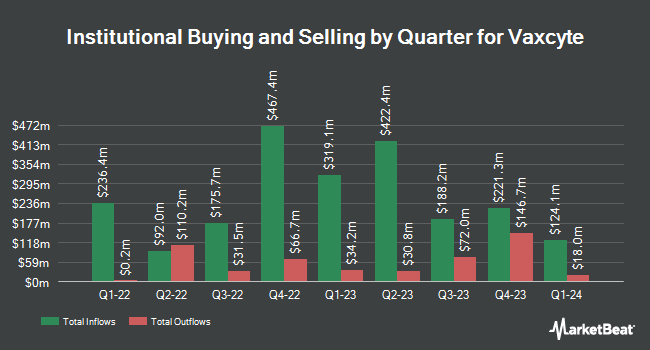

Charles Schwab Investment Management Inc. raised its holdings in Vaxcyte, Inc. (NASDAQ:PCVX - Free Report) by 47.9% during the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 1,295,837 shares of the company's stock after acquiring an additional 419,600 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.04% of Vaxcyte worth $148,075,000 as of its most recent filing with the Securities & Exchange Commission.

A number of other hedge funds and other institutional investors have also bought and sold shares of PCVX. RA Capital Management L.P. grew its holdings in shares of Vaxcyte by 4.0% in the first quarter. RA Capital Management L.P. now owns 8,203,754 shares of the company's stock worth $560,398,000 after purchasing an additional 312,500 shares during the last quarter. Price T Rowe Associates Inc. MD grew its position in shares of Vaxcyte by 18.6% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 3,176,181 shares of the company's stock worth $216,966,000 after buying an additional 498,359 shares in the last quarter. Driehaus Capital Management LLC raised its holdings in shares of Vaxcyte by 3.6% in the second quarter. Driehaus Capital Management LLC now owns 1,934,747 shares of the company's stock valued at $146,093,000 after acquiring an additional 66,940 shares in the last quarter. Novo Holdings A S grew its holdings in Vaxcyte by 12.4% during the 2nd quarter. Novo Holdings A S now owns 950,000 shares of the company's stock worth $71,734,000 after acquiring an additional 105,000 shares in the last quarter. Finally, Maverick Capital Ltd. raised its position in shares of Vaxcyte by 93.7% in the 2nd quarter. Maverick Capital Ltd. now owns 687,908 shares of the company's stock worth $51,944,000 after acquiring an additional 332,777 shares in the last quarter. Hedge funds and other institutional investors own 96.78% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts recently commented on the stock. Bank of America boosted their price objective on shares of Vaxcyte from $101.00 to $140.00 and gave the stock a "buy" rating in a research note on Wednesday, September 4th. Jefferies Financial Group increased their price target on shares of Vaxcyte from $108.00 to $129.00 and gave the stock a "buy" rating in a report on Tuesday, September 3rd. Leerink Partners lifted their price objective on shares of Vaxcyte from $106.00 to $153.00 and gave the company an "outperform" rating in a research note on Tuesday, September 3rd. Mizuho boosted their target price on shares of Vaxcyte from $113.00 to $163.00 and gave the company an "outperform" rating in a research report on Tuesday, September 10th. Finally, Cantor Fitzgerald restated an "overweight" rating on shares of Vaxcyte in a research report on Wednesday, November 6th. Seven analysts have rated the stock with a buy rating, Based on data from MarketBeat, Vaxcyte has a consensus rating of "Buy" and an average target price of $147.50.

Check Out Our Latest Stock Analysis on Vaxcyte

Vaxcyte Stock Performance

Vaxcyte stock traded up $3.16 during mid-day trading on Monday, hitting $91.70. The company had a trading volume of 1,750,097 shares, compared to its average volume of 903,407. The business has a fifty day moving average of $107.89 and a 200 day moving average of $89.57. Vaxcyte, Inc. has a 1 year low of $48.35 and a 1 year high of $121.06.

Vaxcyte (NASDAQ:PCVX - Get Free Report) last announced its earnings results on Tuesday, November 5th. The company reported ($0.83) earnings per share for the quarter, topping the consensus estimate of ($1.10) by $0.27. During the same quarter last year, the company posted ($0.91) EPS. Research analysts forecast that Vaxcyte, Inc. will post -4.14 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, CEO Grant Pickering sold 2,366 shares of the firm's stock in a transaction on Thursday, November 7th. The stock was sold at an average price of $103.89, for a total transaction of $245,803.74. Following the sale, the chief executive officer now owns 137,398 shares in the company, valued at $14,274,278.22. This trade represents a 1.69 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CFO Andrew Guggenhime sold 8,000 shares of the stock in a transaction dated Wednesday, September 18th. The stock was sold at an average price of $115.94, for a total transaction of $927,520.00. Following the transaction, the chief financial officer now owns 90,383 shares in the company, valued at approximately $10,479,005.02. The trade was a 8.13 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders have sold 102,464 shares of company stock worth $11,455,576. 3.10% of the stock is owned by corporate insiders.

About Vaxcyte

(

Free Report)

Vaxcyte, Inc, a clinical-stage biotechnology vaccine company, develops novel protein vaccines to prevent or treat bacterial infectious diseases. Its lead vaccine candidate is VAX-24, a 24-valent investigational pneumococcal conjugate vaccine for the prevention of invasive pneumococcal disease. The company also develops VAX-31 to protect against emerging strains and to help address antibiotic resistance; VAX-A1, a novel conjugate vaccine candidate to prevent disease caused by Group A Streptococcus; VAX-PG, a novel protein vaccine candidate targeting keystone pathogen responsible for periodontitis; and VAX-GI to prevent Shigella, a bacterial illness.

Read More

Before you consider Vaxcyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vaxcyte wasn't on the list.

While Vaxcyte currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.