Charles Schwab Investment Management Inc. increased its holdings in shares of Rigetti Computing, Inc. (NASDAQ:RGTI - Free Report) by 14.4% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,149,934 shares of the company's stock after buying an additional 144,742 shares during the quarter. Charles Schwab Investment Management Inc. owned 0.60% of Rigetti Computing worth $901,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

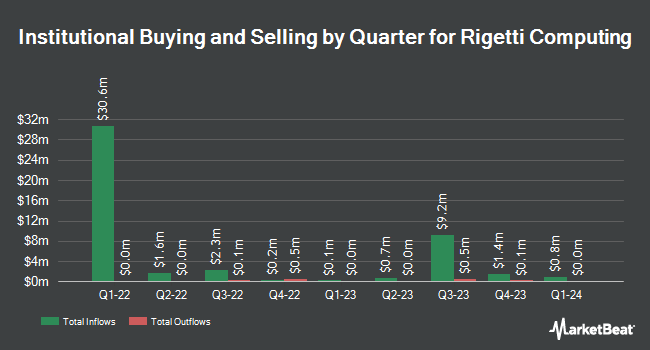

Several other hedge funds have also recently modified their holdings of RGTI. SG Americas Securities LLC acquired a new position in shares of Rigetti Computing during the 2nd quarter worth approximately $25,000. Cetera Advisors LLC purchased a new position in shares of Rigetti Computing in the first quarter worth about $38,000. Caprock Group LLC acquired a new position in Rigetti Computing during the second quarter worth about $42,000. Point72 DIFC Ltd purchased a new stake in Rigetti Computing during the 2nd quarter valued at about $88,000. Finally, Rhumbline Advisers acquired a new stake in Rigetti Computing in the 2nd quarter valued at about $161,000. Institutional investors and hedge funds own 35.38% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages have recently weighed in on RGTI. Needham & Company LLC restated a "buy" rating and set a $2.00 target price on shares of Rigetti Computing in a report on Wednesday, November 13th. Benchmark restated a "buy" rating and issued a $2.50 target price on shares of Rigetti Computing in a report on Thursday, November 14th. Finally, B. Riley boosted their price target on shares of Rigetti Computing from $3.50 to $4.00 and gave the company a "buy" rating in a research report on Monday, November 25th.

Check Out Our Latest Stock Report on RGTI

Insider Activity at Rigetti Computing

In other Rigetti Computing news, major shareholder Bessemer Venture Partners X. L. sold 580,125 shares of Rigetti Computing stock in a transaction dated Thursday, November 14th. The stock was sold at an average price of $1.63, for a total transaction of $945,603.75. Following the completion of the sale, the insider now directly owns 19,002,093 shares of the company's stock, valued at $30,973,411.59. The trade was a 2.96 % decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director Michael S. Clifton sold 125,000 shares of Rigetti Computing stock in a transaction on Monday, December 9th. The stock was sold at an average price of $5.03, for a total transaction of $628,750.00. Following the sale, the director now owns 1,063,864 shares in the company, valued at $5,351,235.92. This represents a 10.51 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders sold 2,955,125 shares of company stock worth $5,489,354. Company insiders own 2.81% of the company's stock.

Rigetti Computing Stock Performance

NASDAQ:RGTI opened at $11.13 on Wednesday. Rigetti Computing, Inc. has a 52 week low of $0.66 and a 52 week high of $11.20. The company has a fifty day simple moving average of $2.44 and a two-hundred day simple moving average of $1.46. The company has a quick ratio of 4.84, a current ratio of 4.84 and a debt-to-equity ratio of 0.02. The company has a market cap of $2.14 billion, a price-to-earnings ratio of -29.29 and a beta of 2.72.

About Rigetti Computing

(

Free Report)

Rigetti Computing, Inc, through its subsidiaries, builds quantum computers and the superconducting quantum processors. The company offers cloud in a form of quantum processing unit, such as 9-qubit chip and Ankaa-2 system under the Novera brand name; and sells access to its quantum computers through quantum computing as a service.

Read More

Before you consider Rigetti Computing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rigetti Computing wasn't on the list.

While Rigetti Computing currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.