Charles Schwab Investment Management Inc. grew its holdings in Amedisys, Inc. (NASDAQ:AMED - Free Report) by 2.7% during the third quarter, according to the company in its most recent filing with the SEC. The fund owned 346,082 shares of the health services provider's stock after acquiring an additional 9,004 shares during the quarter. Charles Schwab Investment Management Inc. owned about 1.06% of Amedisys worth $33,400,000 at the end of the most recent reporting period.

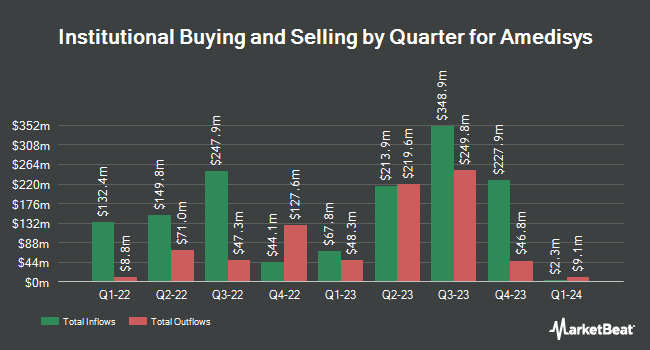

A number of other hedge funds have also made changes to their positions in the business. Alpine Associates Management Inc. increased its holdings in shares of Amedisys by 0.9% in the 2nd quarter. Alpine Associates Management Inc. now owns 1,280,897 shares of the health services provider's stock valued at $117,586,000 after acquiring an additional 11,000 shares during the last quarter. Dimensional Fund Advisors LP grew its stake in Amedisys by 4.0% during the 2nd quarter. Dimensional Fund Advisors LP now owns 514,166 shares of the health services provider's stock worth $47,202,000 after buying an additional 19,660 shares during the last quarter. Calamos Advisors LLC grew its stake in Amedisys by 11.6% during the 2nd quarter. Calamos Advisors LLC now owns 397,347 shares of the health services provider's stock worth $36,476,000 after buying an additional 41,220 shares during the last quarter. Highbridge Capital Management LLC boosted its position in Amedisys by 34.7% during the second quarter. Highbridge Capital Management LLC now owns 323,200 shares of the health services provider's stock worth $29,670,000 after purchasing an additional 83,200 shares in the last quarter. Finally, SG Americas Securities LLC increased its position in shares of Amedisys by 413.4% in the third quarter. SG Americas Securities LLC now owns 196,713 shares of the health services provider's stock valued at $18,985,000 after buying an additional 158,398 shares in the last quarter. Hedge funds and other institutional investors own 94.36% of the company's stock.

Amedisys Price Performance

NASDAQ AMED traded down $1.29 during trading hours on Wednesday, reaching $84.98. The company's stock had a trading volume of 1,379,593 shares, compared to its average volume of 369,084. The company has a debt-to-equity ratio of 0.05, a quick ratio of 1.19 and a current ratio of 1.19. The stock has a market cap of $2.78 billion, a PE ratio of 34.23, a PEG ratio of 1.92 and a beta of 0.73. The company's 50-day moving average is $94.41 and its two-hundred day moving average is $95.53. Amedisys, Inc. has a fifty-two week low of $84.06 and a fifty-two week high of $98.95.

Amedisys (NASDAQ:AMED - Get Free Report) last issued its quarterly earnings data on Wednesday, November 6th. The health services provider reported $1.00 earnings per share for the quarter, missing analysts' consensus estimates of $1.19 by ($0.19). Amedisys had a return on equity of 12.20% and a net margin of 3.57%. The business had revenue of $587.67 million for the quarter, compared to analysts' expectations of $586.75 million. During the same period last year, the business earned $0.98 earnings per share. The company's revenue for the quarter was up 5.7% on a year-over-year basis. Analysts forecast that Amedisys, Inc. will post 4.53 EPS for the current year.

Amedisys Company Profile

(

Free Report)

Amedisys, Inc, together with its subsidiaries, provides healthcare services in the United States. It operates through three segments: Home Health, Hospice, and High Acuity Care. The Home Health segment offers a range of services in the homes of individuals for the recovery of patients from surgery, chronic disability, or terminal illness, as well as prevents avoidable hospital readmissions through its skilled nurses; nursing services, rehabilitation therapists specialized in physical, speech, and occupational therapy; and social workers and aides for assisting its patients.

See Also

Before you consider Amedisys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amedisys wasn't on the list.

While Amedisys currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.