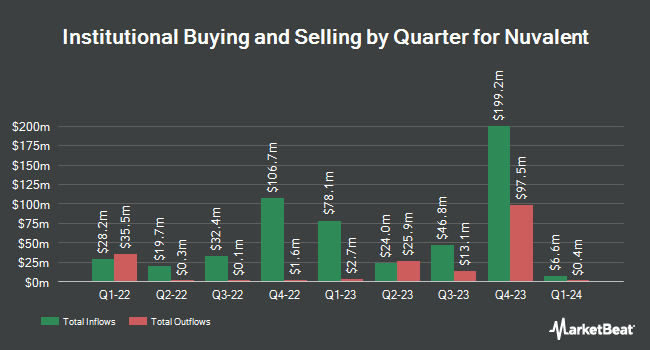

Charles Schwab Investment Management Inc. raised its stake in shares of Nuvalent, Inc. (NASDAQ:NUVL - Free Report) by 19.0% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 315,827 shares of the company's stock after purchasing an additional 50,536 shares during the period. Charles Schwab Investment Management Inc. owned 0.49% of Nuvalent worth $32,309,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors have also added to or reduced their stakes in the stock. Driehaus Capital Management LLC lifted its holdings in Nuvalent by 3.5% during the second quarter. Driehaus Capital Management LLC now owns 696,607 shares of the company's stock valued at $52,845,000 after purchasing an additional 23,730 shares in the last quarter. Fred Alger Management LLC raised its position in shares of Nuvalent by 6.2% in the second quarter. Fred Alger Management LLC now owns 578,130 shares of the company's stock valued at $43,857,000 after buying an additional 33,758 shares during the last quarter. First Turn Management LLC raised its position in shares of Nuvalent by 42.3% in the third quarter. First Turn Management LLC now owns 359,114 shares of the company's stock valued at $36,737,000 after buying an additional 106,838 shares during the last quarter. Dimensional Fund Advisors LP raised its position in shares of Nuvalent by 80.5% in the second quarter. Dimensional Fund Advisors LP now owns 348,089 shares of the company's stock valued at $26,409,000 after buying an additional 155,276 shares during the last quarter. Finally, Samlyn Capital LLC acquired a new stake in shares of Nuvalent in the second quarter valued at about $17,397,000. 97.26% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of brokerages have recently commented on NUVL. Barclays began coverage on shares of Nuvalent in a research report on Thursday, August 29th. They issued an "overweight" rating and a $100.00 target price for the company. JPMorgan Chase & Co. increased their target price on shares of Nuvalent from $100.00 to $125.00 and gave the company an "overweight" rating in a research report on Friday, October 4th. UBS Group assumed coverage on shares of Nuvalent in a research report on Thursday, October 24th. They set a "neutral" rating and a $100.00 price objective for the company. Stifel Nicolaus raised their price objective on shares of Nuvalent from $115.00 to $135.00 and gave the stock a "buy" rating in a research report on Monday, September 16th. Finally, BMO Capital Markets raised their price objective on shares of Nuvalent from $132.00 to $134.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th. One research analyst has rated the stock with a sell rating, one has issued a hold rating, ten have given a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus target price of $112.60.

Get Our Latest Research Report on NUVL

Insider Buying and Selling

In other news, Director Matthew Shair sold 2,000 shares of the business's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $96.22, for a total transaction of $192,440.00. Following the completion of the sale, the director now owns 222,522 shares in the company, valued at approximately $21,411,066.84. The trade was a 0.89 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, insider Deborah Ann Miller sold 3,000 shares of Nuvalent stock in a transaction on Monday, September 9th. The shares were sold at an average price of $88.18, for a total transaction of $264,540.00. Following the completion of the transaction, the insider now directly owns 33,300 shares in the company, valued at $2,936,394. The trade was a 8.26 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 2,093,795 shares of company stock worth $204,762,781 over the last 90 days. 12.52% of the stock is owned by insiders.

Nuvalent Price Performance

Shares of NASDAQ NUVL traded down $0.53 during midday trading on Wednesday, hitting $94.22. The company's stock had a trading volume of 263,770 shares, compared to its average volume of 434,060. The business's fifty day simple moving average is $96.54 and its two-hundred day simple moving average is $85.36. Nuvalent, Inc. has a 1 year low of $61.79 and a 1 year high of $113.51. The firm has a market capitalization of $6.69 billion, a price-to-earnings ratio of -27.52 and a beta of 1.31.

Nuvalent (NASDAQ:NUVL - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The company reported ($1.28) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.93) by ($0.35). During the same period in the prior year, the firm posted ($0.59) EPS. Analysts anticipate that Nuvalent, Inc. will post -3.84 EPS for the current fiscal year.

About Nuvalent

(

Free Report)

Nuvalent, Inc, a clinical stage biopharmaceutical company, engages in the development of therapies for patients with cancer. Its lead product candidates are NVL-520, a novel ROS1-selective inhibitor to address the clinical challenges of emergent treatment resistance, central nervous system (CNS)-related adverse events, and brain metastases that may limit the use of ROS1 tyrosine kinase inhibitors (TKIs) for patients with ROS proto-oncogene 1 (ROS1)-positive non-small cell lung cancer (NSCLC) which is under the phase 2 portion of the ARROS-1 Phase 1/2 clinical trial; NVL-655, a brain-penetrant ALK-selective inhibitor, to address the clinical challenges of emergent treatment resistance, CNS-related adverse events, and brain metastases that might limit the use of first-, second-, and third-generation ALK inhibitors that is under the phase 2 portion of the ALKOVE-1 Phase 1/2 clinical trial; and NVL-330, a brain-penetrant human epidermal growth factor receptor 2 (HER2)-selective inhibitor designed to treat tumors driven by HER2ex20, brain metastases, and avoiding treatment-limiting adverse events including due to off-target inhibition of wild-type EGFR, which is expected to initiate phase 1 trial.

Further Reading

Before you consider Nuvalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nuvalent wasn't on the list.

While Nuvalent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.