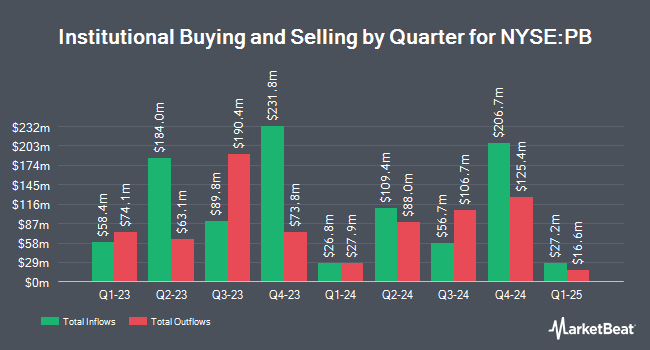

Charles Schwab Investment Management Inc. increased its position in shares of Prosperity Bancshares, Inc. (NYSE:PB - Free Report) by 0.6% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 1,183,295 shares of the bank's stock after buying an additional 6,518 shares during the period. Charles Schwab Investment Management Inc. owned about 1.24% of Prosperity Bancshares worth $85,280,000 at the end of the most recent reporting period.

Other hedge funds have also recently added to or reduced their stakes in the company. Victory Capital Management Inc. lifted its stake in Prosperity Bancshares by 3.0% during the second quarter. Victory Capital Management Inc. now owns 6,359,165 shares of the bank's stock worth $388,799,000 after purchasing an additional 184,453 shares during the last quarter. Dimensional Fund Advisors LP grew its holdings in shares of Prosperity Bancshares by 14.2% during the second quarter. Dimensional Fund Advisors LP now owns 4,287,615 shares of the bank's stock worth $262,141,000 after purchasing an additional 532,241 shares during the last quarter. Bank of New York Mellon Corp increased its position in shares of Prosperity Bancshares by 2.1% during the second quarter. Bank of New York Mellon Corp now owns 935,420 shares of the bank's stock worth $57,192,000 after purchasing an additional 19,224 shares in the last quarter. Vaughan Nelson Investment Management L.P. lifted its holdings in shares of Prosperity Bancshares by 4.6% in the 3rd quarter. Vaughan Nelson Investment Management L.P. now owns 835,565 shares of the bank's stock valued at $60,219,000 after purchasing an additional 36,480 shares during the last quarter. Finally, Thrivent Financial for Lutherans boosted its position in shares of Prosperity Bancshares by 0.9% in the 3rd quarter. Thrivent Financial for Lutherans now owns 818,744 shares of the bank's stock valued at $59,007,000 after purchasing an additional 6,972 shares during the period. Institutional investors and hedge funds own 80.69% of the company's stock.

Insider Buying and Selling at Prosperity Bancshares

In related news, Director Leah Henderson sold 1,100 shares of the company's stock in a transaction that occurred on Friday, November 22nd. The shares were sold at an average price of $83.24, for a total transaction of $91,564.00. Following the transaction, the director now owns 7,525 shares of the company's stock, valued at approximately $626,381. This represents a 12.75 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Chairman H E. Timanus, Jr. sold 4,000 shares of Prosperity Bancshares stock in a transaction that occurred on Monday, November 25th. The stock was sold at an average price of $86.50, for a total transaction of $346,000.00. Following the completion of the sale, the chairman now directly owns 229,953 shares of the company's stock, valued at $19,890,934.50. The trade was a 1.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 6,100 shares of company stock valued at $520,264 over the last quarter. Corporate insiders own 4.28% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on PB. Raymond James cut Prosperity Bancshares from a "strong-buy" rating to an "outperform" rating and set a $80.00 price objective for the company. in a research note on Tuesday, September 17th. Morgan Stanley upgraded shares of Prosperity Bancshares from an "equal weight" rating to an "overweight" rating and lifted their price objective for the company from $75.00 to $86.00 in a research note on Monday, August 5th. Hovde Group raised their price target on Prosperity Bancshares from $80.50 to $82.50 and gave the stock an "outperform" rating in a report on Monday, August 26th. StockNews.com cut Prosperity Bancshares from a "hold" rating to a "sell" rating in a research note on Wednesday, November 20th. Finally, DA Davidson downgraded Prosperity Bancshares from a "buy" rating to a "neutral" rating and decreased their price target for the stock from $80.00 to $78.00 in a report on Tuesday, October 15th. One analyst has rated the stock with a sell rating, four have given a hold rating and nine have given a buy rating to the company's stock. According to MarketBeat.com, Prosperity Bancshares has an average rating of "Moderate Buy" and a consensus target price of $78.96.

Read Our Latest Stock Report on Prosperity Bancshares

Prosperity Bancshares Stock Performance

PB stock traded down $0.56 during trading on Thursday, reaching $84.17. 387,678 shares of the company were exchanged, compared to its average volume of 571,783. The stock's 50 day moving average price is $75.54 and its 200 day moving average price is $69.49. Prosperity Bancshares, Inc. has a 52-week low of $57.16 and a 52-week high of $86.75. The company has a market cap of $8.02 billion, a P/E ratio of 17.87, a PEG ratio of 1.27 and a beta of 0.89.

Prosperity Bancshares (NYSE:PB - Get Free Report) last announced its quarterly earnings results on Wednesday, October 23rd. The bank reported $1.34 EPS for the quarter, topping the consensus estimate of $1.31 by $0.03. The business had revenue of $459.00 million for the quarter, compared to analyst estimates of $299.83 million. Prosperity Bancshares had a return on equity of 6.46% and a net margin of 25.39%. During the same quarter in the previous year, the company earned $1.20 EPS. As a group, equities research analysts forecast that Prosperity Bancshares, Inc. will post 5.05 EPS for the current year.

Prosperity Bancshares Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, January 2nd. Shareholders of record on Friday, December 13th will be given a dividend of $0.58 per share. The ex-dividend date is Friday, December 13th. This represents a $2.32 dividend on an annualized basis and a yield of 2.76%. This is a boost from Prosperity Bancshares's previous quarterly dividend of $0.56. Prosperity Bancshares's payout ratio is presently 49.26%.

Prosperity Bancshares Profile

(

Free Report)

Prosperity Bancshares, Inc operates as bank holding company for the Prosperity Bank that provides financial products and services to businesses and consumers. It accepts various deposit products, such as demand, savings, money market, and time accounts, as well as and certificates of deposit. The company also offers 1-4 family residential mortgage, commercial real estate and multifamily residential, commercial and industrial, agricultural, and non-real estate agricultural loans, as well as construction, land development, and other land loans; consumer loans, including automobile, recreational vehicle, boat, home improvement, personal, and deposit account collateralized loans; term loans and lines of credit; and consumer durables and home equity loans, as well as loans for working capital, business expansion, and purchase of equipment and machinery.

Featured Articles

Before you consider Prosperity Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Prosperity Bancshares wasn't on the list.

While Prosperity Bancshares currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report