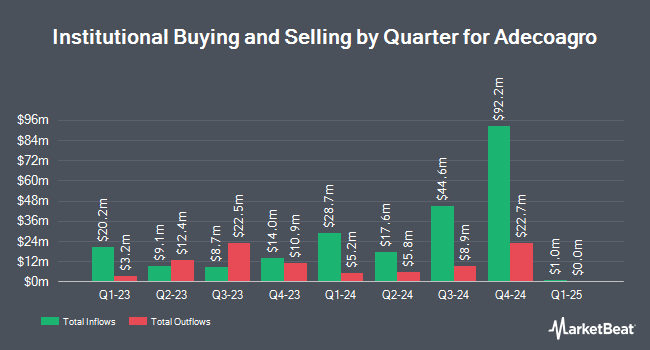

Charles Schwab Investment Management Inc. reduced its position in shares of Adecoagro S.A. (NYSE:AGRO - Free Report) by 32.3% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 413,165 shares of the company's stock after selling 197,269 shares during the period. Charles Schwab Investment Management Inc. owned about 0.40% of Adecoagro worth $4,574,000 at the end of the most recent quarter.

A number of other hedge funds and other institutional investors have also bought and sold shares of the company. Point72 Hong Kong Ltd bought a new stake in Adecoagro during the 2nd quarter worth about $42,000. Blue Trust Inc. raised its holdings in Adecoagro by 1,281.5% during the third quarter. Blue Trust Inc. now owns 7,322 shares of the company's stock worth $81,000 after acquiring an additional 6,792 shares in the last quarter. Quarry LP boosted its position in Adecoagro by 259.4% during the second quarter. Quarry LP now owns 7,598 shares of the company's stock valued at $74,000 after purchasing an additional 5,484 shares during the last quarter. nVerses Capital LLC bought a new position in Adecoagro in the third quarter valued at approximately $94,000. Finally, Advisors Asset Management Inc. acquired a new position in shares of Adecoagro during the 3rd quarter worth approximately $195,000. Institutional investors and hedge funds own 45.25% of the company's stock.

Adecoagro Price Performance

Shares of NYSE:AGRO traded down $0.15 during trading on Friday, reaching $10.43. 671,776 shares of the company traded hands, compared to its average volume of 713,402. The firm has a market capitalization of $1.09 billion, a PE ratio of 6.95, a PEG ratio of 1.24 and a beta of 1.03. Adecoagro S.A. has a 52 week low of $8.72 and a 52 week high of $12.07. The company has a quick ratio of 1.09, a current ratio of 2.40 and a debt-to-equity ratio of 0.48. The company's 50 day moving average is $11.15 and its two-hundred day moving average is $10.55.

Adecoagro Increases Dividend

The company also recently disclosed a Semi-Annual dividend, which was paid on Wednesday, November 27th. Investors of record on Tuesday, November 12th were paid a $0.174 dividend. This represents a yield of 2.9%. This is a boost from Adecoagro's previous Semi-Annual dividend of $0.16. The ex-dividend date was Tuesday, November 12th. Adecoagro's dividend payout ratio (DPR) is 23.33%.

Wall Street Analysts Forecast Growth

A number of research analysts have recently commented on the stock. Morgan Stanley downgraded shares of Adecoagro from an "overweight" rating to an "equal weight" rating and decreased their price objective for the company from $14.50 to $12.50 in a research report on Tuesday, September 17th. Bank of America lowered their price target on Adecoagro from $15.50 to $14.50 and set a "buy" rating on the stock in a research report on Monday, September 9th. Finally, UBS Group assumed coverage on Adecoagro in a research report on Monday, October 14th. They issued a "neutral" rating and a $12.00 price objective for the company. Four analysts have rated the stock with a hold rating and one has given a buy rating to the stock. Based on data from MarketBeat, the stock currently has an average rating of "Hold" and a consensus price target of $12.63.

Read Our Latest Stock Report on AGRO

Adecoagro Company Profile

(

Free Report)

Adecoagro SA operates as an agro-industrial company in South America. The company mainly operates through three segments: Farming; Sugar, Ethanol and Energy; and Land Transformation. It engages in farming crops, rice and other agricultural products, dairy operations, and land transformation activities, as well as sugar, ethanol, and energy production activities.

See Also

Before you consider Adecoagro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adecoagro wasn't on the list.

While Adecoagro currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.