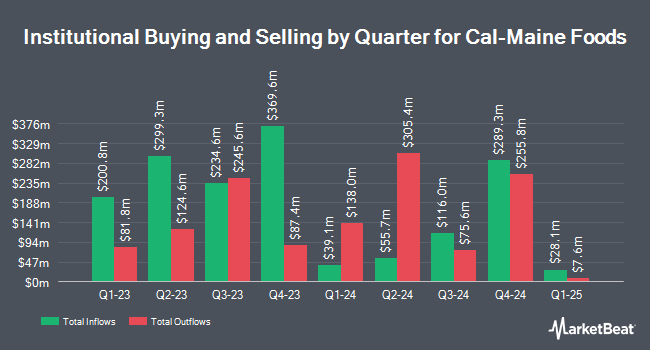

Charles Schwab Investment Management Inc. increased its holdings in shares of Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report) by 3.7% in the fourth quarter, according to its most recent disclosure with the SEC. The firm owned 644,130 shares of the basic materials company's stock after purchasing an additional 22,939 shares during the period. Charles Schwab Investment Management Inc. owned 1.31% of Cal-Maine Foods worth $66,294,000 as of its most recent filing with the SEC.

A number of other hedge funds and other institutional investors have also bought and sold shares of CALM. Quarry LP grew its holdings in Cal-Maine Foods by 32.5% during the third quarter. Quarry LP now owns 770 shares of the basic materials company's stock worth $58,000 after purchasing an additional 189 shares during the period. Smartleaf Asset Management LLC lifted its position in Cal-Maine Foods by 339.1% during the fourth quarter. Smartleaf Asset Management LLC now owns 1,032 shares of the basic materials company's stock worth $105,000 after acquiring an additional 797 shares during the last quarter. GAMMA Investing LLC lifted its position in Cal-Maine Foods by 24.3% during the fourth quarter. GAMMA Investing LLC now owns 1,368 shares of the basic materials company's stock worth $141,000 after acquiring an additional 267 shares during the last quarter. Nisa Investment Advisors LLC lifted its position in Cal-Maine Foods by 350.5% during the fourth quarter. Nisa Investment Advisors LLC now owns 1,437 shares of the basic materials company's stock worth $148,000 after acquiring an additional 1,118 shares during the last quarter. Finally, KBC Group NV lifted its position in Cal-Maine Foods by 59.8% during the fourth quarter. KBC Group NV now owns 1,681 shares of the basic materials company's stock worth $173,000 after acquiring an additional 629 shares during the last quarter. Institutional investors own 84.67% of the company's stock.

Analyst Ratings Changes

Several brokerages have issued reports on CALM. Stephens restated an "equal weight" rating and set a $97.00 price objective on shares of Cal-Maine Foods in a research report on Thursday, March 6th. StockNews.com upgraded shares of Cal-Maine Foods from a "hold" rating to a "buy" rating in a research report on Wednesday, January 15th.

View Our Latest Research Report on CALM

Cal-Maine Foods Trading Up 0.3 %

NASDAQ CALM opened at $87.63 on Wednesday. Cal-Maine Foods, Inc. has a 1-year low of $55.00 and a 1-year high of $116.41. The company has a 50 day moving average of $101.76 and a 200-day moving average of $92.87. The company has a market cap of $4.30 billion, a price-to-earnings ratio of 6.82 and a beta of -0.12.

Cal-Maine Foods (NASDAQ:CALM - Get Free Report) last released its quarterly earnings results on Tuesday, January 7th. The basic materials company reported $4.47 earnings per share for the quarter, beating analysts' consensus estimates of $4.05 by $0.42. Cal-Maine Foods had a net margin of 20.39% and a return on equity of 33.69%. The company had revenue of $954.70 million during the quarter, compared to the consensus estimate of $751.50 million. During the same period in the previous year, the business earned $0.35 earnings per share. The firm's quarterly revenue was up 82.5% on a year-over-year basis. On average, equities research analysts forecast that Cal-Maine Foods, Inc. will post 15.59 earnings per share for the current year.

Insider Activity

In related news, Director Letitia Callender Hughes sold 809 shares of Cal-Maine Foods stock in a transaction that occurred on Tuesday, January 14th. The shares were sold at an average price of $109.97, for a total value of $88,965.73. Following the transaction, the director now directly owns 42,761 shares of the company's stock, valued at $4,702,427.17. This trade represents a 1.86 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. 13.45% of the stock is owned by company insiders.

Cal-Maine Foods Profile

(

Free Report)

Cal-Maine Foods, Inc, together with its subsidiaries, produces, grades, packages, markets, and distributes shell eggs. The company offers specialty shell eggs, such as nutritionally enhanced, cage free, organic, free-range, pasture-raised, and brown eggs under the Egg-Land's Best, Land O' Lakes, Farmhouse Eggs, Sunups, Sunny Meadow, and 4Grain brand names.

Featured Articles

Want to see what other hedge funds are holding CALM? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Cal-Maine Foods, Inc. (NASDAQ:CALM - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cal-Maine Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cal-Maine Foods wasn't on the list.

While Cal-Maine Foods currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.