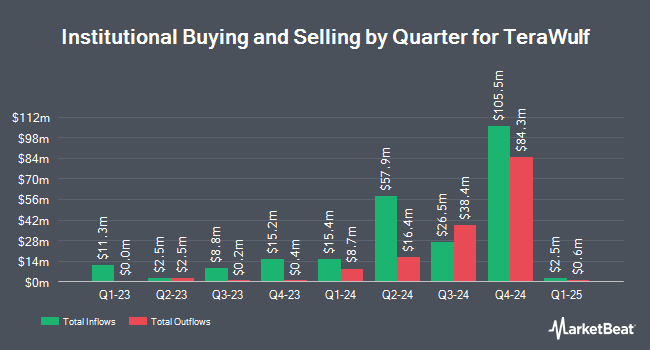

Charles Schwab Investment Management Inc. grew its stake in shares of TeraWulf Inc. (NASDAQ:WULF - Free Report) by 258.2% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 2,363,951 shares of the company's stock after purchasing an additional 1,704,013 shares during the period. Charles Schwab Investment Management Inc. owned about 0.62% of TeraWulf worth $11,063,000 as of its most recent SEC filing.

Several other hedge funds have also modified their holdings of the stock. Aspect Partners LLC purchased a new stake in TeraWulf in the 3rd quarter worth about $26,000. Amalgamated Bank increased its position in TeraWulf by 57.7% in the 2nd quarter. Amalgamated Bank now owns 7,963 shares of the company's stock worth $35,000 after purchasing an additional 2,912 shares during the last quarter. KBC Group NV acquired a new position in TeraWulf in the 3rd quarter worth about $39,000. Pekin Hardy Strauss Inc. acquired a new position in TeraWulf in the 2nd quarter worth about $44,000. Finally, ARS Investment Partners LLC acquired a new position in TeraWulf in the 2nd quarter worth about $44,000. 62.49% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research analysts have weighed in on WULF shares. Needham & Company LLC upped their target price on TeraWulf from $6.00 to $9.50 and gave the stock a "buy" rating in a research report on Wednesday, November 13th. Rosenblatt Securities reaffirmed a "buy" rating and issued a $10.00 target price on shares of TeraWulf in a research report on Thursday, December 5th. Stifel Canada downgraded TeraWulf from a "strong-buy" rating to a "moderate buy" rating in a research note on Tuesday, October 29th. Cantor Fitzgerald reissued an "overweight" rating and issued a $11.00 price objective on shares of TeraWulf in a research note on Wednesday, December 4th. Finally, B. Riley reissued a "buy" rating and issued a $6.00 price objective on shares of TeraWulf in a research note on Monday, October 7th. Seven research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat.com, TeraWulf presently has an average rating of "Buy" and a consensus target price of $8.07.

Get Our Latest Stock Report on TeraWulf

TeraWulf Stock Performance

NASDAQ WULF traded down $0.57 during trading on Tuesday, hitting $6.72. The company's stock had a trading volume of 20,588,470 shares, compared to its average volume of 21,399,006. The firm has a 50 day moving average price of $6.41 and a 200 day moving average price of $5.00. TeraWulf Inc. has a 52 week low of $1.24 and a 52 week high of $9.30.

TeraWulf Company Profile

(

Free Report)

TeraWulf Inc, together with its subsidiaries, operates as a digital asset technology company in the United States. The company develops, owns, and operates bitcoin mining facilities in New York and Pennsylvania. It is also involved in the provision of miner hosting services to third-party entities. The company was founded in 2021 and is headquartered in Easton, Maryland.

Featured Stories

Before you consider TeraWulf, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TeraWulf wasn't on the list.

While TeraWulf currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.