on CRL

Charles River Laboratories International Stock Up 2.5 %

CRL stock traded up $5.30 during midday trading on Monday, hitting $220.69. The company's stock had a trading volume of 774,498 shares, compared to its average volume of 616,718. Charles River Laboratories International has a twelve month low of $168.24 and a twelve month high of $275.00. The company has a debt-to-equity ratio of 0.61, a current ratio of 1.48 and a quick ratio of 1.21. The company's fifty day moving average price is $194.37 and its 200 day moving average price is $208.00. The stock has a market capitalization of $11.29 billion, a P/E ratio of 27.62, a PEG ratio of 5.80 and a beta of 1.38.

Charles River Laboratories International (NYSE:CRL - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The medical research company reported $2.59 EPS for the quarter, topping analysts' consensus estimates of $2.43 by $0.16. The company had revenue of $1.01 billion for the quarter, compared to analysts' expectations of $975.99 million. Charles River Laboratories International had a return on equity of 14.29% and a net margin of 10.44%. Charles River Laboratories International's revenue was down 1.6% on a year-over-year basis. During the same quarter last year, the business earned $2.72 earnings per share. As a group, equities research analysts predict that Charles River Laboratories International will post 10.2 EPS for the current year.

Charles River Laboratories International declared that its board has authorized a share repurchase program on Wednesday, August 7th that permits the company to buyback $1.00 billion in outstanding shares. This buyback authorization permits the medical research company to repurchase up to 9.6% of its shares through open market purchases. Shares buyback programs are generally an indication that the company's board believes its shares are undervalued.

Institutional Inflows and Outflows

Several large investors have recently added to or reduced their stakes in the stock. Tortoise Investment Management LLC raised its holdings in Charles River Laboratories International by 77.0% in the 2nd quarter. Tortoise Investment Management LLC now owns 131 shares of the medical research company's stock worth $27,000 after acquiring an additional 57 shares during the last quarter. Wolff Wiese Magana LLC purchased a new position in shares of Charles River Laboratories International during the third quarter valued at $32,000. Assetmark Inc. grew its stake in Charles River Laboratories International by 1,153.3% in the third quarter. Assetmark Inc. now owns 188 shares of the medical research company's stock valued at $37,000 after purchasing an additional 173 shares during the last quarter. Headlands Technologies LLC purchased a new stake in Charles River Laboratories International in the first quarter valued at about $41,000. Finally, Whittier Trust Co. of Nevada Inc. boosted its position in Charles River Laboratories International by 219.3% in the second quarter. Whittier Trust Co. of Nevada Inc. now owns 281 shares of the medical research company's stock valued at $58,000 after buying an additional 193 shares during the last quarter. Institutional investors own 98.91% of the company's stock.

About Charles River Laboratories International

(

Get Free Report)

Charles River Laboratories International, Inc provides drug discovery, non-clinical development, and safety testing services in the United States, Europe, Canada, the Asia Pacific, and internationally. It operates through three segments: Research Models and Services (RMS), Discovery and Safety Assessment (DSA), and Manufacturing Solutions (Manufacturing).

See Also

Before you consider Charles River Laboratories International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Charles River Laboratories International wasn't on the list.

While Charles River Laboratories International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.