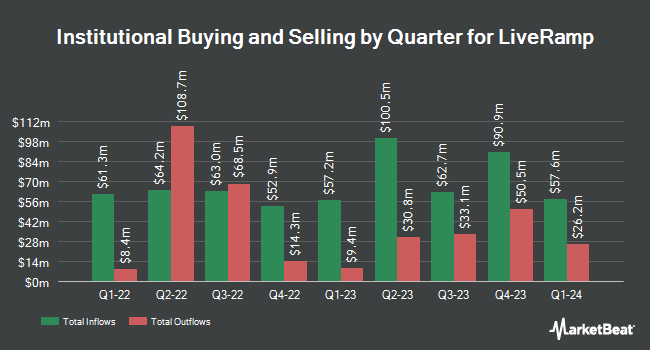

Charles Schwab Investment Management Inc. boosted its position in LiveRamp Holdings, Inc. (NYSE:RAMP - Free Report) by 7.9% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 946,808 shares of the company's stock after buying an additional 69,063 shares during the quarter. Charles Schwab Investment Management Inc. owned approximately 1.45% of LiveRamp worth $23,462,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors and hedge funds have also bought and sold shares of the business. Dimensional Fund Advisors LP grew its position in LiveRamp by 7.7% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,265,391 shares of the company's stock worth $70,090,000 after acquiring an additional 161,373 shares during the last quarter. Assenagon Asset Management S.A. increased its stake in shares of LiveRamp by 111.4% in the third quarter. Assenagon Asset Management S.A. now owns 559,213 shares of the company's stock worth $13,857,000 after buying an additional 294,743 shares during the period. Fort Washington Investment Advisors Inc. OH bought a new stake in LiveRamp during the 2nd quarter valued at $13,214,000. Millennium Management LLC boosted its position in LiveRamp by 143.8% during the 2nd quarter. Millennium Management LLC now owns 395,619 shares of the company's stock valued at $12,240,000 after buying an additional 233,329 shares during the period. Finally, Connor Clark & Lunn Investment Management Ltd. grew its holdings in LiveRamp by 55.3% in the 3rd quarter. Connor Clark & Lunn Investment Management Ltd. now owns 355,131 shares of the company's stock worth $8,800,000 after acquiring an additional 126,527 shares during the last quarter. 93.83% of the stock is currently owned by institutional investors.

Insider Buying and Selling

In other LiveRamp news, Director Debora B. Tomlin sold 9,765 shares of the stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $25.07, for a total transaction of $244,808.55. Following the sale, the director now directly owns 24,509 shares in the company, valued at approximately $614,440.63. This trade represents a 28.49 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider Kimberly Bloomston sold 4,000 shares of the business's stock in a transaction on Thursday, September 26th. The stock was sold at an average price of $25.17, for a total value of $100,680.00. Following the completion of the transaction, the insider now owns 117,247 shares of the company's stock, valued at $2,951,106.99. This represents a 3.30 % decrease in their position. The disclosure for this sale can be found here. 3.39% of the stock is currently owned by company insiders.

Wall Street Analyst Weigh In

A number of analysts have recently weighed in on the stock. Craig Hallum dropped their target price on shares of LiveRamp from $55.00 to $43.00 and set a "buy" rating for the company in a report on Thursday, August 8th. Macquarie reiterated an "outperform" rating and issued a $43.00 price objective on shares of LiveRamp in a report on Thursday, November 7th. Wells Fargo & Company started coverage on LiveRamp in a research note on Monday, October 28th. They set an "equal weight" rating and a $25.00 target price on the stock. Evercore ISI dropped their price target on LiveRamp from $50.00 to $40.00 and set an "outperform" rating for the company in a research note on Thursday, August 8th. Finally, Benchmark cut their price target on shares of LiveRamp from $48.00 to $42.00 and set a "buy" rating on the stock in a report on Thursday, November 7th. One equities research analyst has rated the stock with a hold rating and seven have issued a buy rating to the company. Based on data from MarketBeat.com, LiveRamp presently has an average rating of "Moderate Buy" and a consensus price target of $41.14.

Check Out Our Latest Report on LiveRamp

LiveRamp Trading Up 2.7 %

LiveRamp stock traded up $0.84 on Friday, hitting $31.75. 339,819 shares of the stock traded hands, compared to its average volume of 640,372. LiveRamp Holdings, Inc. has a 1 year low of $21.45 and a 1 year high of $42.66. The firm has a market cap of $2.07 billion, a P/E ratio of 618.32 and a beta of 0.97. The business's fifty day simple moving average is $26.77 and its 200 day simple moving average is $27.92.

LiveRamp (NYSE:RAMP - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported $0.51 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.37 by $0.14. LiveRamp had a net margin of 0.40% and a return on equity of 1.25%. The company had revenue of $185.00 million during the quarter, compared to analysts' expectations of $176.16 million. During the same period last year, the company posted $0.21 EPS. LiveRamp's revenue was up 15.6% on a year-over-year basis. As a group, analysts predict that LiveRamp Holdings, Inc. will post 0.36 earnings per share for the current year.

LiveRamp Profile

(

Free Report)

LiveRamp Holdings, Inc, a technology company, operates a data collaboration platform in the United States, Europe, the Asia-Pacific, and internationally. The company operates LiveRamp Data Collaboration platform enables an organization to unify customer and prospect data to build a single view of the customer in a way that protects consumer privacy.

Read More

Before you consider LiveRamp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LiveRamp wasn't on the list.

While LiveRamp currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.