Charles Schwab Investment Management Inc. increased its holdings in shares of American Financial Group, Inc. (NYSE:AFG - Free Report) by 1.1% in the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 508,687 shares of the insurance provider's stock after purchasing an additional 5,572 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 0.61% of American Financial Group worth $69,655,000 at the end of the most recent quarter.

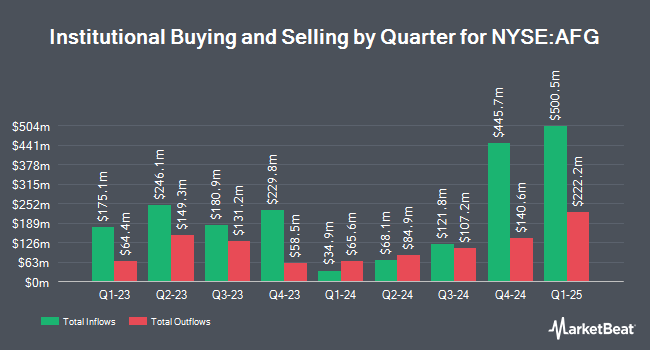

Other institutional investors have also recently added to or reduced their stakes in the company. UMB Bank n.a. lifted its stake in American Financial Group by 86.8% during the fourth quarter. UMB Bank n.a. now owns 340 shares of the insurance provider's stock worth $47,000 after purchasing an additional 158 shares during the last quarter. Jones Financial Companies Lllp increased its position in American Financial Group by 91.2% during the fourth quarter. Jones Financial Companies Lllp now owns 520 shares of the insurance provider's stock worth $71,000 after buying an additional 248 shares during the period. Allworth Financial LP increased its position in American Financial Group by 301.1% during the fourth quarter. Allworth Financial LP now owns 702 shares of the insurance provider's stock worth $94,000 after buying an additional 527 shares during the period. iA Global Asset Management Inc. acquired a new position in American Financial Group during the third quarter worth approximately $125,000. Finally, Brooklyn Investment Group acquired a new position in American Financial Group during the third quarter worth approximately $130,000. Hedge funds and other institutional investors own 64.37% of the company's stock.

American Financial Group Trading Down 1.0 %

NYSE:AFG opened at $125.41 on Wednesday. The firm has a market cap of $10.53 billion, a P/E ratio of 11.86 and a beta of 0.79. The company has a current ratio of 0.53, a quick ratio of 0.53 and a debt-to-equity ratio of 0.31. The stock's 50 day simple moving average is $129.98 and its 200-day simple moving average is $134.42. American Financial Group, Inc. has a 12-month low of $118.97 and a 12-month high of $150.19.

American Financial Group (NYSE:AFG - Get Free Report) last released its earnings results on Tuesday, February 4th. The insurance provider reported $3.12 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $3.15 by ($0.03). American Financial Group had a net margin of 10.66% and a return on equity of 20.30%. Equities analysts anticipate that American Financial Group, Inc. will post 10.5 EPS for the current year.

American Financial Group Announces Dividend

The firm also recently declared a special dividend, which will be paid on Friday, March 28th. Investors of record on Monday, March 17th will be paid a $2.00 dividend. The ex-dividend date of this dividend is Monday, March 17th. American Financial Group's dividend payout ratio (DPR) is presently 30.27%.

Insider Activity at American Financial Group

In other American Financial Group news, Director Gregory G. Joseph purchased 3,000 shares of the firm's stock in a transaction that occurred on Thursday, February 20th. The shares were purchased at an average cost of $121.00 per share, for a total transaction of $363,000.00. Following the completion of the purchase, the director now directly owns 57,477 shares in the company, valued at $6,954,717. This represents a 5.51 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Company insiders own 14.50% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have commented on the company. Keefe, Bruyette & Woods lowered American Financial Group from an "outperform" rating to a "market perform" rating and cut their price target for the stock from $164.00 to $144.00 in a research report on Friday, February 7th. Piper Sandler lifted their price target on American Financial Group from $135.00 to $150.00 and gave the stock a "neutral" rating in a research report on Tuesday, November 12th. Finally, BMO Capital Markets boosted their target price on American Financial Group from $135.00 to $143.00 and gave the company a "market perform" rating in a report on Friday, November 15th.

Get Our Latest Stock Report on AFG

About American Financial Group

(

Free Report)

American Financial Group, Inc, an insurance holding company, provides specialty property and casualty insurance products in the United States. The company offers property and transportation insurance products, such as physical damage and liability coverage for buses and trucks, inland and ocean marine, agricultural-related products, and other commercial property and specialty transportation coverages; specialty casualty insurance, including primarily excess and surplus, executive and professional liability, general liability, umbrella and excess liability, and specialty coverage in targeted markets, as well as customized programs for small to mid-sized businesses and workers' compensation insurance; and specialty financial insurance products comprising risk management insurance programs for lending and leasing institutions, fidelity and surety products, and trade credit insurance.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American Financial Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Financial Group wasn't on the list.

While American Financial Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.