Charles Schwab Investment Management Inc. lifted its holdings in Nomura Holdings, Inc. (NYSE:NMR - Free Report) by 22.5% in the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 382,107 shares of the financial services provider's stock after buying an additional 70,216 shares during the period. Charles Schwab Investment Management Inc.'s holdings in Nomura were worth $2,212,000 as of its most recent SEC filing.

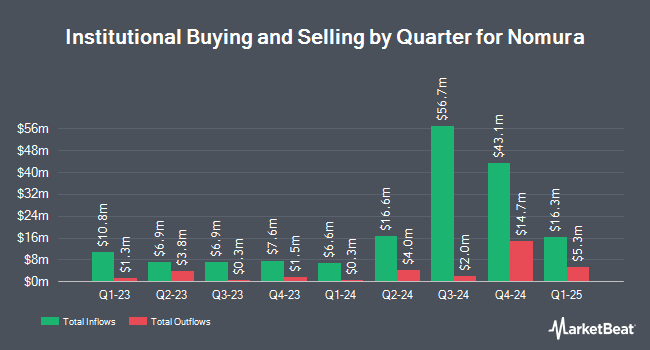

A number of other institutional investors and hedge funds have also modified their holdings of NMR. Wilmington Savings Fund Society FSB purchased a new stake in Nomura in the 3rd quarter worth approximately $25,000. R Squared Ltd acquired a new position in shares of Nomura in the fourth quarter worth $26,000. Adero Partners LLC purchased a new stake in shares of Nomura during the fourth quarter worth $59,000. Savant Capital LLC acquired a new stake in Nomura during the fourth quarter valued at $59,000. Finally, SYM FINANCIAL Corp purchased a new position in Nomura in the fourth quarter valued at about $89,000. Hedge funds and other institutional investors own 15.14% of the company's stock.

Nomura Stock Down 3.8 %

Shares of NMR traded down $0.25 during mid-day trading on Monday, hitting $6.15. 810,158 shares of the company's stock were exchanged, compared to its average volume of 815,415. The stock has a market cap of $18.26 billion, a price-to-earnings ratio of 8.78, a P/E/G ratio of 0.30 and a beta of 0.60. The firm has a fifty day moving average of $6.51 and a two-hundred day moving average of $5.96. The company has a quick ratio of 1.11, a current ratio of 1.17 and a debt-to-equity ratio of 7.52. Nomura Holdings, Inc. has a twelve month low of $4.66 and a twelve month high of $6.99.

Nomura (NYSE:NMR - Get Free Report) last posted its earnings results on Wednesday, February 5th. The financial services provider reported $0.22 EPS for the quarter, topping the consensus estimate of $0.14 by $0.08. Nomura had a net margin of 7.96% and a return on equity of 9.19%. On average, sell-side analysts forecast that Nomura Holdings, Inc. will post 0.76 earnings per share for the current year.

Wall Street Analyst Weigh In

Separately, StockNews.com upgraded Nomura from a "hold" rating to a "buy" rating in a report on Wednesday, December 11th.

Get Our Latest Stock Analysis on NMR

Nomura Profile

(

Free Report)

Nomura Holdings, Inc provides various financial services to individuals, corporations, financial institutions, governments, and governmental agencies worldwide. It operates through three segments: Retail, Investment Management, and Wholesale. The Retail segment offers various financial products and investment consultation services.

Featured Stories

Before you consider Nomura, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nomura wasn't on the list.

While Nomura currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.