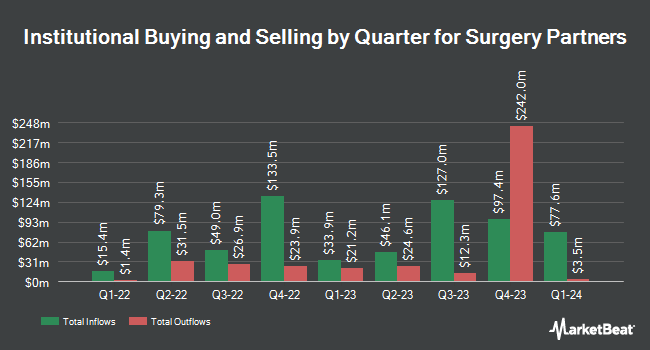

Charles Schwab Investment Management Inc. boosted its position in Surgery Partners, Inc. (NASDAQ:SGRY - Free Report) by 8.0% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 834,417 shares of the company's stock after purchasing an additional 61,671 shares during the period. Charles Schwab Investment Management Inc. owned about 0.66% of Surgery Partners worth $17,665,000 as of its most recent SEC filing.

Other hedge funds have also recently bought and sold shares of the company. KBC Group NV increased its stake in Surgery Partners by 31.8% in the 3rd quarter. KBC Group NV now owns 2,385 shares of the company's stock valued at $77,000 after purchasing an additional 576 shares in the last quarter. Point72 Asia Singapore Pte. Ltd. increased its stake in Surgery Partners by 747.6% in the 3rd quarter. Point72 Asia Singapore Pte. Ltd. now owns 3,831 shares of the company's stock valued at $124,000 after purchasing an additional 3,379 shares in the last quarter. MeadowBrook Investment Advisors LLC increased its stake in Surgery Partners by 16.6% in the 4th quarter. MeadowBrook Investment Advisors LLC now owns 10,280 shares of the company's stock valued at $218,000 after purchasing an additional 1,460 shares in the last quarter. Empowered Funds LLC purchased a new position in Surgery Partners in the 4th quarter valued at approximately $245,000. Finally, Natixis Advisors LLC increased its stake in Surgery Partners by 3.0% in the 3rd quarter. Natixis Advisors LLC now owns 12,828 shares of the company's stock valued at $414,000 after purchasing an additional 376 shares in the last quarter.

Insider Transactions at Surgery Partners

In related news, CFO David T. Doherty sold 13,641 shares of Surgery Partners stock in a transaction on Friday, February 7th. The stock was sold at an average price of $25.61, for a total value of $349,346.01. Following the transaction, the chief financial officer now owns 108,862 shares in the company, valued at approximately $2,787,955.82. This trade represents a 11.14 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, insider Harrison R. Bane sold 56,315 shares of Surgery Partners stock in a transaction on Friday, February 7th. The shares were sold at an average price of $25.64, for a total value of $1,443,916.60. Following the completion of the transaction, the insider now owns 107,037 shares in the company, valued at $2,744,428.68. The trade was a 34.47 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 106,622 shares of company stock worth $2,717,860 over the last quarter. 2.30% of the stock is currently owned by insiders.

Wall Street Analyst Weigh In

Several equities analysts recently weighed in on the company. JPMorgan Chase & Co. dropped their price objective on Surgery Partners from $38.00 to $28.00 and set a "neutral" rating for the company in a research note on Tuesday, December 3rd. Bank of America initiated coverage on Surgery Partners in a report on Monday, December 16th. They set a "buy" rating and a $30.00 target price on the stock. Finally, Macquarie lowered their target price on Surgery Partners from $34.00 to $33.00 and set an "outperform" rating on the stock in a report on Tuesday, March 11th. One research analyst has rated the stock with a sell rating, two have issued a hold rating and seven have given a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average target price of $36.63.

View Our Latest Stock Analysis on SGRY

Surgery Partners Trading Down 0.7 %

Shares of SGRY stock traded down $0.18 during mid-day trading on Friday, hitting $24.21. 1,232,193 shares of the company's stock were exchanged, compared to its average volume of 1,064,620. Surgery Partners, Inc. has a fifty-two week low of $19.50 and a fifty-two week high of $33.97. The stock has a 50-day simple moving average of $23.93 and a two-hundred day simple moving average of $25.78. The company has a quick ratio of 1.66, a current ratio of 1.80 and a debt-to-equity ratio of 0.99. The stock has a market cap of $3.09 billion, a price-to-earnings ratio of -50.44, a PEG ratio of 19.21 and a beta of 2.73.

Surgery Partners (NASDAQ:SGRY - Get Free Report) last posted its quarterly earnings data on Monday, March 3rd. The company reported $0.39 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.38 by $0.01. Surgery Partners had a positive return on equity of 2.85% and a negative net margin of 2.03%. The business had revenue of $864.40 million for the quarter, compared to analysts' expectations of $828.09 million. Equities analysts expect that Surgery Partners, Inc. will post 0.67 EPS for the current fiscal year.

About Surgery Partners

(

Free Report)

Surgery Partners, Inc, together with its subsidiaries, owns and operates a network of surgical facilities and ancillary services in the United States. The company provides ambulatory surgery centers and surgical hospitals that offer non-emergency surgical procedures in various specialties, including orthopedics and pain management, ophthalmology, gastroenterology, and general surgery.

Featured Articles

Before you consider Surgery Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Surgery Partners wasn't on the list.

While Surgery Partners currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.