Charles Schwab Investment Management Inc. grew its position in shares of Marcus & Millichap, Inc. (NYSE:MMI - Free Report) by 3.3% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 384,775 shares of the real estate investment trust's stock after purchasing an additional 12,401 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 0.99% of Marcus & Millichap worth $15,249,000 as of its most recent SEC filing.

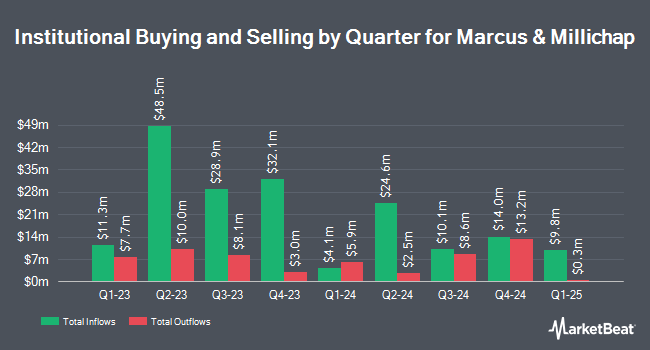

Several other hedge funds and other institutional investors also recently made changes to their positions in MMI. LRI Investments LLC grew its stake in shares of Marcus & Millichap by 11.0% in the second quarter. LRI Investments LLC now owns 4,706 shares of the real estate investment trust's stock worth $148,000 after purchasing an additional 468 shares during the last quarter. Heritage Family Offices LLP acquired a new stake in shares of Marcus & Millichap in the second quarter valued at about $207,000. Hsbc Holdings PLC bought a new position in shares of Marcus & Millichap during the second quarter worth about $212,000. Price T Rowe Associates Inc. MD lifted its stake in shares of Marcus & Millichap by 12.7% in the first quarter. Price T Rowe Associates Inc. MD now owns 6,795 shares of the real estate investment trust's stock worth $233,000 after acquiring an additional 767 shares during the period. Finally, Scharf Investments LLC boosted its holdings in Marcus & Millichap by 17.9% in the second quarter. Scharf Investments LLC now owns 6,962 shares of the real estate investment trust's stock valued at $219,000 after acquiring an additional 1,057 shares during the last quarter. 62.78% of the stock is currently owned by institutional investors.

Marcus & Millichap Stock Up 0.7 %

Marcus & Millichap stock traded up $0.27 during trading hours on Friday, reaching $41.15. 42,363 shares of the company's stock were exchanged, compared to its average volume of 80,255. The firm's 50 day simple moving average is $39.27 and its 200 day simple moving average is $37.04. Marcus & Millichap, Inc. has a twelve month low of $29.93 and a twelve month high of $44.24. The firm has a market capitalization of $1.60 billion, a PE ratio of -50.80 and a beta of 1.15.

Wall Street Analysts Forecast Growth

Separately, Wells Fargo & Company upped their price objective on shares of Marcus & Millichap from $20.00 to $30.00 and gave the company an "underweight" rating in a research note on Friday, September 6th.

Read Our Latest Analysis on Marcus & Millichap

Insider Activity at Marcus & Millichap

In other Marcus & Millichap news, Director Norma J. Lawrence sold 1,123 shares of Marcus & Millichap stock in a transaction on Friday, September 13th. The shares were sold at an average price of $40.00, for a total value of $44,920.00. Following the completion of the sale, the director now directly owns 24,971 shares of the company's stock, valued at approximately $998,840. The trade was a 4.30 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 39.20% of the stock is owned by corporate insiders.

Marcus & Millichap Company Profile

(

Free Report)

Marcus & Millichap, Inc, an investment brokerage company, provides real estate investment brokerage and financing services to sellers and buyers of commercial real estate in the United States and Canada. The company offers commercial real estate investment sales, financing, research, and advisory services for multifamily, retail, office, industrial, single-tenant net lease, seniors housing, self-storage, hospitality, medical office, and manufactured housing, as well as capital markets.

Read More

Before you consider Marcus & Millichap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marcus & Millichap wasn't on the list.

While Marcus & Millichap currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.