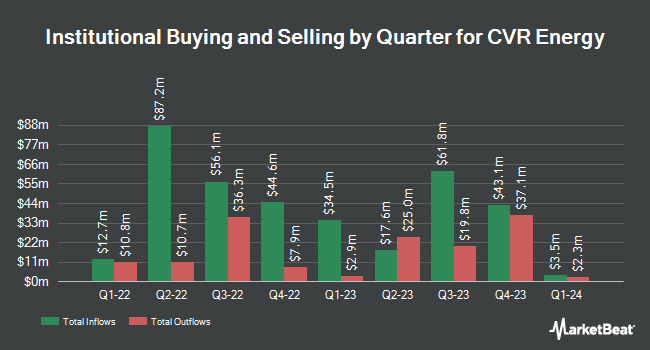

Charles Schwab Investment Management Inc. raised its stake in CVR Energy, Inc. (NYSE:CVI - Free Report) by 14.6% in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The institutional investor owned 639,138 shares of the oil and gas company's stock after buying an additional 81,590 shares during the period. Charles Schwab Investment Management Inc. owned approximately 0.64% of CVR Energy worth $14,719,000 at the end of the most recent reporting period.

Other hedge funds also recently added to or reduced their stakes in the company. Dimensional Fund Advisors LP increased its holdings in CVR Energy by 2.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 2,072,334 shares of the oil and gas company's stock valued at $55,476,000 after acquiring an additional 44,636 shares in the last quarter. Bank of New York Mellon Corp grew its position in shares of CVR Energy by 0.3% in the second quarter. Bank of New York Mellon Corp now owns 975,323 shares of the oil and gas company's stock valued at $26,109,000 after purchasing an additional 3,134 shares during the last quarter. SIR Capital Management L.P. purchased a new position in shares of CVR Energy during the 2nd quarter worth approximately $17,907,000. American Century Companies Inc. raised its position in shares of CVR Energy by 60.3% during the 2nd quarter. American Century Companies Inc. now owns 407,819 shares of the oil and gas company's stock worth $10,917,000 after purchasing an additional 153,396 shares during the last quarter. Finally, Advisors Asset Management Inc. lifted its stake in CVR Energy by 37.2% in the 3rd quarter. Advisors Asset Management Inc. now owns 352,075 shares of the oil and gas company's stock valued at $8,108,000 after buying an additional 95,371 shares in the last quarter. 98.88% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several analysts have recently issued reports on CVI shares. The Goldman Sachs Group reduced their price objective on CVR Energy from $24.00 to $21.00 and set a "sell" rating on the stock in a research report on Friday. Mizuho reduced their target price on shares of CVR Energy from $27.00 to $25.00 and set a "neutral" rating on the stock in a report on Monday, September 16th. UBS Group lowered their price target on shares of CVR Energy from $33.75 to $30.00 and set a "neutral" rating for the company in a report on Tuesday, August 13th. StockNews.com raised shares of CVR Energy from a "sell" rating to a "hold" rating in a research note on Friday. Finally, JPMorgan Chase & Co. lowered their target price on shares of CVR Energy from $26.00 to $23.00 and set an "underweight" rating for the company in a research note on Wednesday, October 2nd. Five analysts have rated the stock with a sell rating and three have given a hold rating to the stock. Based on data from MarketBeat, the stock has an average rating of "Reduce" and an average target price of $24.00.

Check Out Our Latest Analysis on CVR Energy

CVR Energy Trading Up 2.5 %

NYSE:CVI traded up $0.46 during trading hours on Friday, reaching $18.78. 1,427,774 shares of the company were exchanged, compared to its average volume of 1,252,390. The firm has a market cap of $1.89 billion, a price-to-earnings ratio of 27.22 and a beta of 1.57. The stock has a 50 day simple moving average of $20.76 and a 200 day simple moving average of $23.88. CVR Energy, Inc. has a 52-week low of $15.60 and a 52-week high of $38.07. The company has a debt-to-equity ratio of 1.84, a current ratio of 1.33 and a quick ratio of 0.86.

CVR Energy (NYSE:CVI - Get Free Report) last issued its earnings results on Monday, October 28th. The oil and gas company reported ($0.50) earnings per share for the quarter, missing the consensus estimate of ($0.09) by ($0.41). The firm had revenue of $1.83 billion during the quarter, compared to analysts' expectations of $1.91 billion. CVR Energy had a return on equity of 2.88% and a net margin of 0.89%. The company's quarterly revenue was down 27.3% compared to the same quarter last year. During the same period last year, the business posted $1.89 earnings per share. As a group, analysts predict that CVR Energy, Inc. will post -0.12 EPS for the current year.

CVR Energy Profile

(

Free Report)

CVR Energy, Inc, together with its subsidiaries, engages in the petroleum refining and marketing, and nitrogen fertilizer manufacturing activities in the United States. It operates in two segments, Petroleum and Nitrogen Fertilizer. The Petroleum segment refines and supplies gasoline, crude oil, distillate, diesel fuel, and other refined products.

Recommended Stories

Before you consider CVR Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CVR Energy wasn't on the list.

While CVR Energy currently has a "Strong Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.